HYBE, ADOR Executives' KakaoTalk Chat Contents Revealed

Plan Includes Min Hee-jin Cashing Out Shares, Lowering Stock Value, and Buying Back Company

It has been confirmed that Min Hee-jin, CEO of ADOR, had plans to liquidate the 20% stake in ADOR held by herself and her close associates. The intention was to turn ADOR into a "shell company" and then repurchase it to secure management rights.

HYBE announced the interim audit results on the 25th regarding the attempt to seize management rights of ADOR, which included these details. During the audit, HYBE also secured concrete evidence discussing specific execution plans such as "turning ADOR into a shell company and then buying it back."

According to the interim audit results, CEO Min exercised a call option (the right to buy shares at a predetermined price) in early last year to purchase an 18% stake in ADOR for about 1.1 billion KRW. Initially, CEO Min held stock options rather than call options. Gains from exercising stock options are subject to comprehensive income tax, with a progressive tax rate reaching up to 45%. HYBE canceled the stock option grant and, through a board resolution, sold the shares to CEO Min at a low price by granting call options. Two percent of the shares were taken by executives close to CEO Min.

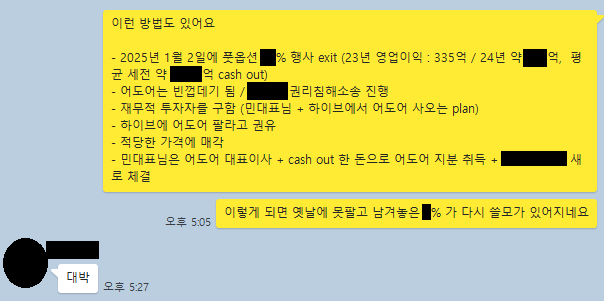

The 20% stake secured by CEO Min became the foundation for fully acquiring management rights of ADOR. The KakaoTalk conversations of ADOR’s management disclosed by HYBE contained specific methods enabling CEO Min to repurchase ADOR. They discussed concrete ways such as prematurely terminating exclusive contracts with artists or invalidating contracts between ADOR’s CEO and HYBE.

CEO Min planned to exercise the put-back option (repurchase claim right) she holds on January 2, 2025, to liquidate her shares into cash. Given that the securities market currently estimates ADOR’s corporate value to reach 2 trillion KRW by 2025-2026, it is calculated that she could secure up to 400 billion KRW.

At the same time, CEO Min’s side planned to turn ADOR into a "shell company." They intended to file a rights infringement lawsuit against NewJeans to lower the stock value, then combine financial investors’ funds with CEO Min’s cash to repurchase ADOR.

There were also conversations such as "Bring in global funds and make a deal with HYBE," "Critically appeal against everything HYBE does," and "Think of ways to harass HYBE." HYBE also secured a statement from the audit subject that the phrase "Ultimately, we will exit HYBE" was a note taken from the words of ADOR’s CEO.

HYBE plans to completely remove CEO Min and the management team from the company. They requested a board meeting on the 22nd, and the board meeting is scheduled for the 30th of next month. If ADOR’s board members do not attend and the meeting cannot be held, HYBE plans to apply to the court for permission to convene an extraordinary shareholders’ meeting. Once the court’s decision is made, the notice for the extraordinary shareholders’ meeting will be issued on the same day, and the meeting and board meeting will be held 15 days later. HYBE is expected to dismiss the existing board members, including CEO Min, and appoint new directors through the extraordinary shareholders’ meeting. Separately, HYBE will file a complaint with investigative authorities on the same day against those involved for breach of fiduciary duty and other charges.

Regarding the comeback of ADOR’s girl group NewJeans, HYBE stated, "We will do our best for a successful comeback and plan to meet with the legal representatives of the members as soon as possible to discuss ways to protect them." HYBE CEO Park Ji-won said, "We apologize to fans, artists, and members for the concerns caused by incidents that occurred during the process of advancing the multi-label system."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)