HBM to Have Highest Sales Share Among DRAM Groups

DI Rises 58.8% This Month...Expecting HBM Benefits

Improved Performance Expected for HBM-Related Equipment Companies

Due to concerns over a potential war between Iran and Israel, foreign and domestic institutional investors are reducing their stock holdings. Investment sentiment has also weakened following news that the U.S. Federal Reserve's (Fed) interest rate cut timing may be delayed longer than expected. As a result, a downturn in the domestic stock market seems inevitable, but high-bandwidth memory (HBM)-related stocks are expected to continue their upward trend, attracting investors' attention.

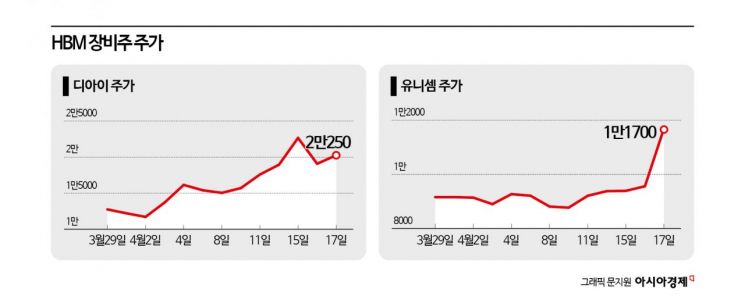

According to the financial investment industry on the 18th, DI's stock price has risen 58.8% since the beginning of this month. During the same period, the KOSPI fell by 5.9%. The return compared to the market reached 64.7 percentage points.

Founded in 1961, DI is a semiconductor inspection equipment developer. It supplies DRAM and NAND burn-in testers. Its consolidated subsidiary, Digital Frontier (DF), succeeded in domestic production of wafer tester equipment. It supplies memory wafers and burn-in testers as a partner of SK Hynix.

According to data from market research firm TechInsights, the share of HBM in the DRAM market is expected to rise from 16% this year to 33% by 2029. It is anticipated to become the highest revenue-generating product among all DRAM products.

Semiconductor manufacturers such as Samsung Electronics and SK Hynix have recently been actively expanding their HBM production capacity. KB Securities researcher Kwon Tae-woo said, "Demand for HBM inspection equipment will increase," adding, "Since DRAM stacking affects yield, demand for yield improvement-related equipment will continue to be highlighted."

HBM wafer testers can quickly identify defective products at the early production stage. They help improve the quality of the final product and reduce overall production costs. DI's subsidiary is developing burn-in testers for HBM upon development requests from clients. Researcher Kwon predicted, "It is expected that equipment verification for HBM wafer testers is underway," adding, "Since this is an essential piece of equipment for HBM rather than a general inspection device, demand for this equipment will increase as HBM generations are replaced."

Unisem is a company that develops scrubbers, which purify harmful gases generated during semiconductor manufacturing processes, and chillers, which control wafer temperature. It also supplies scrubbers and chillers needed for the silicon through-via (TSV) line required in HBM manufacturing processes. Its stock price has risen 27.7% since the beginning of this month. SK Securities researcher Lee Dong-joo forecasted, "Considering the aggressive TSV expansion plans of front-end customers, the back-end process will partially fill the gap in front-end investment this year."

SK Securities estimated that Unisem recorded sales of 57.9 billion KRW and operating profit of 5.5 billion KRW in the first quarter of this year. These figures represent increases of 12% and 28%, respectively, compared to the same period last year.

EO Technics, which develops laser cutting equipment necessary for semiconductor production processes, has risen 17% since the beginning of this month. Kyobo Securities researcher Kim Min-chul explained, "As the number of HBM stacking layers increases, wafer thickness must become thinner," adding, "Laser cutting is more suitable than the existing blade method for wafer cutting." He continued, "Demand for annealing equipment used to improve yield will be proportional to HBM demand," and added, "EO Technics' competitiveness is superior compared to its competitors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.