Decline in Overseas and Domestic Index-Linked ELS

Hong Kong H Index Down 90%

Due to large-scale losses from Hong Kong H Index equity-linked securities (ELS), the issuance amount of ELS, including equity-linked bonds (ELB), significantly decreased in the first quarter. In particular, the issuance amount of ELS linked to the Hong Kong H Index dropped by 89.7% compared to the previous quarter.

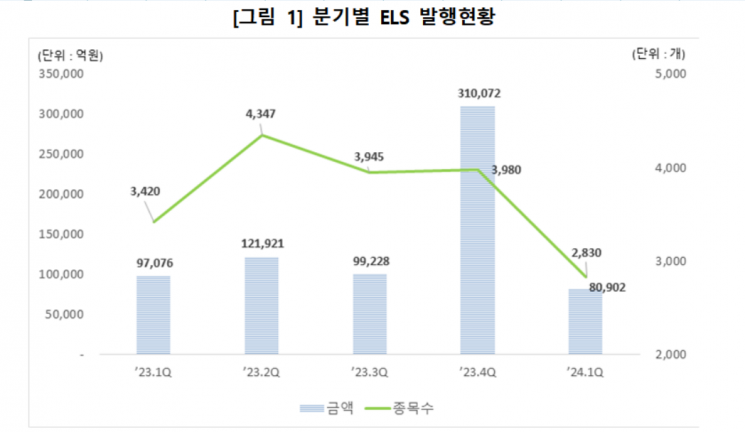

According to the Korea Securities Depository on the 18th, the issuance amount of ELS in the first quarter was 8.09 trillion won, down 16.7% year-on-year and 73.9% quarter-on-quarter. The number of issued products also decreased by 17.3% and 28.9% respectively during the same period, totaling 2,830 products.

By issuance type, public offerings accounted for 86.5% of the total, while private placements made up 13.5%. Public offerings decreased by 16.9% year-on-year and 76.9% quarter-on-quarter. Private placements decreased by 15% year-on-year but increased by 60.4% compared to the previous quarter.

By underlying asset type, index-linked ELS based on overseas and domestic indices accounted for 50.1% of the total issuance amount. However, issuance of both overseas and domestic indices declined compared to the previous quarter.

Specifically, ELS including the S&P 500 and Euro Stoxx 50 decreased by 52.4% and 51% respectively compared to the previous quarter, while ELS linked to the Hong Kong H Index (HSCEI) and Nikkei 225 also fell by 89.7% and 72.9% respectively. ELS including the KOSPI 200 also dropped by 55.3%.

Among a total of 22 ELS issuers, the top five securities firms (Hana, Shinhan Investment, NH Investment, Samsung, and Korea Investment) accounted for 54.1% of the issuance amount.

The redemption amount of ELS was 15.5866 trillion won, up 19.5% year-on-year but down 44.3% quarter-on-quarter. The outstanding balance of unredeemed issuance was 59.7494 trillion won, down 11.7% year-on-year and 11% compared to the previous quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.