Cosmetics Stocks Show Recent Price Strength

Performance Improvement Accelerates with Industry Recovery

Target Prices Raised, Expectations Rising

Cosmetics stocks are continuing their rare strong performance. Despite difficulties caused by COVID-19 and the slowdown in growth in China, the largest market, recent improvements in the business environment have led to noticeable improvements in earnings, attracting attention. It is expected that the business recovery will continue this year due to an increase in Chinese tourists and diversification of export regions outside China.

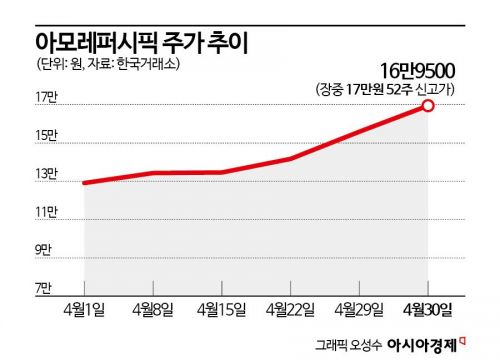

According to the Korea Exchange on the 2nd, Amorepacific has risen for six consecutive trading days recently. On the 30th of last month, it touched 170,000 KRW intraday, setting a new 52-week high. Institutional buying has continuously flowed in, driving the stock price up. Institutions have been net buyers of Amorepacific for 16 consecutive trading days since the 8th of last month. LG Household & Health Care also rose for three consecutive days recently, pushing its stock price into the 420,000 KRW range. This is the first time LG Household & Health Care has reached the 420,000 KRW level since October last year. Compared to the 52-week low recorded on February 1st, it has risen by 40%. The TIGER Cosmetics ETF, an exchange-traded fund, rose more than 18% during April.

The strong performance of cosmetics stocks is due to improvements in the business environment and earnings recovery. The business environment is clearly improving, with exports performing well. According to the Korea Customs Service, cosmetics exports from January to March this year increased by 21.7% year-on-year to 2.3 billion USD (approximately 3.1765 trillion KRW), achieving the highest quarterly performance ever.

The improvement in the business environment has led to earnings recovery for companies. Amorepacific announced on the 29th of last month that its first-quarter sales this year decreased by 0.2% year-on-year to 911.5 billion KRW, while operating profit increased by 12.9% to 72.7 billion KRW. The operating profit was a significant 'earnings surprise,' far exceeding market expectations. Jeong Ji-yoon, a researcher at NH Investment & Securities, said about Amorepacific, "The overseas business performed well in the first quarter, delivering an earnings surprise," adding, "With improved profitability in domestic cosmetics, reduction of fixed costs in China, visible expansion stories in regions outside China, and COSRX achieving better-than-expected results, the profit momentum is expected to continue into the second quarter."

LG Household & Health Care, which announced its earnings earlier, recorded sales of 1.7287 trillion KRW and operating profit of 151 billion KRW in the first quarter. These figures represent increases of 2.7% and 3.5%, respectively, compared to the same period last year. Sales turned positive for the first time in four quarters since the first quarter of last year, and operating profit returned to growth for the first time in ten quarters since the third quarter of 2021. Park Hyun-jin, a researcher at Shinhan Investment Corp., analyzed LG Household & Health Care, saying, "Operating profit tripled compared to the previous quarter, which recorded an earnings shock, exceeding consensus estimates by more than 16%. Despite increased marketing expenses, changes in channel mix and efforts to improve cost efficiency lowered the breakeven point, resulting in operating profit improvements surpassing market expectations."

Amid the earnings recovery, securities firms have raised target prices and investment opinions for cosmetics stocks. Korea Investment & Securities raised Amorepacific's target price from 200,000 KRW to 220,000 KRW, Shinhan Investment Corp. from 170,000 KRW to 220,000 KRW, NH Investment & Securities from 170,000 KRW to 210,000 KRW, and Hanwha Investment & Securities from 160,000 KRW to 220,000 KRW. Shinhan Investment Corp. upgraded LG Household & Health Care's investment opinion from 'Trading Buy' to 'Buy' and raised the target price from 410,000 KRW to 500,000 KRW. Meritz Securities upgraded LG Household & Health Care's investment opinion from 'Neutral' to 'Buy' and raised the target price from 400,000 KRW to 480,000 KRW.

The business environment is expected to continue improving this year. Exports remain robust, and the number of Chinese tourists is expected to continue increasing. Oh Ji-woo, a researcher at Ebest Investment & Securities, said, "As of April 1-10, the average daily cosmetics export amount increased by 12% year-on-year, maintaining growth," adding, "Thanks to diversification of export regions outside China and continued growth of K-Indie brands, the cosmetics business recovery is expected to continue." Ha In-hwan, a researcher at KB Securities, said, "The recent depreciation of the Korean won against the Chinese yuan may positively affect the influx of Chinese tourists," adding, "The increase in Chinese tourists, which had stalled from September to November last year, resumed from the end of the year, and since Chinese tourists still prefer cosmetics when shopping, cosmetics companies are expected to benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.