Excessive Expectations and Caution Lead to Flood of Listings

This Week's Big Tech Earnings Announcements as a Turning Point

The securities industry is analyzing the decline in semiconductor stocks as an opportunity for 'divided buying.' Rather than interpreting it as a slowdown in artificial intelligence (AI) demand growth, it is explained that the sell-off was due to caution against excessive expectations. Earlier, TSMC downgraded its earnings forecast, leading to a sharp drop in major semiconductor stocks such as Nvidia.

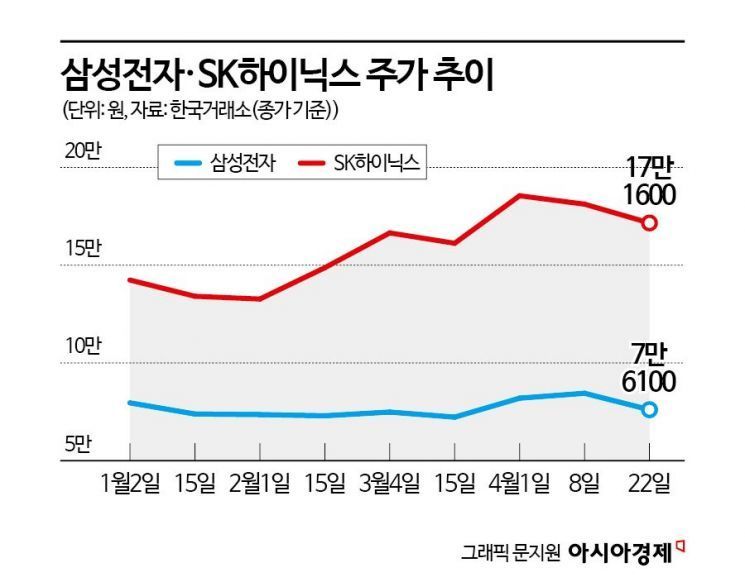

According to the Korea Exchange on the 22nd, Samsung Electronics closed at 76,100 KRW, down 1.93% (1,500 KRW) from the previous trading day. SK Hynix also ended at 171,600 KRW, down 0.98% (1,700 KRW).

The decline in domestic semiconductor stocks on that day was due to a series of negative factors. On the 18th (local time), TSMC's downward revision of its growth forecast was the trigger. TSMC lowered the growth rate forecast for the global semiconductor market (excluding memory) from 'over 10%' to 'about 10%.' The global foundry (semiconductor contract manufacturing) growth forecast was also lowered from 'about 20%' to 'mid-to-late teens in the 10% range.'

As a result, the next day, Nvidia's stock price plunged 10% from the previous close to $762 (1.05 million KRW), marking the lowest price since February 21 this year. Nvidia accounts for 80% of the global AI chip market, and most of its self-designed AI chip manufacturing is entrusted to TSMC.

Additionally, stocks such as AMD (-5.4%), Micron (-4.6%), Intel (-2.4%), and Qualcomm (-2.4%) also closed lower. Consequently, the Philadelphia Semiconductor Index fell by 4.12%.

Moreover, Super Micro (SMCI US) not releasing preliminary earnings for the first time in eight quarters also significantly impacted semiconductor investment sentiment. As a result, SMCI's stock price plunged 23%.

The sell-off in semiconductor stocks is interpreted as arising from concerns over a slowdown in AI demand growth. However, the securities industry holds the view that the current weakening of investment sentiment in the semiconductor sector is difficult to attribute to a slowdown in demand. Rather, it is evaluated as a large-scale sell-off triggered by increased caution as expectations for semiconductor profit growth became excessive.

Kim Il-hyeok, a researcher at KB Securities, said, "Looking at TSMC's performance, it is hard to say there is a problem with AI demand," adding, "In particular, the impact of weakened iPhone demand from Apple, a major customer of TSMC, was offset by AI semiconductor demand including Nvidia."

Regarding SMCI, Kim said, "Although the earnings growth trend is strong, it is a stock that strongly exhibits the characteristics of a meme stock (stocks traded speculatively by individual investors through online word-of-mouth) within semiconductor stocks."

Ryu Young-ho, a researcher at NH Investment & Securities, also stated, "AI-related demand this year is expected to be difficult to fully meet with TSMC's high-end package (CoWoS), confirming a solid outlook," adding, "With Nvidia's new product GB200 launching in the second half, some pent-up demand may occur, but this does not imply an overall reduction in AI investment."

Ryu predicted, "In the short term, the market is likely to take time to adjust elevated expectations until clear evidence is found," and "The earnings and guidance of big tech companies starting this time will be an important turning point." This week, big tech earnings are awaited from Tesla (Tuesday), Meta (Wednesday), Microsoft, and Alphabet (Thursday).

Kim Young-geon, a researcher at Mirae Asset Securities, also noted, "The recovery in NAND demand based on April data is noteworthy," and judged, "It is meaningful to consider this adjustment period as an opportunity to re-enter leading stocks (Nvidia) or to increase sector weight."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.