As mortgage loan interest rates at internet-only banks have risen above those of some commercial banks, their rate competitiveness is disappearing.

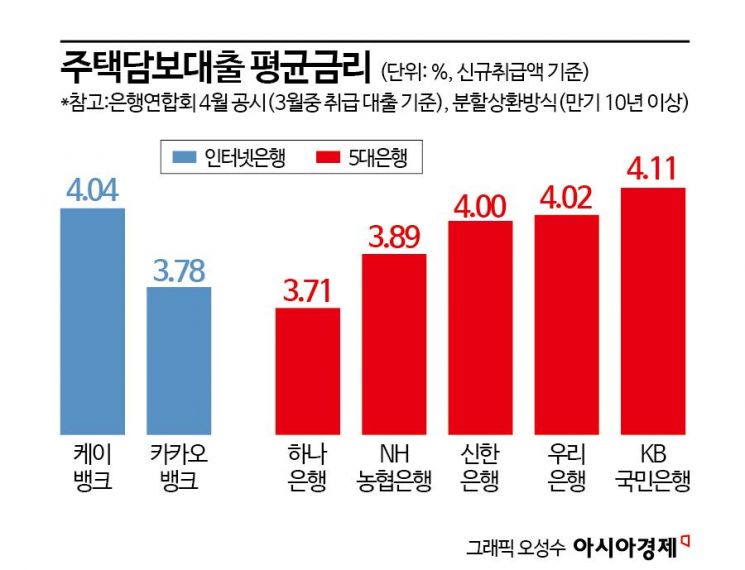

According to the April disclosure by the Korea Federation of Banks (covering loans handled in March) on the 2nd, K-Bank's average mortgage loan interest rate reached 4.04%, entering the 4% range for the first time this year. This contrasts with the end of last year when internet banks' mortgage loan rates were nearly 1 percentage point lower than those of commercial banks.

Looking at the average mortgage loan interest rates of major commercial banks, Hana Bank recorded 3.71%, NH Nonghyup Bank 3.89%, Shinhan Bank 4.00%, and Woori Bank 4.02%. Among the top five banks, except for KB Kookmin Bank (4.11%), all offered rates lower than K-Bank. KakaoBank's average mortgage loan interest rate was 3.78%, which was also higher than Hana Bank's rate. In this regard, a K-Bank official explained, "The average rate increased somewhat due to the hike in fixed (hybrid) mortgage loan interest rates."

The proportion of mortgage loans with interest rates in the 4% range was also higher compared to commercial banks. For K-Bank, 62.2% of loans were subject to 4% range rates, which was significantly higher than NH Nonghyup Bank (15.7%), Shinhan Bank (46.9%), Woori Bank (47.5%), and Hana Bank (5.5%). Although 78% of KakaoBank borrowers received rates in the 3% range, 22% were subject to rates in the 4% range.

The situation was similar for unsecured loans. K-Bank's average unsecured loan interest rate (excluding low-income financial products) was 5.09%, higher than Nonghyup Bank (4.81%) and Hana Bank (5.04%). The average credit score was also 938, higher than the top five banks (913?932). Typically, higher interest rates correspond to lower credit scores, or lower rates to higher scores, but in this case, both were high. Among internet banks, Toss Bank had the highest average unsecured loan interest rate at 7.05%, with an average credit score of 920, similar to commercial banks. KakaoBank's average unsecured loan interest rate was 5.97%, with an average credit score of 907.

Unlike commercial banks, internet-only banks, which can reduce branch operating costs, have grown their business by expanding mortgage loans through rate competitiveness, but the atmosphere has changed this year. In particular, as they have been identified as one of the causes of household debt, they now have to be cautious of financial authorities. Moreover, with reports that refinancing demand for mortgage loans at the beginning of this year was concentrated on internet banks, there is a growing mood to slow down.

However, for internet banks that need to find a way out by increasing stable loans like mortgages while defending mid- to low-credit loans and expanding their size, the situation is difficult. A financial industry official said, "As the household debt issue has emerged, it is difficult to increase loans significantly due to the need to be cautious of authorities," adding, "Internet banks must be facing many concerns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)