Bank of Korea Announces 'April Consumer Sentiment Survey Results'

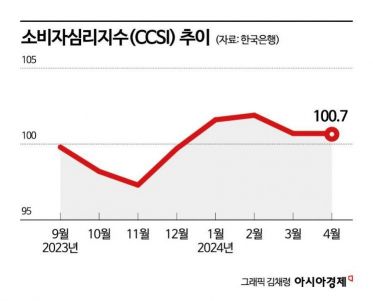

Consumer Confidence Index (CCSI) at 100.7, Unchanged from Previous Month

As exports improved, consumers' optimism about the economic situation continued. However, consumers still felt the burden of high inflation and high interest rates.

According to the "April Consumer Sentiment Survey Results" released by the Bank of Korea on the 24th, the Consumer Confidence Index (CCSI) for this month was 100.7, unchanged from the previous month.

The CCSI is a sentiment indicator calculated using six major indices from the Consumer Sentiment Index (CSI). When it exceeds the long-term average of 100, it indicates that consumers are optimistic about the economic situation.

The CCSI remained below 100 until December last year but has exceeded 100 for four consecutive months since January this year. However, the figure is slightly lower than the previous peak of 101.9 in February.

Hwang Hee-jin, head of the Statistical Survey Team at the Economic Statistics Bureau of the Bank of Korea, explained, "Despite the continued increase in exports, the consumer sentiment index remained unchanged from the previous month due to prolonged burdens of inflation and interest rates, which weakened consumers' spending capacity."

Among the six major component indices, the Living Conditions Outlook CSI rose by 1 point to 94 compared to the previous month, and the Future Economic Outlook CSI also increased by 1 point to 81. This is interpreted as a slight rise in consumers' expectations regarding their living conditions and future economic outlook compared to the previous month.

However, the Consumer Spending Outlook CSI fell by 1 point to 110. The Current Living Conditions CSI was 89, Household Income Outlook CSI was 99, and Current Economic Conditions CSI was 68, all unchanged from the previous month.

Hwang said, "While the economic outlook improved due to increased exports centered on semiconductors, the consumer spending outlook declined," adding, "Overall, the atmosphere was similar to the previous month."

Among other indices, the Interest Rate Level Outlook CSI rose by 2 points to 100 compared to the previous month. This was influenced by a slight rebound in market interest rates due to weakened expectations for a Federal Reserve (Fed) rate cut following the U.S. Consumer Price Index (CPI) exceeding forecasts.

The Housing Price Outlook CSI also rose by 6 points to 101, marking the first time it exceeded 100 since November last year. Hwang analyzed, "This was influenced by a slowdown in the decline of apartment sale prices and a slight recovery in transaction volumes."

The expected inflation rate, which indicates the forecasted consumer price inflation over the next year, fell by 0.1 percentage points to 3.1% compared to the previous month.

The response proportions for major items expected to affect consumer price inflation over the next year were agricultural, livestock, and fishery products (64.1%), public utility charges (47.3%), and petroleum products (35.8%), in that order.

Hwang said, "Although prices of daily necessities such as agricultural products have recently risen, expectations that prices will decrease were reflected due to government stabilization measures and warming weather. However, since there is a possibility of public utility fee increases in the second half of the year, future trends need to be monitored."

This survey was conducted from the 8th to the 16th of this month, targeting 2,500 households in urban areas nationwide (with 2,324 households responding).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)