Shinhan Surpasses KB in Net Profit After Five Quarters... Recaptures 'Leading Finance' Position

Steady Growth in Interest and Non-Interest Income... Affiliate Financial Firms' Performance Up

Shinhan, KB, Hana Maintain Net Profit Over 1 Trillion Won... Operating Profit Also Rises

Woori Sees Decline in Net and Operating Profit Compared to Last Year

As major domestic financial holding companies consecutively announced their first-quarter earnings, KB Financial Group and Shinhan Financial Group achieved solid profitability despite the shock of loss compensation related to Hong Kong H-Share Index (Hang Seng China Enterprises Index·HSCEI) equity-linked securities (ELS). In contrast, Woori Financial Group's profitability, which was hardly affected by ELS-related shocks, showed a decline. NH Nonghyup Financial Group recorded the largest decrease in controlling company net profit (net income) among the major financial holding companies.

The profitability of these major financial holding companies varied depending on interest income, non-interest income, and the performance of their affiliated financial firms. While the performance of KB Financial and Shinhan Financial's affiliated financial firms generally improved, Woori Financial and Nonghyup affiliates showed sluggish trends.

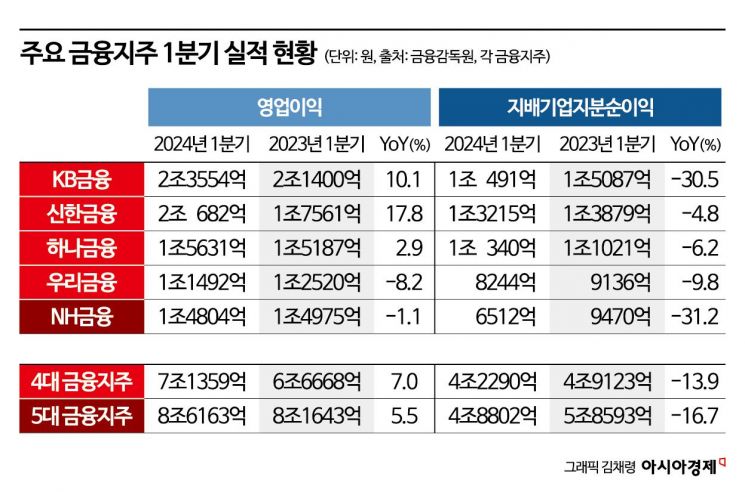

According to the Financial Supervisory Service and the financial sector on the 29th, the operating profit of the five major financial holding companies?KB, Shinhan, Hana, Woori, and Nonghyup Financial?was 8.6164 trillion won in the first quarter of this year, a 5.5% increase from 8.1645 trillion won in the same period last year.

Operating profit was highest in the order of KB Financial, Shinhan Financial, Hana Financial, Nonghyup Financial, and Woori Financial. KB Financial's operating profit increased by 10.1% year-on-year to 2.3554 trillion won, and Shinhan Financial recorded 2.0682 trillion won, up 17.8%. Hana Financial's operating profit also improved by 2.9% to 1.5631 trillion won. On the other hand, Nonghyup Financial declined by 1.1% to 1.4804 trillion won, and Woori Financial fell by 8.2% to 1.1492 trillion won.

The increase in operating profit was largely contributed by interest income. The total interest income of the five major financial holding companies was about 12.5911 trillion won, up 6.5% from 11.8213 trillion won last year. KB Financial showed the largest increase of 11.6%, followed by Shinhan Financial (9.4%), Nonghyup Financial (8.7%), and Hana Financial (2.1%). Only Woori Financial recorded a decline in interest income.

The net income of the major financial holding companies, a matter of utmost interest, plunged by more than 16% due to cost recognition from voluntary compensation for Hong Kong H-Share Index ELS. The first-quarter net income of the five major financial holding companies was 4.8802 trillion won, down 16.7% from 5.8593 trillion won last year. However, considering the 'illusion effect' caused by ELS-related provisions, the net income of the five major financial holding companies is about 6.55 trillion won, exceeding the performance of the same period last year. The scale of ELS-related provision recognition by holding companies reached 1.665 trillion won, with KB Financial recording the largest amount at 862 billion won, followed by Shinhan Financial at 274 billion won, Hana Financial at 179.9 billion won, Woori Financial at 7.5 billion won, and Nonghyup Financial at 341.6 billion won.

KB Financial Cedes 'Leading Financial' Title to Shinhan Financial

The most notable change in the first-quarter earnings announcements of major financial holding companies is that Shinhan Financial reclaimed the 'leading financial' title by surpassing KB Financial in net income. After five quarters since the third quarter of 2022, Shinhan Financial recorded net income of 1.3215 trillion won, approximately 270 billion won more than KB Financial, and outpaced KB Financial by 7 percentage points in operating profit growth rate.

The background to Shinhan Financial's recovery of the leading financial title includes the fact that its ELS-related provision shock was only about one-third of KB Financial's. Additionally, strong performance in both interest and non-interest sectors positively influenced the outcome.

Shinhan Financial's interest income increased by 9.4% year-on-year to 2.8159 trillion won. This was due to a 2.7% increase in bank won-denominated loan assets and a 3 basis points (bp) rise in net interest margin (NIM) during the quarter. On a group basis, NIM rebounded from 1.94% last year to 2.00% in the first quarter of this year.

Non-interest income also rose by 0.3% year-on-year to 1.0025 trillion won, driven by insurance profits and fee income increasing by 21.4% and 16.6%, respectively. Although gains related to securities decreased, credit card, securities trading, and investment banking (IB) fee income grew evenly across all sectors. Insurance profits benefited positively from the activation of short-term premium whole life insurance sales.

Researcher Park Hye-jin of Daishin Securities evaluated, "First-quarter net income exceeded consensus by 6.8%. Despite reflecting ELS compensation, real estate project financing (PF) provisions, and 140 billion won in overseas real estate impairment losses, the performance was quite solid."

Although Shinhan Bank took over the leading financial position, KB Financial's performance was also considered solid. Operating profit improved by more than 10%, with net interest income increasing by 11.6% and net fee income by 8.3%. Internally, this was attributed to strengthened competitiveness in core business divisions and successful diversification of the non-bank portfolio through mergers and acquisitions (M&A), resulting in favorable fee income.

A KB Financial Group official said, "Excluding one-time costs such as large-scale ELS loss compensation incurred this quarter, net income stands at about 1.5929 trillion won, maintaining a solid profit base at a recurring level." Researcher Kim Do-ha of Hanwha Investment & Securities analyzed, "Net income significantly exceeded estimates due to record-high fee income, low recurring credit costs, and better-than-expected special factors."

Meanwhile, Hana Financial's first-quarter net income was 1.034 trillion won, down 6.2% year-on-year. Although it achieved net income in the 1 trillion won range alongside Shinhan and KB, its operating profit growth rate was only 3.0%. ELS-related provisions were smaller than those of KB Financial, Shinhan Financial, and Nonghyup Financial, but foreign exchange losses of 81.3 billion won due to exchange rate increases negatively impacted net income.

Woori Financial, with Minimal ELS Compensation Impact, Shows 'Weak' Performance... Operating and Net Profit 'Decline'

Woori Financial, which bore a minimal burden from ELS loss compensation compared to other financial holding companies, showed poor performance. Although Woori Financial recognized only 7.5 billion won in provisions, its net income was 824.5 billion won, down 9.8% year-on-year. Operating profit also declined by more than 8%, marking the weakest performance among the five major financial holding companies.

Unlike KB Financial and Shinhan Financial, which recorded growth due to NIM improvement, Woori Financial's interest income shrank by 0.9%. Although non-interest income increased by 5.7% compared to the same period last year, it was insufficient to improve overall profitability. Looking at affiliated financial firms, Woori Bank, which accounts for 80% of the group, saw operating profit decrease by 5.7% year-on-year and net income fall by 8.4%. Additionally, Woori Card's net income change rate was -36.6% year-on-year, and Woori Financial Capital recorded -15.4%. Only Woori Comprehensive Financial showed improvement, with net income rising from 8 billion won to 13 billion won.

Nonghyup Financial showed a similar trend to Woori Bank. Operating profit declined by 1.2% year-on-year to 1.4803 trillion won, and net income, reflecting ELS provisions, fell by 31.2% to 651.2 billion won, the largest drop among the five major financial holding companies. Although Nonghyup Bank posted an operating profit growth rate in the 5% range, the poor performance of other major affiliates such as Nonghyup Life (-27.5%) and Nonghyup Property & Casualty Insurance (-22.3%), excluding NH Investment & Securities, hindered the group's growth momentum.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)