Expansion of Agreement Institutions to 43 Banks Including Shinhan, Woori Bank, Saemaeul Geumgo, Nonghyup, and Shinhyup in the Secondary Financial Sector... Interest Support of 2~2.5% per Year for New Loans up to 300 Million KRW from the 22nd, with Loan Principal of 100 Billion KRW

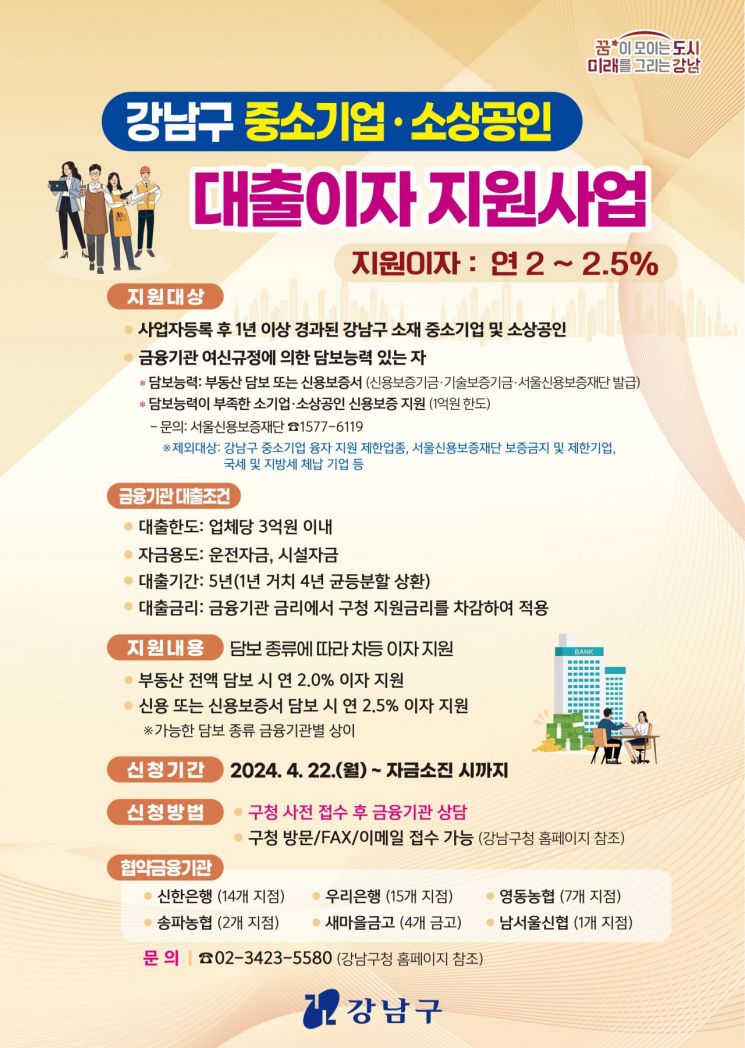

Gangnam-gu (District Mayor Jo Seong-myeong) will implement a loan interest support project starting on the 22nd, providing an annual interest rate subsidy of 2~2.5% on new loans from partner financial institutions to alleviate financial difficulties faced by small and medium-sized enterprises (SMEs) and small business owners due to the economic downturn and interest rate hikes.

This support project has a total loan principal scale of 100 billion KRW, with the district subsidizing an annual interest rate of 2~2.5% on loan principals up to 300 million KRW per business, while the borrower pays the remaining interest. For real estate collateral loans, the support rate is 2% per year, and for credit collateral loans, it is 2.5% per year, with support available for up to five years.

In particular, to resolve the issue where some eligible recipients could not receive support due to difficulties in loan execution from primary financial institutions, this year the agreement has been expanded to include secondary financial institutions (Yeongdong Nonghyup, Songpa Nonghyup, Saemaeul Geumgo, Namseoul Credit Union). These institutions also apply preferential interest rates similar to those of primary financial institutions.

The support targets are SMEs and small business owners located in Gangnam-gu who have maintained their business for more than one year after business registration and have received new loans from one of the 43 financial institutions partnered with Gangnam-gu after the 22nd. Businesses restricted from SME development fund loan support, those restricted by the Seoul Credit Guarantee Foundation, or those that have relocated their business outside Gangnam-gu are excluded. Applications can be submitted via district office visits, fax, or email, and support is provided on a first-come, first-served basis until funds are exhausted. For more details, please refer to the district office website or contact the district office’s Regional Economy Division.

Jo Seong-myeong, Mayor of Gangnam-gu, stated, “This year, by expanding partner institutions to include secondary financial institutions, we have enabled small business owners and companies facing financial difficulties due to blocked loans from primary financial institutions to receive support. We will continue to promote support projects that provide practical benefits for the management stability and financial relief of local businesses.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.