SoftBank with 50% Stake Announces Line Yahoo and Parent Company Subsidiaries

Naver Classified as Investment in Other Corporations

"Agreement to Incorporate Subsidiaries Under SoftBank"

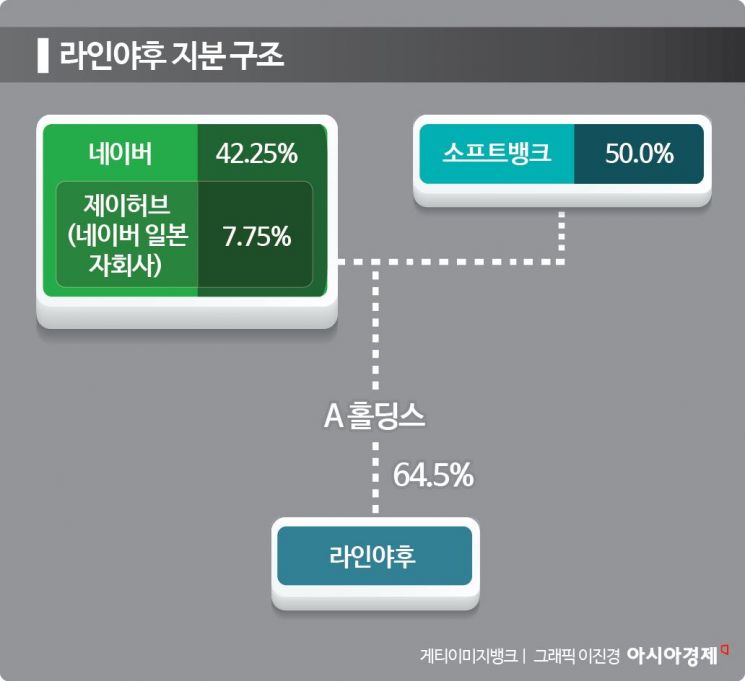

Naver has been confirmed to have classified A Holdings, the parent company of Line Yahoo, as an investment in an affiliate rather than a subsidiary since 2021. Naver holds a 50% stake in A Holdings, while the Japanese company SoftBank, which owns the remaining 50%, began designating the company as a subsidiary in its disclosures around the same time. The two companies made this decision through an agreement at that time, but with the recent Line Yahoo controversy, there is an interpretation that Naver may have ultimately made a decision that did not bring practical benefits. This is because SoftBank appears to be more involved in the management of Line Yahoo, and as a Japanese company, it is believed to support the Japanese government's logic of strengthening its domestic control.

According to Japan's Electronic Disclosure System (EDINET) on the 8th, SoftBank Group classified A Holdings, the parent company holding 64.5% of Line Yahoo's shares, as a subsidiary in its annual securities report for the period from April 1, 2022, to March 31, 2023.

SoftBank and Naver each hold a 50% stake in A Holdings. Although their stakes are equal, SoftBank also listed Z Holdings, Line, and Yahoo as subsidiaries along with A Holdings. Z Holdings, Yahoo, and Line merged last October to form Line Yahoo, with A Holdings as the largest shareholder.

SoftBank's disclosure of A Holdings and its subsidiary Line Yahoo as subsidiaries was possible due to an agreement with Naver. SoftBank explained in a note, "Although the ownership ratio of voting rights in (A Holdings) is less than 50%, we determined that we control it and therefore consolidated it as a subsidiary."

When the integrated corporation was launched in 2020, SoftBank requested Naver to include A Holdings and Line Yahoo as subsidiaries of the group. A Naver official said, "At the time of management integration, we agreed to a 50-50 shareholding ratio but to have SoftBank consolidate the subsidiaries," adding, "Subsequently, with the exclusion of the Line business segment, the operating profit of Naver's business division increased."

This is because there is a difference between accounting for subsidiaries and investments in affiliates. If disclosed only as an investment, it is reflected as non-operating income. However, if classified as a subsidiary, both sales and operating profit must be disclosed on a consolidated basis. At that time, Line Yahoo's operating profit decreased due to significant investments.

From the 2021 business report onward, Naver only listed A Holdings under investments in affiliates and did not include it in the list of consolidated subsidiaries or affiliates. Conversely, SoftBank has disclosed A Holdings as a subsidiary starting from the annual securities report for the period from April 1, 2020, to March 31, 2021. While Naver classified it as an investment in an affiliate and saw an increase in operating profit, SoftBank included A Holdings and its subsidiaries in its financial statements despite the profit decline.

Although Naver agreed to disclose A Holdings as a subsidiary of SoftBank, recent developments have led to evaluations that Naver has effectively lost ground in terms of legitimacy. Since Line Yahoo is explicitly listed as a subsidiary of SoftBank, Naver's position, despite holding an equal 50% stake, has relatively weakened.

Professor Hwang Yong-sik of Sejong University's Department of Business Administration explained, "In a joint venture, SoftBank should represent both parties' interests and reduce risks when issues related to shares or management rights arise, but so far, that does not seem to be the case," adding, "We have no choice but to consider SoftBank's intentions." He further stated, "Because Line Yahoo is a SoftBank company, it has become easier to pursue the intention of strengthening Japan's influence," and added, "SoftBank's influence and leverage over Line Yahoo can be used as a bargaining chip."

Line Yahoo and SoftBank are scheduled to announce their earnings from the afternoon of the day through the next day. As the Japanese government has stepped up pressure through administrative guidance, there are forecasts that Naver might sell some of its shares. However, there are also voices suggesting that, without legal enforcement, this situation may be resolved without any share sales.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)