Instructor 'Minerva Olppaemi' Acquisition Tax and Capital Gains Tax, etc.

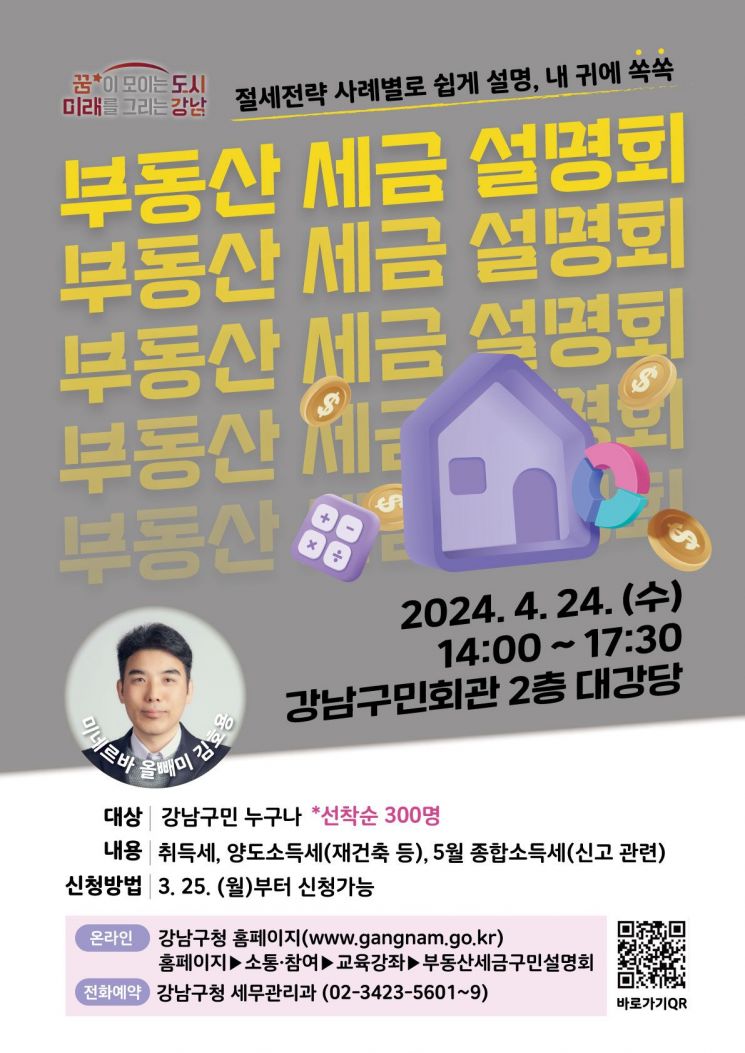

Gangnam-gu, Seoul (District Mayor Jo Seong-myeong) will hold a 'Real Estate Tax Briefing Session' for 450 residents on the 24th from 2:00 PM to 5:30 PM at the Residents' Hall Auditorium (154 Samsung-ro).

Gangnam-gu is an area greatly affected by real estate policies, and residents have a strong interest in real estate taxes. Real estate taxes are divided into national taxes (comprehensive real estate tax, capital gains tax) and local taxes (acquisition tax, property tax), making it a challenging area for taxpayers.

Accordingly, the district prepared an integrated lecture on real estate taxes to resolve questions and provide practical help. Originally planned for 300 people, the number of participants was expanded to about 450 due to strong interest from residents, and pre-registration was accepted.

The special lecture will be given by Kim Ho-yong, CEO of Mirjin Tax and known as ‘Minerva Owl’ with 100,000 subscribers on Naver Blog. The lecture will easily explain topics such as ▲heavy acquisition tax for multi-homeowners ▲capital gains tax special cases for reconstruction and redevelopment ▲various tax-saving know-how related to the May comprehensive income tax filing using illustrations and examples. Customized consultations through individual Q&A will be provided after the lecture.

The district plans to hold another tax briefing session in October this year. It will cover ▲major amendments to national and local tax laws ▲special lectures on inheritance and gift tax savings ▲tax-saving strategies to cope with the era of high inflation, high interest rates, and high exchange rates.

District Mayor Jo Seong-myeong said, “I hope this briefing session will be an opportunity to resolve residents’ questions about complicated and difficult taxes,” and added, “We will continue to provide useful tax-saving information and promote tax administration that communicates with residents.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.