132 Shareholding Changes in Q1, Hanatour Tops Increase

Holding Companies Like Doosan, OCI Holdings, GS Also Raise Stakes

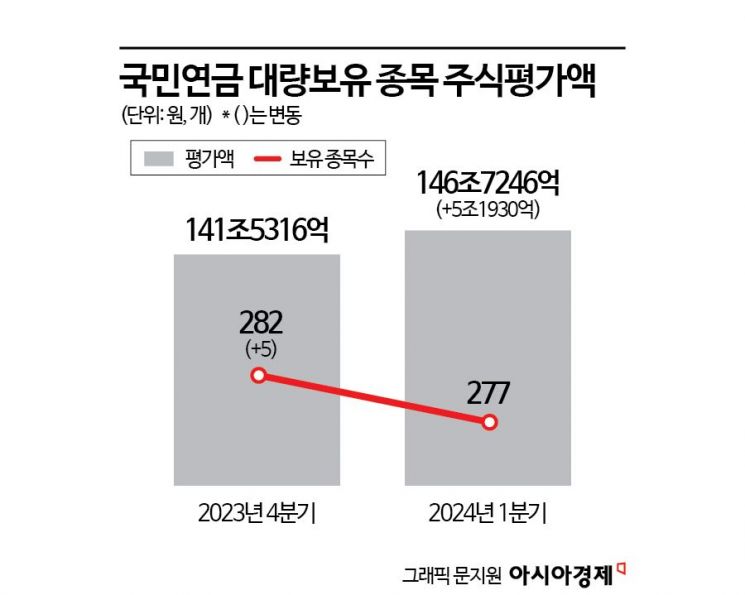

Stock Valuation Increased by About 5 Trillion Won During Q1

Among the stocks in which the National Pension Service (NPS) holds more than a 5% stake, about half saw changes in their shareholding ratios during the first quarter. Overall, Chinese beneficiary stocks and holding companies mostly increased their stakes, while domestic sectors such as small and mid-sized cosmetics and food companies were reduced from the portfolio. Additionally, with the stock valuation increasing by about 5 trillion KRW during the same period, it appears that the NPS has made a smooth start to the year.

On the 11th, the NPS disclosed its large-scale holdings for the first quarter of 2024 on its website. There were a total of 132 stocks. Of these, 41 increased, while the remaining 91 decreased.

Stocks with more than 5% holdings that experienced changes are disclosed as required on an ad hoc basis and are collectively announced quarterly. As of this date, the NPS holds a total of 277 large-scale holdings. Half of these stocks experienced changes in shareholding ratios. Considering that 112 stocks were disclosed in the fourth quarter of last year, it is interpreted that the NPS has been trading more actively this year.

Increased Stakes in Chinese Beneficiary Stocks and Holding Companies

The stock with the largest increase in shareholding ratio during the first quarter was Hana Tour. It rose from 5.34% to 8.64%, an increase of 3.3 percentage points. Recently, travel demand has recovered to pre-COVID-19 levels, increasing interest in related stocks. According to statistics from the Ministry of Land, Infrastructure and Transport, the number of passengers on domestic airlines in the first quarter of this year was 22,530,875, which is 96% of the 23.39 million passengers in the first quarter of 2019, before COVID-19.

Next, stocks that were heavily added to the NPS portfolio include Hanwha Engine (7.16→9.32%), LG Household & Health Care (6.94→9.09%), Doosan (6.19→8.3%), and Jahwa Electronics (4.97→7.07%). Hanwha Engine is a company newly launched this year after Hanwha Group completed the acquisition of HSD Engine, the world's second-largest manufacturer of low-speed marine engines, and renamed it Hanwha Engine. The securities industry estimates that Hanwha Engine's first-quarter order performance is about 576 billion KRW, and expects the company to enter a performance normalization phase from its first year of operation.

LG Household & Health Care has experienced severe stock price declines since reaching 1.76 million KRW in 2021. As of the closing price on the 11th, it was 353,000 KRW, down about 80% from its peak. Recently, with the recovery of exports to China, signs of a rebound are emerging. Along with Hana Tour, which the NPS increased its stake in the most, it can be classified as a 'Chinese beneficiary stock.' Doosan is the holding company of the Doosan Group. Holding companies are considered 'perennially undervalued stocks' and are expected to benefit from 'value-up' prospects. The NPS also increased its stakes in other holding companies such as OCI Holdings (9.27→10.41%) and GS (6.34→7.4%).

Significant Reduction in Domestic Stocks Including Hotels, Food, and Casinos

On the other hand, the NPS reduced its shareholding ratios by more than 3 percentage points in stocks such as Ssangyong C&E (5.06→0.32%), Hwasung Enterprise (7.5→4.22%), Clio (9.29→6.01%), Hotel Shilla (9.84→6.63%), and Taekwang (8.23→5.04%). In the case of Ssangyong C&E, there was a special situation where the private equity fund (PEF) operator Hahn & Company pursued a public tender offer for voluntary delisting. The footwear manufacturer Hwasung Enterprise was hit hard by poor performance, as its main client Adidas recorded a deficit of about 80 billion KRW for the first time in 32 years last year, resulting in a 75% decrease in operating profit in 2023 compared to the previous year.

The NPS also reduced its holdings in other small and mid-sized cosmetics stocks such as Korea Kolmar (13.2→11.39%) and Cosmax (13.35→12.19%), including Clio. Domestic-related stocks were also significantly reduced. In addition to Hotel Shilla, food stocks such as Nongshim (11.17→9.97%) and Samyang Foods (12.72→10.67%), as well as the casino public enterprise Grand Korea Leisure (11.33→8.92%), were also reduced.

Meanwhile, the NPS held 277 stocks with more than 5% stakes, with a total stock valuation of 146.7246 trillion KRW (based on closing prices on the 9th). At the end of the fourth quarter of last year, the number of large-scale holdings was 282, with a valuation of 141.5316 trillion KRW. Although the number of stocks decreased by five, the valuation increased by 3.66% (5.193 trillion KRW). Considering that the KOSPI rose by 1.8% during this period (January 2 to April 9), it appears that the NPS received a good report card for its first-quarter trading this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.