Samil Records Nearly 900 Billion KRW in Sales Last Fiscal Year... Expectations Rise for 1 Trillion

Samjong, Appointed as Samsung Electronics' External Auditor, Draws Attention for Rapid Growth

Industry attention is focused on whether the country's 'Big 2' accounting firms will surpass annual sales of 1 trillion won (excluding consulting). The main players are Samil, which recorded sales in the 900 billion won range last year, and Samjong, which achieved sales in the 800 billion won range. However, the prevailing view is that Samil will be the first to join the '1 trillion club.'

Domestic No.1 Samil Likely to Surpass 1 Trillion Won Excluding PwC Consulting... Samjong, Having Secured Samsung Electronics as a Client, Also in Fierce Pursuit

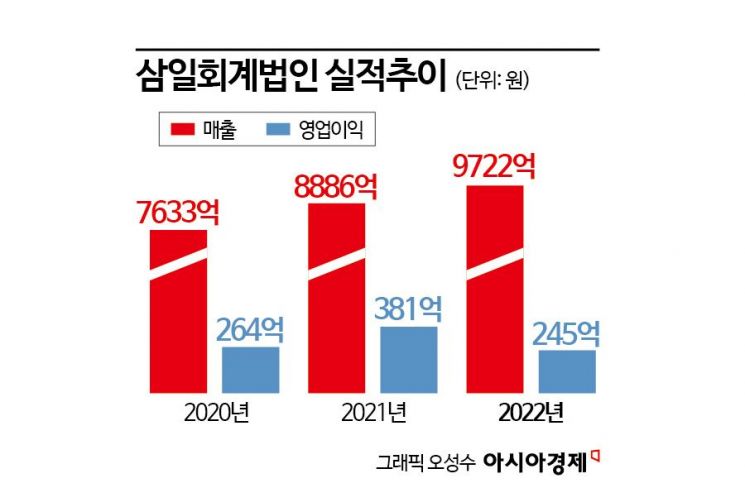

In the accounting audit industry, there is widespread expectation that Samil Accounting Corporation, which closes its fiscal year in June, will surpass 1 trillion won in operating revenue (sales) from July 2023 to June this year. Samil Accounting Corporation recorded sales of 972.2 billion won in the last fiscal year (from July 2022 to June 2023). Including PwC Consulting, a separate entity, sales for the period reached 1.3685 trillion won, but Samil Accounting Corporation alone has not yet exceeded 1 trillion won. It is predicted that in this fiscal year, sales from accounting audit, tax advisory, and management consulting alone will exceed 1 trillion won. Since CEO Yoon Hoon-soo took office in 2020, Samil has maintained stable growth across all service areas including audit, tax, and deals (M&A). While solidifying its position as the top accounting firm, it is also creating new revenue streams by launching a digital solution subscription service that allows easy access to overseas subsidiary sales and management information, a first among accounting firms.

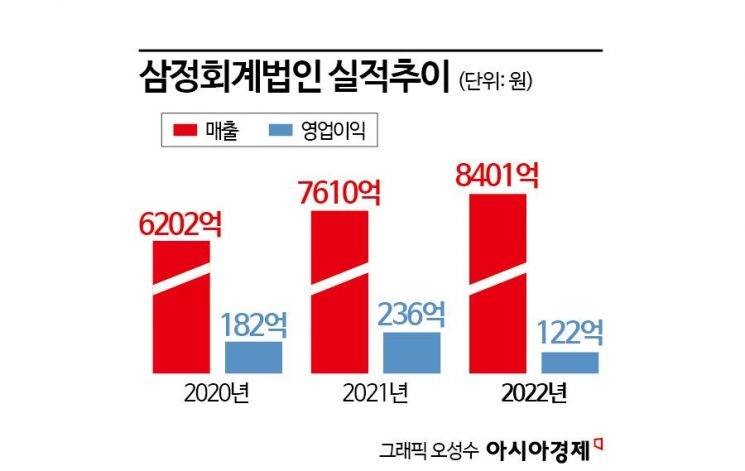

For Samjong Accounting Corporation, which closes its fiscal year in March, it attracted market attention with outstanding sales capabilities, having been appointed as an external auditor for Samsung Electronics following SK Hynix last year. However, due to the recent sluggishness in the M&A market, it is expected to be difficult to surpass 1 trillion won in sales. Although the business report has not yet been released, it is reported that sales for the recent fiscal year (April 2023 to March 2024) remained at the level of the previous year. Samjong Accounting Corporation recorded operating revenue in the 840 billion won range in the last fiscal year (April 2022 to March 2023). A senior industry official said, "Sales in the accounting audit sector were not bad, but sales from M&A and consulting, such as management advisory, decreased." As management advisory sales, which have accounted for more than half of annual sales, declined, Samjong's entry into the '1 trillion club' is expected to be delayed until next year or later. Nevertheless, the industry holds a high view of Samjong's growth. A senior official at Firm A hinted, "Samjong has shown steady double-digit growth every year, leveraging the sales capabilities of Chairman Kim Gyo-tae, and its industry reputation is improving."

With the M&A Market Shrinking, Building Performance through Small and Medium-sized Deals

In the first quarter of this year, the domestic M&A market shrank sharply, with no trillion-won scale deals completed, but Samil and Samjong have steadily accumulated performance by handling small and medium-sized deals. According to the financial investment industry, Samil Accounting Corporation ranked first in the financial advisory sector for M&A deals completed (final payment made) in the first quarter of this year. Samil handled a total of 32 deal advisories, completing transactions worth 2.4537 trillion won. In the first quarter of last year, Samil was only 10th (1.745 trillion won, 13 deals). Its market share was 6.3%, but expanded to 56.0% in just one year. The number of deals increased from 13 to 32. Samjong also targeted small and medium-sized deals, increasing the number of deals handled. Although the deal size decreased from 2.3838 trillion won to 558 billion won, the number of deals rose from 6 to 10. Its market share also increased from 8.6% to 12.8%, and its ranking improved from 4th to 2nd.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)