Last Year, 606,353 Insurance Agents... 2.9% Increase Compared to Previous Year

Average Monthly Income per Exclusive Agent 3.04 Million KRW

It was revealed that the number of insurance planners exceeded 600,000 last year.

The Financial Supervisory Service announced on the 23rd that as of the end of last year, the number of insurance planners reached 606,353, an increase of 16,844 (2.9%) compared to the previous year (589,509).

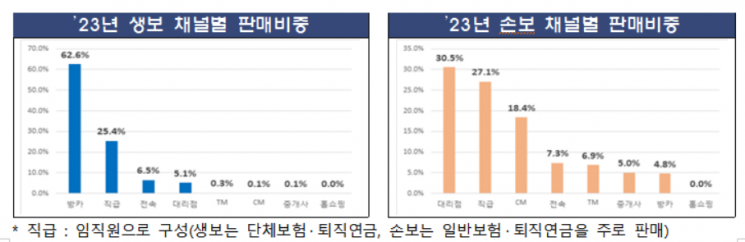

Based on initial insurance premiums, the sales proportions by channel for life insurance were highest in bancassurance (62.6%), followed by rank-based (25.4%), exclusive (6.5%), and agencies (5.1%). For non-life insurance, the order was agencies (30.5%), rank-based (27.1%), online subscription (18.4%), and exclusive (7.3%).

The insurance contract retention rates were 84.4% at 1 year (13th installment) and 65.4% at 2 years (25th installment). The 5-year (61st installment) retention rate was only 41.5%. Since 2021, due to the high-interest rate trend and increased cancellations of low-interest savings-type insurance, the retention rate for life insurance, which has a high proportion of savings-type insurance, was particularly low.

Looking at retention rates by channel, the exclusive and GA channels had high initial (1-year) retention rates of 86% and 87.9%, respectively. However, due to increased contract cancellations after the commission recovery period (within 2 years), retention rates dropped significantly after 2 years (25th installment). Bancassurance had the lowest retention rate compared to other channels, with retention falling below 50% after 2 years due to cancellations of savings-type insurance.

The incomplete sales ratio improved by 0.01 percentage points from the previous year to 0.03%. The incomplete sales ratio has been steadily improving over the past five years, from 0.11% in 2019. By channel, for life insurance, face-to-face channels such as exclusive and GA (0.07%) had higher rates than non-face-to-face channels (0.06%). For non-life insurance, face-to-face channels (0.02%) had lower rates than non-face-to-face channels (0.03%). Although GA’s incomplete sales ratio had been higher than that of exclusive planner channels, it has maintained a similar level since 2022. The telemarketing (TM) channel has also shown continuous improvement in incomplete sales rates over the past five years.

The retention rate of exclusive insurance planners at insurance companies (1 year) was 47.3%, a decrease of 0.1 percentage points from the previous year (47.4%). Life insurance (36.9%) saw a decline compared to the previous year (39%) due to exclusive planners moving to GA, while non-life insurance (53.2%) slightly increased from the previous year (52.2%).

The average monthly income per exclusive insurance planner was 3.04 million KRW, an increase of 290,000 KRW (10.5%) compared to the previous year (2.75 million KRW). On the other hand, the average monthly insurance premium income per planner was 24.02 million KRW, a decrease of 1.07 million KRW (4.3%) compared to the previous year (25.09 million KRW).

The Financial Supervisory Service plans to focus on managing insurance companies with low contract retention rates and strengthen supervision and control over unsound sales practices. A representative from the Financial Supervisory Service stated, "We will take a zero-tolerance approach to illegal activities within insurance recruitment organizations and impose management responsibilities linked to internal control accountability on insurance companies. We will promote fundamental institutional improvements to eradicate unsound sales practices focused on short-term performance and establish a consumer-centered sales culture."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)