Sales of 12.4296 trillion won... Record high for Q1

Memory product prices rise by double digits

Positive outlook for H2 including Q2

"12-layer HBM3E to be developed this year, supplied next year"

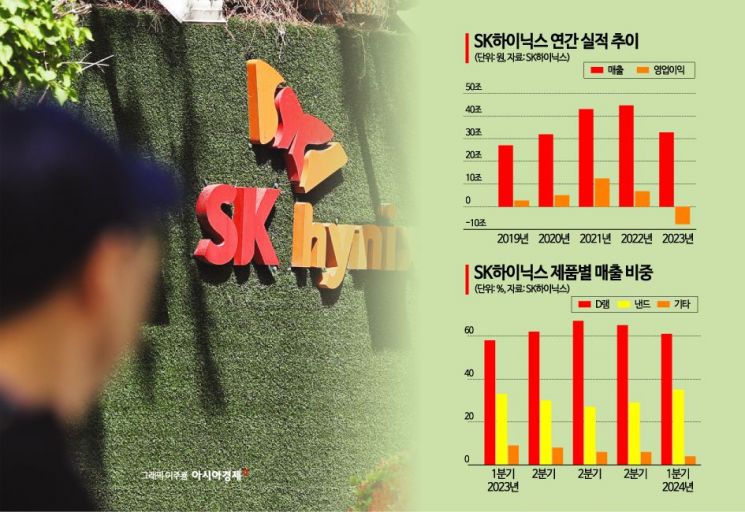

SK Hynix succeeded in turning a profit in the first quarter of this year, delivering results that exceeded market expectations. This was due to strong sales of high value-added products such as High Bandwidth Memory (HBM) and rising prices of NAND flash. The outlook is encouraging as the trend of rising memory prices continues into the second quarter, along with increasing demand for high value-added products for artificial intelligence (AI). The company forecasted that the profitability of the 5th generation HBM (HBM3E), which will see increased sales this year, will be higher compared to the previous generation HBM3, as the HBM market is rapidly growing.

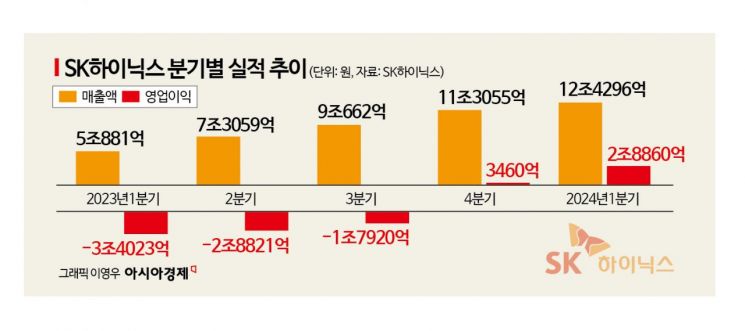

Q2 Operating Profit '2.886 Trillion KRW' Earnings Surprise

SK Hynix announced on the 25th that its operating profit for the first quarter of this year reached 2.886 trillion KRW, marking a turnaround to profit (734%) compared to the same period last year. This is the second highest record since the semiconductor boom in 2018.

During the same period, sales amounted to 12.4296 trillion KRW, an increase of 144.3% year-on-year. This is the highest ever for a first quarter. The operating profit margin was 23%, and net profit was 1.917 trillion KRW.

These results significantly exceeded market forecasts. The consensus for SK Hynix’s first quarter sales and operating profit were 12.1575 trillion KRW and 1.8551 trillion KRW, respectively. Sales slightly exceeded consensus by 2.2%, but operating profit surpassed it by 55.5%.

By customer segment, sales volume of AI memory such as HBM increased. NAND sales also rose, centered on premium products like enterprise solid-state drives (SSD), leading to an increase in average selling price (ASP). The company explained that the DRAM ASP in the first quarter rose more than 20% compared to the previous quarter, and NAND ASP increased by over 30%.

SK Hynix is emphasizing that this performance is not temporary. A company official stated, "We believe we have exited the prolonged downturn phase and entered a clear trend of performance rebound."

SK Hynix plans to expand supply of HBM3E, the world’s first mass-produced product launched in response to growing AI memory demand. Additionally, it plans to release a 10-nanometer (1nm = one billionth of a meter) 5th generation (1b) based 32Gb Double Data Rate (DDR)5 product within the year to strengthen its leadership in the high-capacity server DRAM market. NAND will continue product optimization to sustain the performance improvement trend.

TSMC of Taiwan, which has formed an alliance with SK Hynix for 6th generation HBM (HBM4), announced plans to enter the 1.6-nanometer 'A16' process in the second half of 2026. This strategy aims to bridge between the 2-nanometer and 1.4-nanometer processes scheduled for 2025 and 2027, respectively.

On the 24th (local time), TSMC held a North American Technology Symposium in Santa Clara, California, USA, where it unveiled the A16 process plan for the first time. Y.J. Mia, TSMC’s Chief Operating Officer (COO), emphasized, "The new chip manufacturing technology, A16 process, can supply power from the back of the semiconductor chip, enabling higher speeds. This is a field where we are competing with Intel."

TSMC and Samsung Electronics have been targeting production start for 2-nanometer in 2025 and 1.4-nanometer in 2027. Given the large gap between 2nm and 1.4nm, TSMC has inserted the 1.6nm process in between.

Bright Outlook for Second Half Including Q2 Earnings Due to AI Effect

SK Hynix expects the market to enter a full recovery phase. From the second half, demand from traditional applications such as PCs, mobile devices, and general servers is expected to increase, leading to stable growth in memory demand. Particularly, as AI adoption expands to applications like PCs and mobile devices, related demand is anticipated.

Kim Woo-hyun, SK Hynix’s Chief Financial Officer (CFO), stated, "On the supply side, despite gradual recovery in utilization rates by manufacturers, production of premium products such as HBM is expanding, limiting general DRAM production and accelerating inventory depletion. This will sustain a favorable pricing environment, and the memory market size this year could reach levels comparable to past booms."

The market expects SK Hynix to continue its earnings growth trend in the second quarter. According to a compilation of securities firms’ forecasts by financial information provider FnGuide, the company’s second-quarter sales are projected at 14.4748 trillion KRW, an increase of 98.12% year-on-year. Operating profit is expected to be 3.1915 trillion KRW.

Price increases for major products are also anticipated. Market research firm TrendForce forecasts that DRAM prices will rise 3-8% in the second quarter compared to the previous quarter. NAND prices are also expected to increase by 13-18% in the second quarter. In particular, prices for enterprise SSDs, used in AI servers and others, are projected to rise 20-25%.

SK Hynix expects DRAM shipments to increase by the mid-teens percentage compared to the previous quarter in the second quarter, driven by sales of products like HBM3E. The company began mass production last month by supplying HBM3E to Nvidia in the United States. NAND shipments are expected to remain at similar levels to the previous quarter. However, the company is focusing efforts on responding to the clear demand improvement trend for enterprise SSDs.

Going forward, the company plans to strengthen its leadership in the high-capacity server DRAM market by developing next-generation products such as HBM4 and releasing 10nm 1b-based DDR5 DRAM within the year. As demand for advanced process products like AI memory increases, upgrade investments will also be made. During the conference call, the company stated that the 12-layer HBM3E product development will be completed in the third quarter this year according to customer request schedules, followed by customer certification, and supply will begin next year.

However, with capacity (CAPA) allocation concentrated on some products like HBM, overall DRAM and NAND production growth is expected to be limited this year. The company explained that if product demand for general DRAM increases around the second half, utilization rates could recover quickly. For NAND, although AI demand exists, demand improvement in general applications is not yet as clear as for DRAM, so the company plans to cautiously decide on utilization rate recovery.

This year’s capital expenditure (CAPEX) will increase somewhat from the initial plan due to responding to HBM demand and investment in the new Cheongju M15X fab. SK Hynix spent about 8.3 trillion KRW on CAPEX last year. Although this year’s CAPEX scale will increase compared to last year, the company announced in January that it would minimize the increase focusing on demand response. The company has also announced a $3.87 billion investment to introduce advanced packaging facilities in Indiana, USA, to respond to HBM demand.

"HBM Market Rapidly Growing... Expecting Profitability from HBM3E"

In a conference call following the first-quarter earnings announcement, SK Hynix addressed concerns about potential oversupply of HBM due to recent capacity expansions by competitors, stating, "Compared to just six months ago, HBM demand visibility is becoming clearer," and that market demand is rapidly increasing.

The company explained, "The HBM market will continue rapid growth after 2024," adding, "With product competitiveness and extensive mass production experience, we are discussing long-term projects with many existing and potential customers for 2025 and beyond." They also noted, "We are currently consulting with customers on the scale of HBM capacity for 2025, considering long lead times."

SK Hynix stated that the HBM3E product desired by customers this year is an 8-layer product, and the company will focus on supplying this while developing a 12-layer product. They plan to complete development in the third quarter according to customer request schedules, obtain certification, and supply stably when demand increases significantly next year.

The company also said, "HBM3E reflects a price premium compared to the standard HBM3," and "Mass production of HBM3E is progressing smoothly based on industry-leading EUV productivity and 1b nanometer technology maturity. Considering current progress, achieving yields similar to HBM3 in the near future is possible." They further forecasted that "HBM3E will be a more profitable product."

Meanwhile, SK Hynix reported that DRAM and NAND finished product inventories decreased at the end of the first quarter as sales volume exceeded production despite a conservative sales stance. The company also explained that the AI effect contributed to the NAND turnaround to profitability this quarter. The company stated, "In the short term, growth in the AI market and increased AI utilization by individual companies are realizing demands for high-performance, low-power storage solutions that highlight the advantages of NAND storage."

Regarding the Cheongju M15X investment announced yesterday, the company explained, "We judged that additional cleanroom space is necessary to timely respond to the rapidly increasing AI memory and DRAM demand," adding, "We decided to invest in M15X to maintain our position in the AI memory market where we have competitiveness and to proactively respond to increasing DRAM demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.