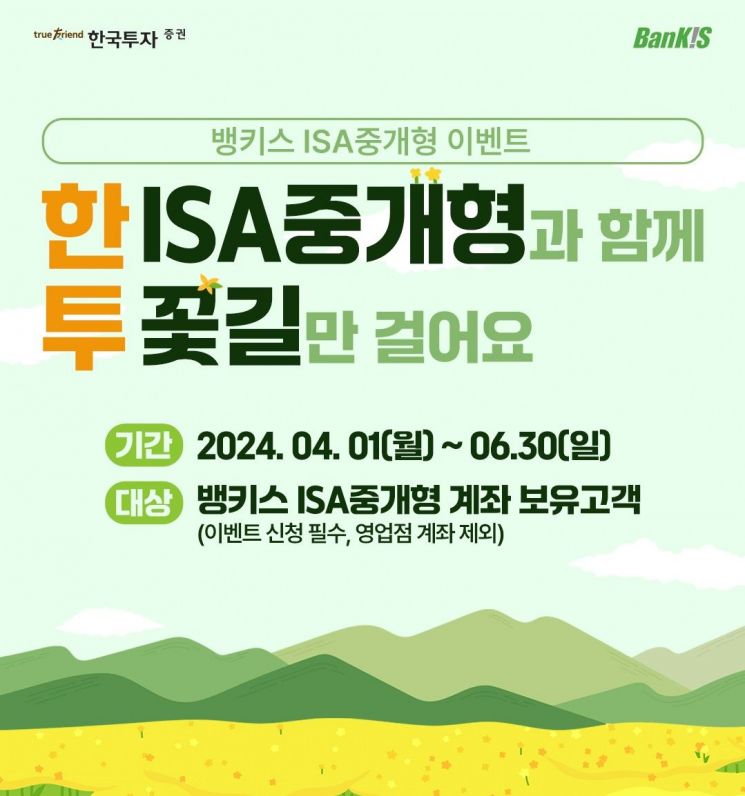

Korea Investment & Securities, a subsidiary of Korea Financial Group, announced on the 11th that it will hold an event for Bankis customers with brokerage-type Individual Savings Accounts (ISA) until the end of June. Bankis is an online-only account and trading service of Korea Investment & Securities that can be opened non-face-to-face or through commercial banks.

Customers who newly open a Korea Investment & Securities 'brokerage-type ISA' account and deposit more than 100,000 KRW will receive a 5,000 KRW gift certificate. Additionally, if the deposit exceeds 5 million KRW, an extra gift certificate of up to 200,000 KRW will be provided according to the deposit amount. Among customers who extend the maturity during the event period, 1,000 will be selected by lottery to receive Starbucks coffee coupons as a maturity extension benefit.

The brokerage-type ISA account is a tax-advantaged account that allows diversified investment in various financial products such as domestic listed stocks and bonds. Dividend and interest income up to 2 million KRW (4 million KRW for the basic type) are tax-exempt, and any amount exceeding the tax-exempt limit is subject to a separate tax rate of 9.9%, which is not included in the comprehensive financial income tax.

In particular, as it has been three years since the brokerage-type ISA account was introduced this year, customers who joined early are reaching maturity as the mandatory holding period for tax benefits has passed. Once maturity passes, financial income such as interest and dividends from financial products in the ISA account will no longer be tax-exempt, so it is advisable to extend the maturity of the ISA account in advance according to the interest/dividend payment date or product maturity.

Jae-Hyun Park, Head of the Individual Customer Group, said, "ISA accounts are gaining attention as essential accounts for asset management," and added, "We will continue to provide various benefits and content to offer customers opportunities to utilize ISA accounts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)