Internal Control Measures for Female Warriors Revised with 'Gyujun'

Support and Control Departments' Joint Approval Required for Partner Selection

Verification Needed for Loan Execution in Used Cars and PF Cases

The Financial Supervisory Service (FSS) will introduce guidelines for selecting and managing partner companies in the credit specialized finance industry, including card and capital companies. It also plans to strengthen controls in used car and real estate project financing (PF) loan businesses.

On the 25th, the FSS disclosed the "Model Code of Internal Control for the Credit Specialized Finance Industry," which includes these details. The main point is to organize the internal control measures that credit specialized finance companies have individually operated into a standardized code.

According to the code, when credit specialized finance companies select partner companies, approval must be obtained not only from the business department but also from support and control departments such as the general affairs department and the compliance support department. Before signing contracts, standards for selecting partner companies must be established based on sales, business history, credit, etc., and the reputation and soundness of the partner companies must be evaluated. Even after contract signing, it is necessary to verify whether normal business operations are maintained and the safety of personal information. If there are any cases where routine audits have not been conducted during the outsourcing contract of partnership services, budget execution controls will be strengthened. Contracts exceeding one year in duration and involving monthly or quarterly payments must have the appropriateness of payments reviewed at least once a year.

Heo Jin-cheol, Director of the Small Finance Inspection Division 3 at the FSS, said, "The issue of partner companies was selected during the process of reviewing the risks generally faced by the credit specialized finance industry," but added, "It was triggered by the financial accident involving Lotte Card employees last year involving hundreds of millions of won." In July of last year, two Lotte Card employees colluded with the representative of a partner company to enter into a partnership contract worth 10.5 billion won, resulting in breach of trust and embezzlement.

Additionally, the FSS decided to improve the business practices of used car financing to block the possibility of misuse and embezzlement of used car loan funds. When credit specialized finance companies pay used car loan funds to third parties such as used car dealers, they must notify consumers of key information via text messages or other services. Furthermore, they must take at least two of the following measures: ▲phone calls with consumers (happy calls), ▲verification of vehicle photos submitted by consumers, and ▲use of escrow accounts for payments. After loan execution, ownership transfer and mortgage registration for used passenger cars must be confirmed within 10 days, and for used commercial vehicles such as trucks, within 25 days. Periodic checks on ownership changes are also necessary.

Credit specialized finance companies engaged in PF projects through real estate land trusts must transfer loan funds to the initially registered trust company’s management account or client account. If designated accounts or withdrawal information such as seals change, regular inspections must be conducted. In general credit operations, credit specialized finance companies will verify the authenticity of supporting documents using public MyData and other means before handling loans.

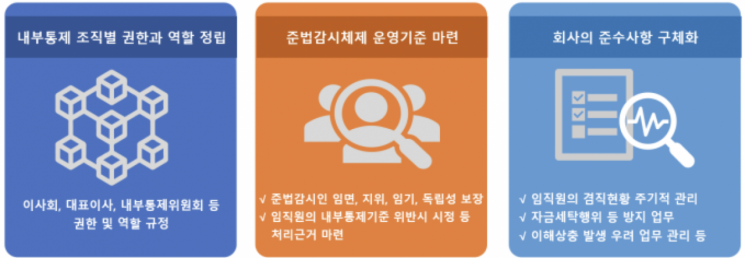

The code released on this day also includes the authority and roles of internal control organizations. Internal control organizations such as the board of directors, CEO, internal control committee, and compliance officers must manage conflicts of interest and concurrent positions held by executives and employees. Compliance personnel must constitute at least 1% of the workforce, and when appointing compliance officers, relevant work experience in internal control and related fields must be considered.

The effectiveness of financial accident prevention activities was also enhanced through a rotation system and mandatory leave system. Accordingly, employees of credit specialized finance companies cannot work continuously in the same department for more than five years, and in unavoidable cases for personnel management, approval from the HR executive must be obtained. The mandatory leave system will be implemented for employees handling high-risk tasks such as fund management or those who have worked in the same department for more than five years.

The FSS stated, "In the credit specialized finance industry, there are many tasks involving multiple stakeholders and partnerships, and high-risk operations such as used car and real estate PF loans have been conducted, so the need to strengthen internal controls has been continuously raised," adding, "We will strive to establish a sound internal control culture through the implementation of this model code."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)