20 Listed VCs, Combined Operating Profit of 350 Billion KRW Last Year

Impact of Increased Book Value or Active Exit Performance

12 Small and Medium VCs Have Been 'Capital Impaired' Since Last Year

The 'rich get richer, poor get poorer' phenomenon is intensifying in the venture capital (VC) industry. While mid-to-large-sized VCs achieved record-breaking performance last year, which was dubbed the 'investment winter,' small-to-medium-sized VCs are facing severe polarization, struggling even to survive.

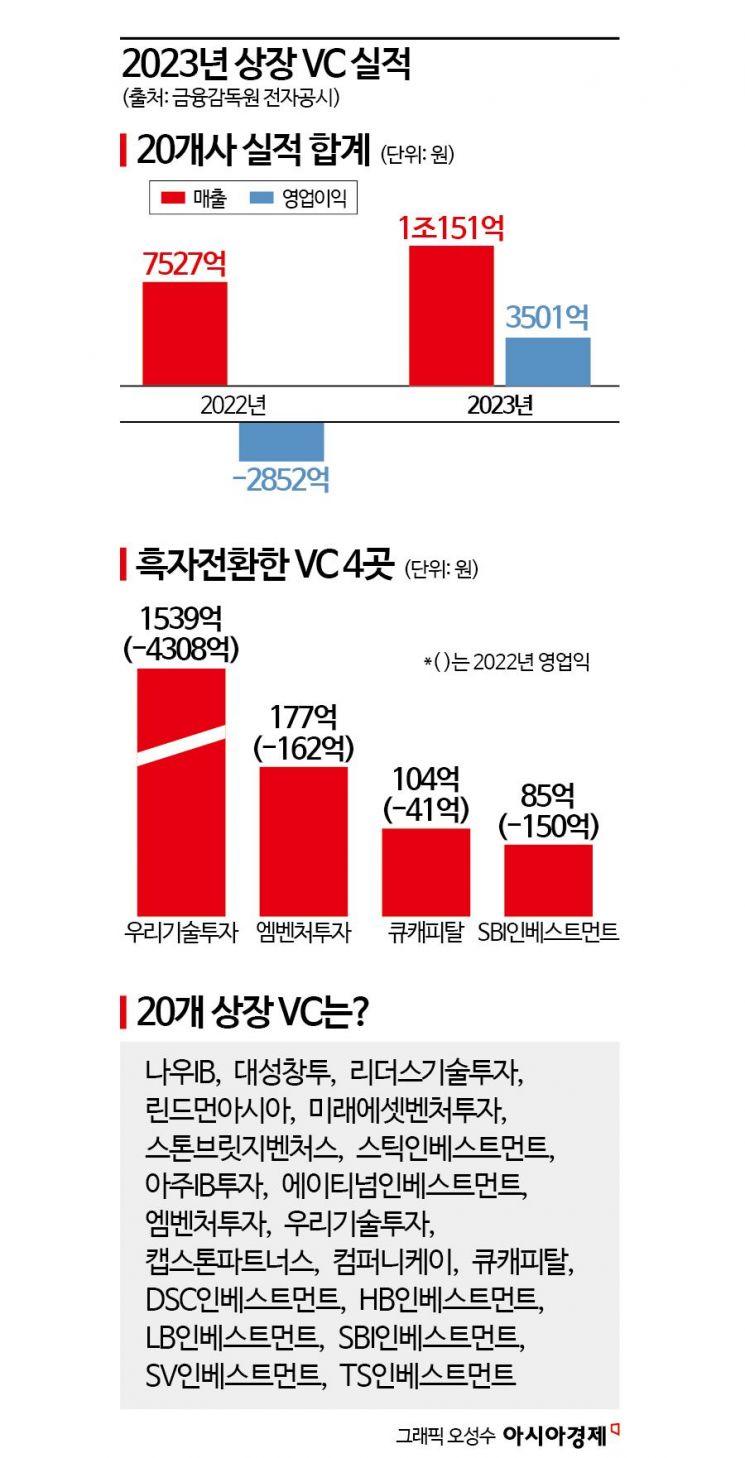

According to the Financial Supervisory Service's electronic disclosure system on the 25th, the combined business reports of 20 publicly listed domestic VCs for the 2023 fiscal year showed total revenue of 1.0151 trillion KRW and total operating profit of 350.1 billion KRW. This is the first time total revenue has exceeded 1 trillion KRW. In 2022, total revenue was 752.7 billion KRW, and operating profit was -285.2 billion KRW. Contrary to the market conditions frozen by the 'three highs' (high interest rates, high inflation, high exchange rates), they actually earned more money.

Some VCs Saw Operating Profit Margins Increase by 265%... Four Turned Profitable

VC performance largely depends on valuation gains of venture funds under management and disposal gains from investment exits. The valuation of the investment portfolio significantly impacts results. Woori Technology Investment, which posted the highest operating profit of 153.9 billion KRW among VCs in 2023, is a representative case. It turned profitable after recording an operating loss of 430.8 billion KRW in 2022 due to an increase in fair value gains from Dunamu. These gains rose from 355.1 billion KRW in 2022 to 506.3 billion KRW. Dunamu, which operates the virtual asset exchange Upbit, saw its value rise as the virtual asset market escaped the harsh winter. The increase in Dunamu's valuation gains (151.2 billion KRW) is similar to the scale of operating profit (153.9 billion KRW).

Excluding Woori Technology Investment, which has an exceptionally large profit scale, the combined operating profit of the remaining 19 companies was 196.2 billion KRW, a 34.7% increase compared to 145.6 billion KRW in 2022. Including Woori Technology Investment, four VCs turned from losses to profits: M Ventures (-16.2 billion KRW → 17.7 billion KRW), Q Capital (-4.1 billion KRW → 10.4 billion KRW), and SBI Investment (-8.5 billion KRW → 15 billion KRW; all operating profits). Among the 20 VCs, six were in the red in 2022, but only three last year. Ten companies saw operating profit growth compared to 2022, while ten experienced declines.

The highest operating profit growth rate was recorded by Aju IB Investment, which increased from 4.8 billion KRW in 2022 to 17.7 billion KRW last year, a 265% rise. This was thanks to active exits. The amount recovered last year alone reached 276.1 billion KRW. Notably, Nanoteam, which invested 3 billion KRW in 2019, went public on KOSDAQ last year, achieving about 28 times the principal in returns. Following Aju IB Investment, Stick Investment (220%), Daesung Venture Capital (101%), and LB Investment (77%) also showed high operating profit growth rates.

Four Companies Under Capital Impairment This Year... Small and Medium VCs Still Face 'Hunger Period'

Jang Pil-sik, Executive Director of SV Investment, said, "Unlike general companies, the industry characteristic of requiring about five years for exits means that past investment results are now appearing. Among listed VCs, many are large firms representing the industry, and their management fees have significantly increased as they operate larger funds compared to the past, which is a background for operating profit growth." Recently, funds of a scale previously seen only in the private equity fund (PEF) industry have also emerged. A representative example is the 'Atinum Growth Investment Fund 2023' worth 860 billion KRW, formed by Atinum Investment last year, the largest in VC industry history. Kim Je-uk, Vice President of Atinum Investment, also became the industry's 'salary king,' receiving a total compensation of 21.095 billion KRW last year. According to venture investment information provider 'The VC,' nine VCs had assets under management (AUM) exceeding 1 trillion KRW as of last year.

On the other hand, the 'hunger period' for small and medium-sized VCs continues. As the market shrinks overall, funds are concentrated in large VCs with both reputation and track records. Executive Director Jang said, "Looking at the market overall, about ten firms operate large funds exceeding 150 billion KRW, and there are dozens of firms created with hundreds of billions of won from the Korea Fund of Funds. Most others continue to struggle even to form funds." According to the Venture Investment Disclosure (DIVA), there were 367 domestic VCs as of the 24th. Many of these are reportedly facing operational difficulties. Eight VCs were requested to improve management by the Ministry of SMEs and Startups last year due to capital impairment, four times the two in 2020. Four more joined this year. In the worst case, they could be delisted and expelled from the market. Newly registered VCs also sharply declined from 42 in 2022 to 19 last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.