Q1 Operating Profit 46.1 Billion KRW... Expected 19% Increase YoY

Beer 'Kelly' Smoothly Settles... Soju Slows Due to Demand Decline

Key Focus on Strong Growth in Overseas Market Performance

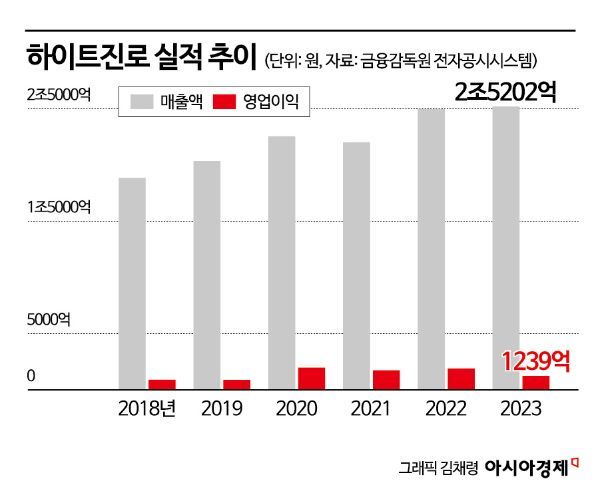

HiteJinro, celebrating its 100th anniversary this year, is drawing attention as to whether it can achieve an operating profit of 200 billion KRW for the first time in its history. Since the beginning of the year, HiteJinro has been focusing on improving profitability by launching new soju products and reducing the increased marketing expenses from last year. However, as the domestic soju business shows growth limitations due to declining consumption, the key to growth is expected to be the performance in overseas markets.

According to financial information provider FnGuide on the 23rd, HiteJinro's operating profit for the first quarter of this year is estimated to increase by 19.3% compared to the same period last year, reaching 46.1 billion KRW. Sales revenue for the same period is also expected to rise by 4.8% to 632.1 billion KRW.

The improvement in first-quarter performance is expected to be led by the beer segment. This is because sales of 'Kelly,' launched in April last year with the goal of reclaiming the top spot in the domestic beer market, have been steadily increasing. Thanks to an aggressive sales strategy, Kelly sold 1 million cases (30 million bottles based on 330mL) within just 36 days of its launch, the shortest period for a single beer brand in Korea, and as of last month, it has recorded cumulative sales of 360 million bottles, successfully establishing itself in the market. In particular, since marketing expenses were high last year due to new product launches, the relative reduction in related costs this year is expected to be a major factor in performance improvement.

On the other hand, the core soju business is expected to slow down somewhat. Although the introduction of a standard sales ratio lowered B2C prices, domestic sales are estimated to have declined due to reduced demand in the domestic entertainment sector amid sluggish dining-out conditions. However, despite the overall demand decrease, the effect of price increases on key products implemented in November last year is expected to prevent a decline in sales revenue.

For HiteJinro to achieve an operating profit of 200 billion KRW this year and sustain continuous growth in the future, the performance in overseas markets, which are showing clear growth unlike the stagnant domestic market, will be crucial. Last year, HiteJinro's domestic soju sales amounted to 1.2254 trillion KRW on a separate basis, down 1.8% from 1.2484 trillion KRW the previous year, while export revenue increased by 44.4% to 60.2 billion KRW. During the same period, exports of other distilled liquors, including fruit soju, also rose by 5.3% to 79.2 billion KRW.

To accelerate overseas business expansion, HiteJinro selected Vietnam as its first overseas production base and signed a main contract in January for securing a soju factory site of 82,083㎡ (approximately 24,873 pyeong) in the Green I-Park Industrial Complex in Thai Binh Province near Hanoi. A HiteJinro representative stated, "Until the local factory in Vietnam is operational, we plan to focus on laying the groundwork for full-scale sales expansion," adding, "By expanding the brand targeting the local market, we will create a foundation to accelerate sales, and with the factory operation in 2026, we will approach the ultimate goal of 'globalizing soju.'"

However, since overseas sales still account for only about 10%, the goal of maintaining the top position in the domestic market is also expected to be pursued simultaneously. Following the full renewal of 'Chamisul Fresh' earlier this year, HiteJinro launched a zero-sugar soju new product, 'Jinro Gold,' last month. Jinro Gold features an alcohol content of 15.5%, which is 0.5 degrees lower than the existing main products Chamisul Fresh (16 degrees) and Jinro (16 degrees). Eunji Kang, a researcher at Korea Investment & Securities, said, "Jinro Gold can strategically enter the market by leveraging the recognition of existing products," and added, "With differentiation in alcohol content, it is possible to secure additional market share in the soju market." Additionally, the expansion of the 'Ilpum Jinro' lineup is expected to respond to the growing premium distilled liquor market.

Furthermore, this year, HiteJinro is expected to adopt a profitability improvement strategy by reducing marketing expenses, which surged due to new product launches last year. Since the third quarter of last year, HiteJinro has been cutting marketing costs, and marketing expenses for the recently launched Jinro Gold are also being spent selectively, demonstrating a commitment to improving profitability. As a result, even considering the possibility of additional expenses to increase market share in the liquor market this year, operating profit improvement is expected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.