Card Loan Balance Reaches 39.4744 Trillion Won Last Month

Increases by Over 2 Trillion Won Year-on-Year

Balloon Effect Due to Strengthened Savings Bank Lending

The outstanding balance of card loans, considered a quick cash source for ordinary people, has approached 40 trillion won, marking an all-time high.

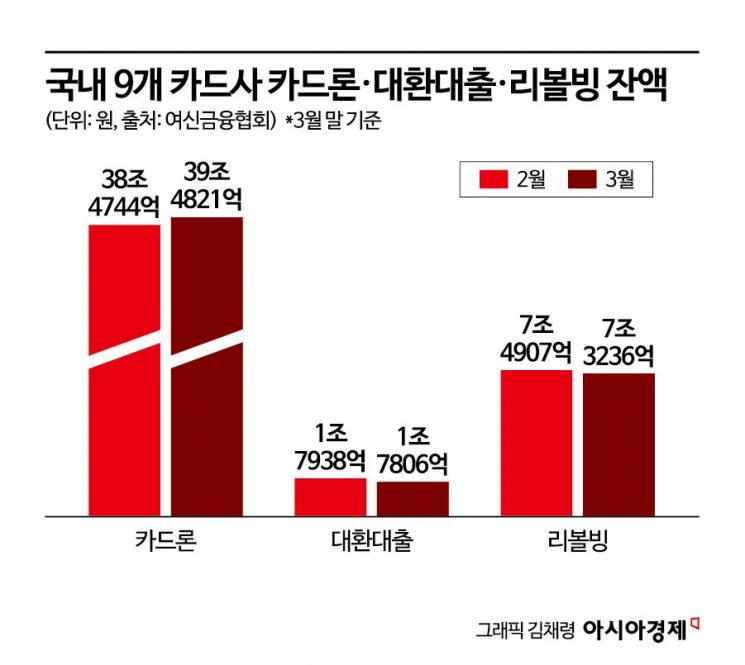

According to the Credit Finance Association on the 22nd, as of the end of March this year, the card loan balance of nine domestic card companies (Samsung, Shinhan, KB Kookmin, Lotte, Hana, Hyundai, BC, NH Nonghyup, and Woori) recorded 39.4821 trillion won. This is an increase of 7.7 billion won over one month compared to the end of February, which was the previous record high at 39.4744 trillion won. Compared to March last year (36.8 trillion won), it increased by more than 2 trillion won. Card loans are unsecured loans provided by card companies to their subscribed customers. Unlike general credit loans, there is no special screening process, so they are called "quick cash loans."

Looking at the average card loan interest rates by card company last month, Lotte Card had the highest rate at 15.58%. It was followed by Woori Card (14.87%), BC Card (14.79%), and Hana Card (14.70%), generally approaching 15%. Until the end of last year, no company had an interest rate in the 15% range. As the delinquency rate soared in the savings bank sector due to real estate project financing (PF) defaults and other issues, raising the loan threshold, the demand for card loans from low-credit borrowers has increased, causing card loan interest rates to gradually rise.

Refinancing loans used to roll over card loans amounted to 1.7806 trillion won, down 3.2 billion won from the previous month (1.7838 trillion won). However, compared to March last year, it increased by about 620 billion won. Card loan refinancing means that card loan borrowers who are unable to repay the money by the maturity date take out another loan. Although the burden of delinquency may temporarily decrease, credit ratings fall, and typically higher interest rates than existing loans are applied.

The revolving balance for payment-type revolving credit recorded 7.3236 trillion won. It decreased by 16.71 billion won compared to the previous month (7.4907 trillion won), but increased by 10.86 billion won compared to March last year (7.215 trillion won). Revolving credit is a service that allows the balance to be extended for more than a month by paying at least 10% of the card bill. While it can temporarily ease urgent financial needs, borrowers may face a repayment burden as they have to bear interest rates close to 20% per annum depending on their credit score.

Although the demand for quick cash loans such as card loans is increasing, it is expected to become more difficult to receive loan services from secondary financial institutions in the future. According to the "Financial Institution Lending Behavior Survey" announced by the Bank of Korea on the 19th, the lending attitude of card companies in the second quarter was recorded at minus 6. A positive index indicates a relaxation of lending attitudes, such as lowering loan interest rates or expanding limits, while a negative index means financial companies are raising the loan threshold by reducing loan limits or increasing interest rates compared to before. A card industry official said, "As savings banks and loan companies raise loan barriers, a balloon effect is appearing," adding, "Since there have been many delinquent borrowers after recent credit forgiveness, we plan to thoroughly prepare for risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)