Bank of Korea Blog

"Growing Oil Price Risk Amid Middle East Instability"

The Bank of Korea assessed that the slowdown in consumer prices has been "bumpy and sluggish" since July last year.

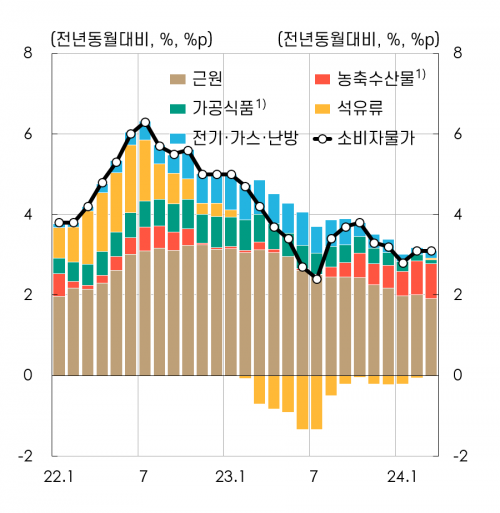

Kim Min-sik, head of the Survey Division, and Park Chang-hyun, head of the Price Trends Team at the Bank of Korea, recently stated on the Bank of Korea blog, "Consumer prices declined smoothly from the peak in July 2022 (6.3%) to July 2023 (2.4%) along a well-paved road, but since then, they have been moving sluggishly and bumpy as if on a foggy unpaved road."

Consumer Price Inflation Rate and Contribution by Item Since 2022. For Processed Foods, Core Items Excluded. Source: Statistics Korea, Bank of Korea

Consumer Price Inflation Rate and Contribution by Item Since 2022. For Processed Foods, Core Items Excluded. Source: Statistics Korea, Bank of Korea

According to the Bank of Korea, the core inflation rate, excluding food and energy, continues a gradual deceleration trend. However, the overall consumer price inflation has stalled due to rising international oil prices and agricultural product prices. The won-dollar exchange rate has also risen significantly due to the strength of the US dollar, increasing the upside risks to inflation.

In particular, recent international oil prices have risen to around $90, higher than the initially expected $80 range, due to the extended production cuts by the oil-producing countries' coalition OPEC Plus (OPEC+) and the conflict between Iran and Israel. There is significant uncertainty about how the escalating Middle East crisis will unfold. Especially concerning is the news that on the 19th (local time), the Iranian military fired surface-to-air missiles in central Isfahan in response to a drone attack, indicating that instability in the Middle East is continuously spreading.

With the expansion of conflicts in the Middle East increasing the upside risk of oil prices, concerns have also grown regarding how long the high rise in agricultural product prices will continue and the effects of differentiated monetary policies among major countries. Additionally, as concerns about delayed disinflation in the United States spread, global financial markets have seen weakened investor sentiment and rising market interest rates.

Kim Min-sik and Park Chang-hyun stated, "Since the Bank of Korea's economic outlook in February, prices have continued to slow down, but recent oil price increases have raised upside risks." They added, "Given the greatly increased uncertainty in inflation forecasts due to the Middle East situation, it has become more important than ever to closely monitor the disinflation trend and assess whether the inflation target (2%) will be met."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.