Appointment of Lee Geon-il as New CEO

Food Industry Expert with Experience at CJ Foodville and Cheil Jedang

Unusual Replacement Despite Non-HR Season and Strong Performance

Q1 Earnings Expected to Decline Due to Deteriorating Dining Market

The head of CJ Freshway, which returned to the 3 trillion KRW sales club last year, has been replaced. Although the company achieved its highest-ever performance by surpassing 3 trillion KRW in sales for the first time in four years, the decision to change the CEO appears to reflect the challenging management environment the company currently faces. It is believed that new leadership is necessary to strengthen mid- to long-term competitiveness.

According to industry sources on the 7th, CJ Group appointed Lee Geon-il, head of Business Management Office 1 (Management Leader) at CJ Corporation, as the new CEO of CJ Freshway on the 3rd. Born in 1970, the new CEO Lee joined CJ CheilJedang in 1997 and has served as head of the Twosome division at CJ Foodville, CEO of CJ Foods USA, and head of the Food Management Support Office. A CJ Group official described him as "a figure with expertise in the food and food service business." Meanwhile, with Lee’s appointment, former CEO Jeong Seong-pil will enter a company-wide sabbatical.

The industry views this CEO appointment as unusual. This is because CJ Group’s regular executive reshuffle for 2024 was announced less than three months ago. CJ Group’s regular executive reshuffles typically occur in November or December, but this year’s was announced in February. Ahead of the reshuffle, CJ Group Chairman Sohn Kyung-shik diagnosed the situation as an "unprecedented crisis" in his New Year’s address, leading to widespread speculation about management reform both inside and outside the group. However, CJ Group Chairman Lee Jae-hyun ultimately chose stability over reform, and former CEO Jeong Seong-pil, whose term was set to expire in March this year, remained in his position.

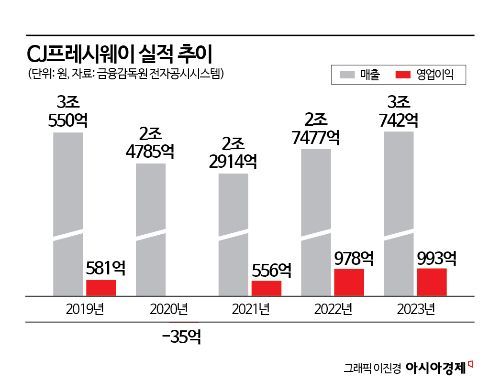

Moreover, the fact that CJ Freshway recorded its best-ever performance last year adds curiosity to the background of the leadership change. CJ Freshway returned to the 3 trillion KRW sales club last year after four years, benefiting from high inflation and a boom in the group meal service industry. Sales increased by 11.9% year-on-year to 3.0742 trillion KRW, and operating profit rose by 1.4% to 99.3 billion KRW. This was driven by an increase in food material distribution customers, continued group meal service contracts with large clients, and efficiency improvements such as logistics and IT infrastructure optimization.

Despite these strong results, the decision to replace CJ Freshway’s CEO is interpreted as reflecting the group management’s judgment that the current business environment the company faces is far from easy. In fact, CJ Freshway is expected to show weak performance in the first quarter due to a slowdown in the dining-out market. According to financial information provider FnGuide, CJ Freshway’s consolidated operating profit for the first quarter of this year is estimated to be 11.4 billion KRW, down 10.2% from the same period last year. Sales for the same period are expected to increase by 6.7% year-on-year to 743.9 billion KRW.

First, in the food material distribution sector, which accounts for the largest portion of sales, profitability is expected to decline due to sluggish performance among general distribution clients. The dining-out solution business, which provides customized consulting for clients, and the group meal service and large franchise channels with differentiated products are expected to continue growing. However, general distribution is forecasted to perform poorly as demand for low-cost food materials has increased amid the dining-out market downturn, but responses to this demand have been relatively insufficient.

The group meal service business is also continuing its overall growth trend with steadily increasing new contracts. The high inflation and resulting dining-out market slump have led to more consumers using company cafeterias, which benefits the group meal service business. However, this year, the strike by medical residents is expected to inevitably worsen the profitability of related establishments. Since meal service providers sign contracts with hospitals based on the number of diners, sales increase as more people use the cafeterias. But since the medical residents’ strike began in February, the number of patients visiting large hospitals has decreased, and meal service providers have not been able to avoid a decline in sales.

With both the food material distribution and group meal service businesses facing difficulties due to the economic downturn and the medical residents’ strike, the B2B (business-to-business) manufacturing business, centered on the subsidiary Freshplus, must put in more effort this year. Freshplus acquired the Chungbuk Eumseong factory from CJ Seafood in August last year and has strengthened manufacturing facilities through investment. The Eumseong factory produces sauces, concentrates, and seasonings. Large-volume sauces are an area where clients can reduce raw material and labor costs compared to making them in-house, while maintaining consistent taste quality, leading to increased demand from dining-out and meal service companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)