CXO Research Institute, Q1 Domestic Stock Market Cap Analysis

SK Hynix Increases Market Cap by 30 Trillion to 133 Trillion

SK Hynix's market capitalization increased by approximately 30 trillion KRW (29%) in the first quarter (January to March). Samsung Electronics saw an increase of about 17 trillion KRW (3.5%). By group, Samsung's market cap was the largest at around 750 trillion KRW as of the end of last month.

Korea CXO Research Institute, a corporate analysis specialist, announced on the 16th the analysis results of the first quarter domestic stock market capitalization changes. A total of 2,692 stocks excluding preferred shares were analyzed.

Overall, the market capitalization rose from 2,503 trillion KRW at the beginning of the year to 2,599 trillion KRW at the end of last month, an increase of 96 trillion KRW (3.8%). The number of stocks joining the '1 trillion KRW club' increased by 4, from 259 to 263 during the same period.

There were 35 stocks whose market capitalization increased by more than 1 trillion KRW. Two of them increased by more than 10 trillion KRW: SK Hynix and Samsung Electronics. SK Hynix's market cap rose from 103.6675 trillion KRW at the beginning of the year to 133.2244 trillion KRW at the end of last month, an increase of 29.5568 trillion KRW (28.5%). Samsung Electronics increased from 475.1946 trillion KRW to 491.9100 trillion KRW, up 16.7153 trillion KRW (3.5%).

Other companies with market capitalization increases exceeding 5 trillion KRW in the first quarter include Celltrion (7.7988 trillion KRW↑), Hanmi Semiconductor (7.096 trillion KRW↑), HLB (6.883 trillion KRW↑), Hyundai Motor (6.8747 trillion KRW↑), KB Financial Group (6.4158 trillion KRW↑), Alteogen (5.6896 trillion KRW↑), Samsung C&T (5.4192 trillion KRW↑), and Kia (5.0657 trillion KRW↑).

On the other hand, LG Energy Solution's market capitalization decreased from 100.503 trillion KRW at the beginning of the year to 92.430 trillion KRW at the end of last month, down 8.073 trillion KRW (8%). Naver (6.5125 trillion KRW↓), POSCO Holdings (5.5817 trillion KRW↓), EcoProMotive (4.7668 trillion KRW↓), LG Chem (3.8472 trillion KRW↓), POSCO Future M (3.7569 trillion KRW↓), HMM (3.3625 trillion KRW↓), POSCO DX (3.1471 trillion KRW↓), and SK Innovation (3.0065 trillion KRW↓) also saw their market caps decrease by more than 3 trillion KRW in the first quarter.

Seven stocks newly joined the 'Top 100' list: HD Hyundai Electric (114→62), SKC (106→90), Enchem (209→91), Hyundai Rotem (112→94), LIG Nex1 (116→97), Rino Industrial (101→98), and NH Investment & Securities (105→99).

Among the 'Top 20', 14 stocks changed their market cap rankings. Kia (7→6), Celltrion (10→7), and Samsung SDI (11→9) rose in rank. POSCO Holdings (6→8), Naver (8→11), and LG Chem (9→10) dropped. New entrants to the Top 20 were Samsung Life Insurance (24→19) and Hana Financial Group (29→20). EcoPro (19→21) and LG Electronics (20→23) fell out of the Top 20.

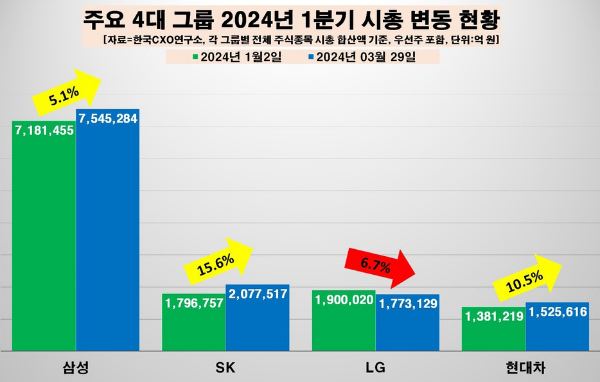

By group, Samsung ranked first. Samsung's market cap increased from 718.1455 trillion KRW at the beginning of the year to 754.5284 trillion KRW at the end of last month, up 36.3829 trillion KRW (5.1%). SK overtook LG, which was second until the beginning of the year. SK's market cap rose from 179.6757 trillion KRW to 207.7517 trillion KRW, an increase of 28.076 trillion KRW (15.6%). The market caps of SK Hynix and SK Square increased. LG's market cap decreased from 190.002 trillion KRW to 177.3129 trillion KRW, down 12.6891 trillion KRW (6.7%). The decline was largely due to LG Energy Solution and LG Chem's market caps dropping from the 34 trillion KRW range to the 30 trillion KRW range. Hyundai Motor's market cap increased from 138.1219 trillion KRW to 152.5616 trillion KRW, up about 14.4397 trillion KRW (10.5%), driven by increases in Hyundai Motor, Kia, and Hyundai Mobis market caps.

Oilseon Oh, director of CXO Research Institute, said, "Although the domestic stock market capitalization increased in the first quarter, the number of stocks with decreased market caps was about 15% higher than those with increased market caps. Despite this situation, leading stocks in the electronics, automotive, finance, and pharmaceutical sectors played a driving role in increasing market capitalization, but secondary battery, chemical, and transportation stocks struggled."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.