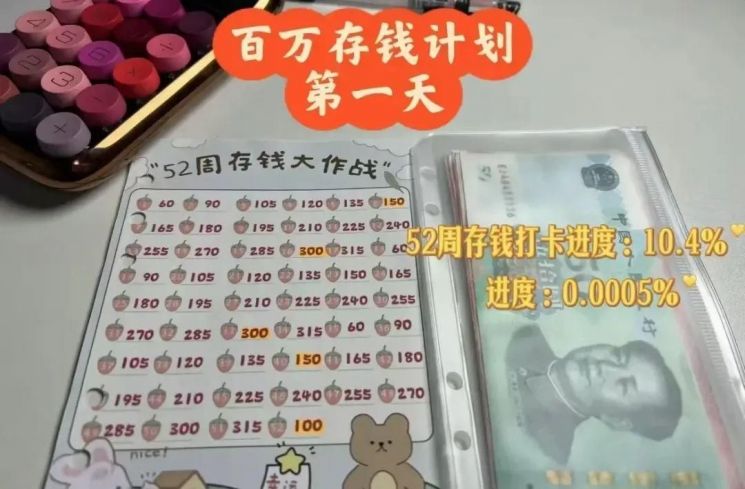

Sharing Budgets and Expenses to Prevent Overspending

MZ Generation in Korea Also Embraces the 'No-Spending Challenge'

Reports have emerged that a culture of Chinese women forming 'temporary friends' with strangers online to reduce consumption is spreading.

On the 1st (local time), the British BBC reported that the hashtag "Jieyue Daz?" (存錢搭子) is becoming very popular in China.

Last year, the Chinese literary monthly Yao Wenzhaozi (咬文嚼字) named Daz? as one of the top ten buzzwords. Daz? refers to a partner with whom one enjoys something together. Among Chinese people, the act of meeting someone on social media to share hobbies is widespread, and Daz? means engaging in hobbies together without interfering with the other person's behavior, habits, or life views. The key point is not to get involved in any aspect of life beyond the hobby.

Yonhap News reported, citing data analysis firm NewsRank, that since first appearing on Xiaohongshu, China's version of Instagram, in February last year, the hashtag has recorded 1.7 million views recently. Chinese netizens have searched for topics related to Jieyue Daz? millions of times on Weibo (微博, China's version of X).

According to the media, mainly women in their 20s to 40s gather in online Jieyue Daz? groups to share their budgets and expenses. The story of a 36-year-old woman with two children from Fujian Province in southern China was introduced.

Ms. Zhuo Cash said, "Five years ago, my mother was diagnosed with cancer, and during the COVID-19 pandemic, my husband’s and my salaries were cut by 50%, which was very difficult." She added, "After that, I started looking for Jieyue Daz?. Through this, I found myself reducing expenses by 40% in just a few months." Her goal is to save 100,000 yuan (about 19 million KRW) this year.

Jieyue Daz? also play a role in preventing impulsive purchases such as shopping. Ms. Zhuo said, "One member who was about to buy a 5,000 yuan (about 950,000 KRW) handbag ended up purchasing a cheaper secondhand bag after listening to others."

Regarding this, Professor Lucy from the National University of Singapore analyzed, "It is because of low confidence in the future economy." However, there is also a forecast that the spread of a frugal culture could become a major obstacle to the Chinese government's efforts to stimulate the economy.

Central banks lower benchmark interest rates to reduce the attractiveness of saving and encourage consumption, but if Chinese people avoid spending and cling to saving, the central banks’ ability is weakened accordingly.

In fact, a significant portion of Chinese household income is saved. Last year, China's household savings rate was 32% of personal disposable income, the highest level in the world. Analysts say that the reason Chinese people save so much money is due to a lack of profitable investment options amid a real estate slump and insufficient welfare systems.

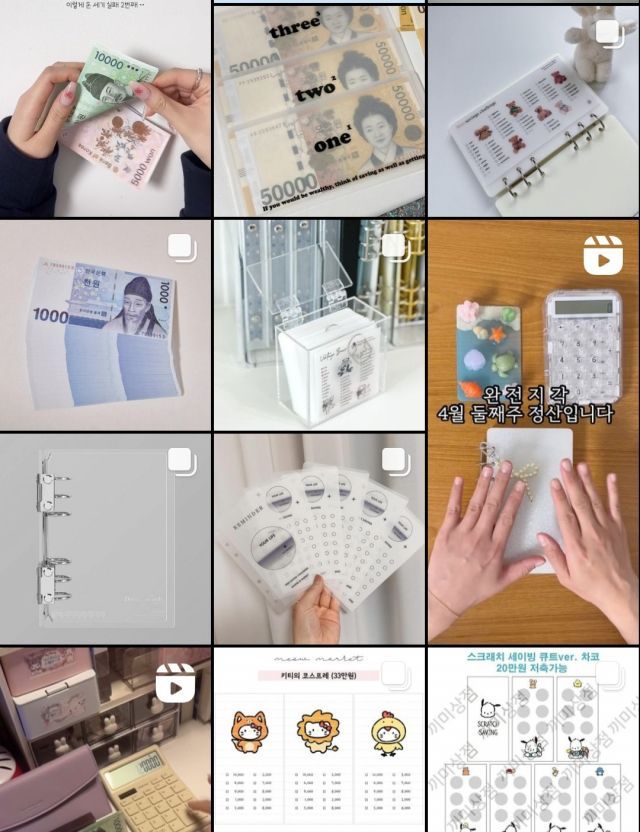

Meanwhile, not only in China but also recently in South Korea, due to unprecedented high inflation and high interest rates, a craze for 'Jjantech' (a portmanteau of 'jjada' meaning frugal and 'jaetech' meaning financial technology) has spread among the MZ generation.

There are quite a few young people who drastically reduce consumption, from the 'No Spending Challenge' where they do not spend a single penny all day to 'Happiness with 10,000 won' where they spend less than 10,000 won per day. They reduce expenses through methods such as 'cutting down on eating out,' 'walking short distances,' 'using company cafeterias,' 'app tech,' and 'utilizing secondhand markets.' A 'Geojibang' (literally 'beggar room') has appeared in KakaoTalk open chat rooms where people help each other control spending and evaluate each other's consumption.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)