2024 Refined Oil Product Demand Expected to Remain Strong... Increased Summer Peak Season Travel Demand Anticipated, Global Major Refined Oil Product Inventories Declining Trend

Progress in Renewable Fuel and Circular Chemical Business... Bio-based

◆Q1 Performance Analysis

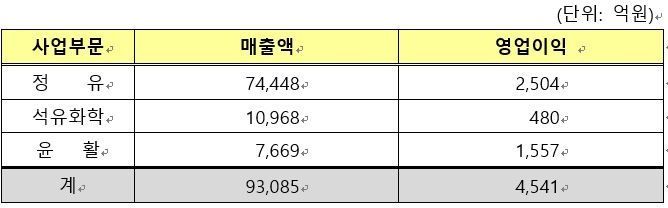

In the first quarter of 2024, sales reached KRW 9.3085 trillion, and operating profit turned positive compared to the previous quarter, recording KRW 454.1 billion.

Sales decreased by 5.3% quarter-on-quarter to KRW 9.3085 trillion due to a decline in average selling prices.

Operating profit was KRW 454.1 billion and net profit was KRW 166.2 billion for the quarter, driven by a turnaround in the refining segment due to improved refining margins and rising oil prices, as well as profit improvement in the petrochemical segment.

▲Refining Segment

Asian refining margins rebounded due to robust demand, scheduled maintenance of global refiners, equipment issues, and supply disruptions caused by geopolitical instability.

▲Petrochemical Segment

Aromatics: The PX market maintained a healthy level following the Lunar New Year holiday due to strong polyester demand, while the BZ market improved due to increased import demand from the U.S.

Olefins Downstream: The PP and PO markets rebounded due to supply constraints caused by operational disruptions at PP/PO production facilities, despite stagnant downstream demand.

▲Lubricants Segment

The base oil spread declined quarter-on-quarter due to a lagging effect from rising raw material prices but maintained a solid trend.

◆Q2 Business Segment Outlook

▲Refining Segment

Asian refining margins are expected to show a stable trend supported by regional scheduled maintenance, followed by an upward trend driven by increased demand entering the summer peak season.

▲Petrochemical Segment

Aromatics: PX and BZ markets are expected to rise due to supply reductions from scheduled maintenance of production facilities, new PTA plant startups, increased downstream demand, and seasonal demand for gasoline blending components.

Olefins Downstream: The PP and PO markets face downward pressure from facility expansions but may gradually recover due to China's economic stimulus measures.

▲Lubricants Segment

The fundamentals of base oils are expected to strengthen due to seasonal demand increases and scheduled maintenance of major global suppliers.

◆Key Management Status

▲Continued Strong Demand for Transportation Fuels

Global oil demand in 2024 is expected to continue steady growth.

With lowered global fuel inventory levels, an increase in transportation fuel demand is anticipated during the summer peak season.

▲Renewable Fuels and Circular Chemical Products Business

To respond to growing demand for renewable fuels and circular chemical products, co-processing of bio-based feedstocks and pyrolysis oil from waste plastics has begun within existing facilities, and ISCC certification has been obtained.

The initial target for the bio-feedstock co-processing business is 150 KTA by 2030, and in the long term, construction of dedicated sustainable aviation fuel production facilities is also under consideration.

▲Shahin Project Progress

In response to the energy transition era and to enhance corporate value, company-wide efforts are being consolidated for the successful execution of the Shahin Project, which is progressing smoothly with mechanical completion targeted for the first half of 2026.

Project progress - Site civil works: 75.4%, EPC (Engineering, Procurement, Construction): 22.4%

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.