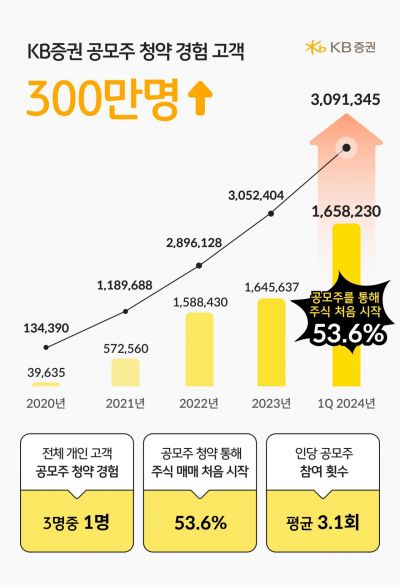

KB Securities announced on the 25th that the number of customers who have experienced public offering subscription has exceeded 3 million cumulatively, which corresponds to 34.4% of KB Securities' total individual customers (domestic residents).

In particular, the number of customers who started stock trading for the first time at KB Securities through public offering subscription has been significantly increasing every year. By the first quarter of this year, about 1.65 million customers who sold allocated public offering stocks started stock trading for the first time, accounting for 53.6% of all public offering subscription customers, which is about 42 times the number at the end of 2020.

The average number of subscriptions per public offering subscription customer was 3.1 times, and 98.1% of the majority of public offering subscription customers conducted subscriptions online through mobile trading systems (MTS) such as KB M-able (M-able) and M-able mini (M-able Mini). KB Securities explained that this was the result of proactively expanding and improving the IT systems related to MTS and home trading systems (HTS) to ensure smooth subscription and listing of mega initial public offering (IPO) stocks.

KB Securities is the only domestic securities company acting as the lead manager for the largest IPO in the first half of this year, HD Hyundai Marine Solutions, with subscriptions taking place over two days from the 25th to the 26th. HD Hyundai Marine Solutions manages the entire lifecycle of ships, including parts and services.

Additionally, the '2024 Public Offering Super Week' event will be held for customers who subscribe to public offerings online until the end of April. Through a lottery, customers can receive overseas stock coupons worth up to 50,000 KRW, and those who use the overseas stock coupons within the validity period can receive additional domestic stock coupons worth up to 50,000 KRW through another lottery.

Furthermore, KB Securities has prepared a special issuance note offering up to 4.8% annual pre-tax yield with a limit of 50 billion KRW for new and dormant customers who succeed in public offering allocation. The special issuance note yields are 4.5% per annum (pre-tax) for a 6-month contract and 4.8% per annum (pre-tax) for a 12-month contract, with individual subscription limits ranging from a minimum of 1 million KRW to a maximum of 300 million KRW. Customers can choose products according to their investment purpose and period by utilizing lump sums such as refunds.

Kim Young-il, Head of M-able Land Tribe, said, "The number of customers starting their first-ever stock investment through public offering subscription, which is possible with just the minimum subscription amount and a securities account without complicated conditions, is increasing." He added, "We hope that novice investors unfamiliar with stock investment will take this opportunity to experience public offering subscription and enjoy the various benefits of the Public Offering Super Week event."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.