Shiseido and Fancl... Targeting the Inner Beauty Market Instead of Color Cosmetics

Nikkei: "Korean Cosmetics Popularity Leads to Poor Performance of Japanese Brands"

There is an analysis that the recent shift of major Japanese cosmetics companies such as Shiseido and Fancl toward the health supplement market, including 'drinkable vitamins,' has been influenced by the strengthened competitiveness of Korean cosmetics.

On the 20th, Nihon Keizai Shimbun (Nikkei) reported that Japanese cosmetics giants are targeting the inner beauty market instead of focusing solely on cosmetics manufacturing as in the past, citing the reason for this strategic change as "the popularity of Korean cosmetics within Japan has diminished the presence of domestic Japanese cosmetics brands."

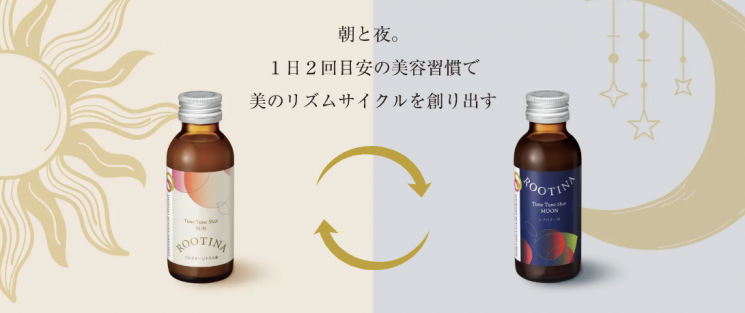

Recently, Japanese cosmetics company Shiseido launched an inner beauty brand called 'Shiseido Beauty Wellness,' which aims to achieve beauty effects through ingestion. They released the drink 'Rutina,' created in collaboration with Kagome, a Japanese food company famous for vegetable juices, and the supplement 'Tune Bote,' developed with pharmaceutical company Tsumura. Rutina is based on the concept that the body's biological rhythms differ between morning and evening, encouraging consumption twice a day to revitalize the skin. Shiseido promoted that Rutina features a blend of beauty ingredients such as strawberry, pineapple, and beta-carotene, leveraging Kagome's extensive research on vegetables. Tune Bote is a pill-type supplement developed in combination with traditional Korean medicine. Considering cases where poor stomach condition causes acne, it aims to improve skin by enhancing the condition of the five organs from a traditional medicine perspective.

Shiseido's inner beauty brand 'Shiseido Beauty Wellness' has launched 'Rutina'. (Photo by Shiseido Beauty Wellness)

Shiseido's inner beauty brand 'Shiseido Beauty Wellness' has launched 'Rutina'. (Photo by Shiseido Beauty Wellness)

This is Shiseido's first attempt to partner with other companies for all processes from product research to launch. Particularly, CEO Masahiko Uotani was strongly determined, personally proposing and negotiating with Kagome and Tsumura.

Shiseido launched the inner beauty brand to find a breakthrough for its shrinking performance. Last year, Shiseido's net profit decreased by 36% year-on-year to 21.7 billion yen (19.47 billion KRW), and sales dropped 9% to 973 billion yen (8.7323 trillion KRW). Currently, Shiseido is seeking alternatives, including reducing product types by 20% through product restructuring.

Shiseido's inner beauty brand 'Shiseido Beauty Wellness' presents 'Tune Bote'. It emphasizes the inclusion of traditional herbal ingredients. (Photo by Shiseido Beauty Wellness)

Shiseido's inner beauty brand 'Shiseido Beauty Wellness' presents 'Tune Bote'. It emphasizes the inclusion of traditional herbal ingredients. (Photo by Shiseido Beauty Wellness)

Fancl, famous for color cosmetics such as eyeshadows, is also securing new customer segments with its calorie-cutting health supplement 'Calorie Meat.' Additionally, it has developed tea and beverages in partnership with Kirin Holdings. Premier Anti-Aging, known for its skincare brand 'Duo,' launched 'Shinto,' which aims for whitening effects through vitamin C, and 'X,' targeting body fat, consecutively last year. Bulk Homme, a men's cosmetics company, has been selling a drinkable protein for people with sleep disorders before bedtime since late November last year.

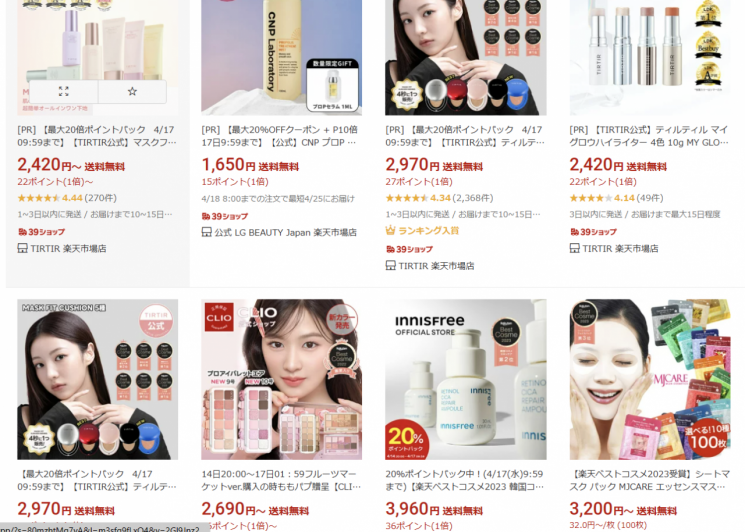

Nikkei analyzed that the background of the poor performance of Japanese cosmetics giants lies in the strengthened competitiveness of Korean cosmetics brands. According to the Japan Imported Cosmetics Association, the import value of Korean cosmetics was 77.5 billion yen (6.953 billion KRW) in 2022, surpassing France?which had held the top spot for about 30 years?for the first time. The import value in 2023 increased further to 95.9 billion yen (8.604 billion KRW), 2.5 times higher than before the COVID-19 pandemic.

Nikkei stated, "Thanks to the popularity of K-pop, Korean Wave dramas, and movies, Korean brand color cosmetics and skincare products are gaining popularity," adding, "Until a few years ago, the main customer base was Generation Z, but recently it has spread to people in their 30s and 40s, indicating that it is not just a fleeting trend but is establishing a firm position." It further noted, "As the presence of Japanese cosmetics brands weakens, there is a mood to seek new opportunities in the health supplement market, which still has growth potential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)