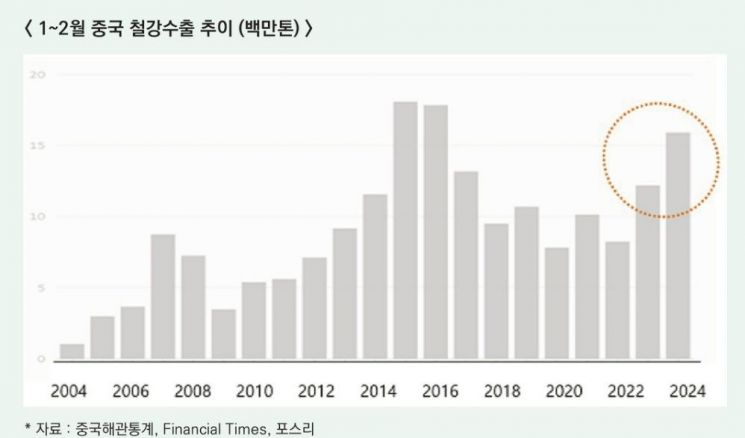

15.91 Million Tons in Jan-Feb... 32.6% Increase YoY

The volume of Chinese steel exported overseas in January and February this year reached the highest level since 2016.

Recently, the United States decided to raise tariffs on 'low-priced' Chinese steel by more than three times to block its inflow into the country. Although China is the primary cause of the strengthened protectionism, the possibility cannot be ruled out that the volumes, which have lost their way due to increased trade barriers by various countries, will flood the domestic market.

According to the industry on the 22nd, China's steel exports last year surged by 35.3% compared to the previous year, reaching 90.26 million tons. This year, the export volume for January and February was 15.91 million tons, up 32.6% from the same period last year, marking the highest level since 2016.

Since the 1990s through the 2010s, China expanded its steel production facilities on a large scale, but after COVID-19, the delayed economic recovery has led to oversupply. Although the Chinese government has enforced production cuts, the excess domestic volume is being redirected overseas at low prices due to lack of demand. Especially recently, export volumes appear to be increasing further.

However, the global steel market is also challenging. Europe strengthened export barriers on major products including steel last year by introducing the Carbon Border Adjustment Mechanism (CBAM). CBAM is a system that, starting in 2026, will impose additional carbon pricing linked to the EU Emissions Trading System (ETS) if the carbon content of imported goods exceeds a certain threshold.

Also, with the U.S. presidential election approaching, President Joe Biden recently indicated an increase in tariffs on Chinese steel. On the 17th (local time), Biden visited the United Steelworkers (USW) in Pittsburgh, Pennsylvania, and announced a plan to raise tariffs on Chinese steel and aluminum to 25%. Additionally, an anti-dumping investigation on Chinese steel has been initiated, and enforcement will be strengthened to prevent Chinese steel from being imported via Mexico.

In particular, if former President Donald Trump, the Republican presidential candidate, is elected, strong sanctions on foreign steel are expected. During his first term, the Trump administration imposed tariffs exceeding 50% on foreign steel, and if re-elected, he has stated intentions to apply similarly high tariffs.

Many evaluations suggest that South Korea will not gain significant benefits despite the U.S. strengthening tariffs against China. In 2018, when the Trump administration imposed high tariffs and volume restrictions on imported steel products under Section 232, South Korea chose to reduce quotas instead of tariffs. Under the quota system, South Korea enjoys a '2.63 million tons tariff-free' export quota to the U.S., making it difficult to sell beyond the restricted volume.

An official from a steel company said, "While the tariff increase on Chinese steel may create favorable conditions for us, it is too early to say it will have a significant impact," adding, "We need to confirm additional measures from the U.S. government to assess the pros and cons."

There is even greater concern that Chinese steel could distort the domestic steel market. If a large volume of low-priced Chinese steel products floods the domestic market, it could further worsen the already sluggish steel industry conditions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)