2nd Seminar on Corporate Value-Up Support Measures on the 2nd

Selecting Key Financial and Non-Financial Indicators for Diagnosis and Goal Setting

Vice Chair Kim So-Young: "A Task to Be Pursued with a Long-Term Perspective"

Starting as early as May, companies listed on the KOSPI and KOSDAQ will be required to establish mid- to long-term corporate value enhancement plans and disclose the results of their implementation evaluations once a year. This is part of the government's 'Corporate Value-Up Plan' announced earlier this year to resolve the Korea Discount (the undervaluation of the Korean stock market). Companies can select one key indicator from various financial and non-financial metrics, in addition to the price-to-book ratio (PBR), to formulate their mid- to long-term improvement plans. Although concerns about lawsuits due to non-disclosure were raised, companies have been relieved as financial authorities decided to apply an exemption system.

On the afternoon of the 2nd, the Financial Services Commission, Korea Exchange, Korea Capital Market Institute, and other related organizations held the '2nd Seminar on Corporate Value-Up Support Measures' at the Korea Exchange in Yeouido, Seoul, where they announced the main contents of the guidelines. The related details will be finalized and announced in May after a final round of public consultation.

The Financial Services Commission clearly stated that corporate value-up is not a short-term task but a "long-term endeavor." Kim So-young, the Vice Chairperson who gave the congratulatory speech that day, emphasized, "The guidelines are not the end but the beginning of the corporate value-up support measures," adding, "Based on this, practical implementation efforts by market participants such as companies and investors are necessary."

The guidelines prepared that day contain comprehensive principles and an overview of the 'Corporate Value Enhancement Plan.' The plan is structured with chapters including 'Company Overview - Current Status Diagnosis - Goal Setting - Plan Formulation - Implementation Evaluation - Communication,' focusing on enhancing understanding and comparability for market participants.

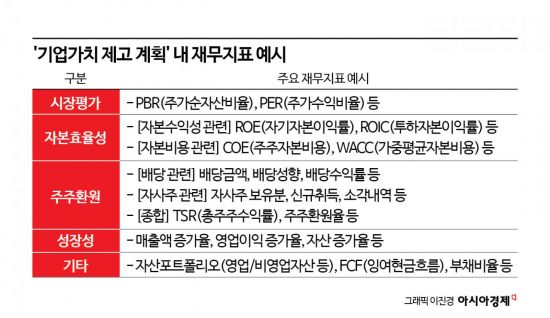

The core is the diagnosis of the current status. Listed companies must self-assess their business status and select key indicators from financial and non-financial metrics that align with the purpose of mid- to long-term value enhancement. Although there was initially mention of unifying to a single indicator such as PBR, as in Japan, companies are allowed to choose various indicators themselves, such as return on equity (ROE) and shareholder return rate. Among non-financial indicators, governance, improvement efforts, board accountability, and auditor independence can be included. For example, companies with issues of overlapping listings of subsidiaries can include plans to strengthen the rights of parent company shareholders. In cases involving listed private company holdings, companies can clarify the exact facts to resolve conflicts of interest concerns.

Based on this, companies can present mid- to long-term goals. While presenting objective figures is recommended, qualitative descriptions or range presentations and other various methods of goal setting are also possible. If changes to goals become unavoidable due to rapid changes in the business environment, companies can revise or supplement goals through corrective disclosures. Until now, listed companies have been concerned about lawsuits due to future non-compliance disclosures, but an exemption system related to forward-looking information in the disclosure regulations of the KOSPI and KOSDAQ exchanges will be applied.

The role of the board of directors, considered a key element of the corporate value enhancement plan, has also been strengthened. The board must supervise whether management appropriately establishes and implements the corporate value enhancement plan and lead reporting, deliberation, or resolution by the board as necessary. Additionally, since a significant portion of the information disclosed will be forward-looking information subject to fair disclosure, companies must first disclose it on the Korea Exchange’s Listing Disclosure System (KIND) before providing it to specific individuals or publishing it on their websites. Periodic disclosures, such as once a year, and English disclosures for foreign investors are recommended, and advance disclosures such as "Scheduled to be disclosed in QX of 20XX" are also possible.

Once the Financial Services Commission announces the finalized plan in May, companies can establish and disclose their corporate value enhancement plans as soon as they are ready. The integrated corporate value-up website, investment indicator comparison and publication, guidance and training programs for boards and disclosure officers, consulting and English translation support for small and medium-sized enterprises will also be launched simultaneously.

Meanwhile, the government and related organizations plan to announce tax improvement measures once they are prepared. In the third quarter of this year, they will develop the 'Korea Value-Up Index,' which gathers excellent companies, and based on this, they will encourage the listing of linked exchange-traded funds (ETFs) in the fourth quarter. They also plan to carry out tasks such as awarding outstanding companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.