Atlas Hydraulic to Electric Robot Generation Shift

New Electric-Driven Robot Unveiled

Boston Dynamics Corporate Value Expected to Rise

Boston Dynamics IPO, Key to Governance Restructuring

Boston Dynamics, a US robotics company under Hyundai Motor Group, has announced the retirement of its hydraulic humanoid robot Atlas. Boston Dynamics is abandoning the expensive and outdated hydraulic drive system and will introduce a new humanoid robot with an electric drive system.

Amid intensifying humanoid wars led by US and Chinese big tech companies such as Tesla, Figure AI, and Unitree, Boston Dynamics is also joining the competition. For Boston Dynamics, which has promised to go public by the first half of 2025, the release of a new humanoid product could determine its corporate valuation.

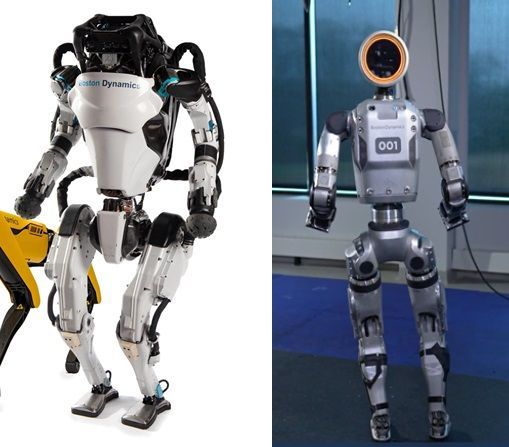

According to industry sources on the 17th (local time), Boston Dynamics posted a video titled "Farewell to Hydraulic (HD) Atlas" on its official YouTube channel the day before. In the video, Atlas demonstrated the development process of humanoid technology it has mastered through falling and getting back up. At the same time, the limitations of the hydraulic robot, such as oil leaks and bursts at the joints, were also shown. On the morning of the same day, Boston Dynamics released consecutive videos of a new version of Atlas equipped with an electric drive system. In the video, Atlas freely bends its joints 360 degrees, stands up, and walks steadily.

Generational Shift from Hydraulic to Electric Robots

Atlas is a bipedal robot developed for disaster response. Since its first unveiling in 2013, it has been regarded as having the most advanced hardware movement among humanoid robots over the past decade.

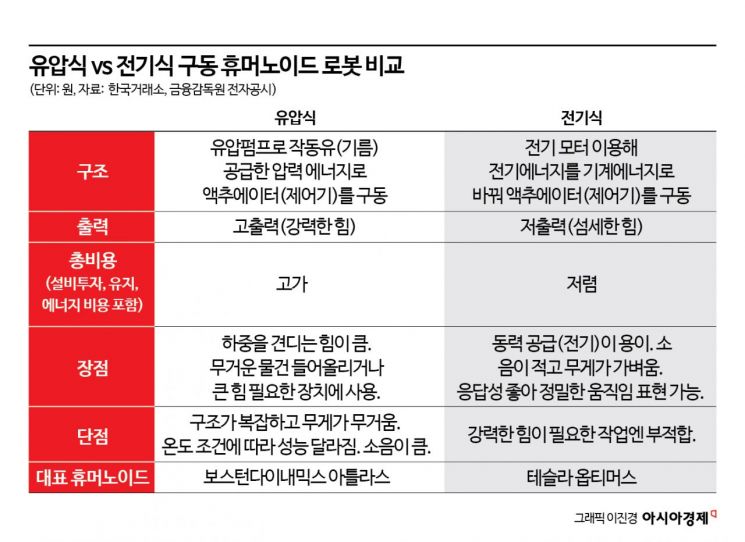

Atlas can perform difficult movements such as backflips and parkour without difficulty. This was possible because it used a hydraulic drive system that can withstand heavy loads and has high durability. However, hydraulic robots have drawbacks such as being heavy and noisy because they require hydraulic pumps filled with oil. They are also sensitive to temperature changes and require complicated maintenance, making them disadvantageous in terms of total cost.

For these reasons, robot companies including Tesla widely adopt electric drive systems. This method uses electric motors to operate actuators (controllers). It allows precise movements and can operate in various temperature environments. Above all, the total cost, including maintenance, is low.

Knowing these limitations, Boston Dynamics has always specified Atlas as a "research platform." The industry has not highly anticipated its commercialization potential. Considering that the price of the company’s quadruped robot Spot exceeds 100 million KRW, it is expected that the launch price of Atlas would easily exceed 200 million KRW. In contrast, Tesla has announced a goal to release its humanoid Optimus at 20,000 USD (about 27 million KRW) per unit as early as 2025.

Key to Governance Restructuring: Possibility of Boston Dynamics’ IPO

In 2020, Hyundai Motor Group included an initial public offering (IPO) plan when acquiring Boston Dynamics shares from SoftBank. According to a put option, if Boston Dynamics fails to IPO on the Nasdaq market by June 2025, Hyundai Motor Group must purchase SoftBank’s 20% stake at a predetermined price. Currently, Boston Dynamics’ shares are held by HMG Global, funded by three Hyundai Motor Group companies, with 50%, Hyundai Motor Group Chairman Chung Euisun holding 20%, Hyundai Glovis 10%, and SoftBank 20%.

Since Hyundai Motor Group’s acquisition, Boston Dynamics has recorded losses every year. However, the market valuation of its stock continues to rise, reflecting expectations for the IPO and the rosy outlook of the humanoid robot market. The commercialization of cost-competitive electric drive humanoids is expected to influence corporate valuation. With about a year left until the IPO target deadline, the launch of the next new product could be linked to the success of the IPO and, furthermore, to Hyundai Motor Group’s governance restructuring.

Im Eun-young, a researcher at Samsung Securities, said, "If Boston Dynamics goes public, the group affiliates could sell cross-shareholdings in the market, use the secured cash to repurchase and cancel treasury shares, and Chairman Chung could consider a long-term governance restructuring project by using dividends and Boston Dynamics’ IPO funds to purchase Mobis shares."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.