Subscriber Growth Following Pro Baseball Broadcasts Spurs Netflix Pursuit

Tving, a native online video service (OTT) platform, is enjoying the benefits of securing professional baseball broadcasting rights, contrary to initial concerns. Since acquiring the new media broadcasting rights for professional baseball, the number of active users and subscribers has rapidly increased, closely chasing Netflix, the 'number one' OTT.

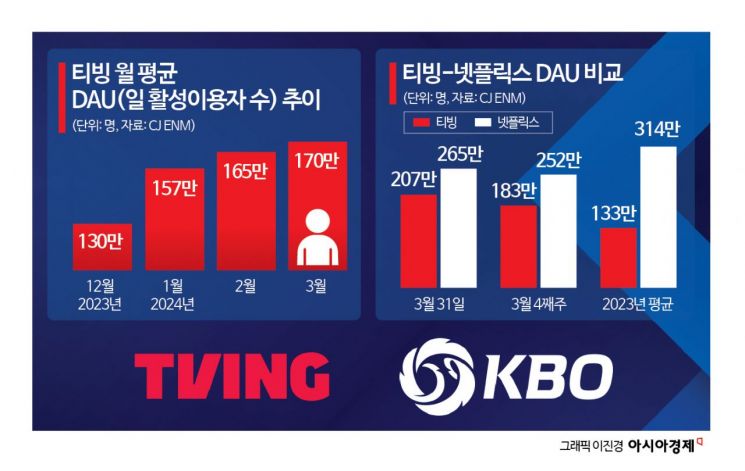

According to CJ ENM, the operator of Tving, the average daily active users (DAU) of the Tving OTT application in the last week of March reached 1.83 million. This is more than a 34% increase compared to the same period last year (1.23 million). The gap with Netflix (2.52 million) narrowed from 1.81 million last year to 690,000.

The number of subscribers is also increasing. CJ ENM stated, "The number of new paid subscribers in the first quarter increased by 50% compared to the previous quarter," adding, "The success of original content, including professional baseball broadcasts, has accelerated the acquisition of new subscribers."

The biggest contributor to Tving's growth is undoubtedly professional baseball broadcasting. From March 9 to 19, the 11 days since the start of professional baseball exhibition game broadcasts, Tving's total usage time was 21.12 million hours, a 7% increase compared to the previous week, recording the highest viewing time among domestic OTTs.

There were concerns that Tving's insistence on monetizing professional baseball broadcasts might alienate baseball fans and fail to increase subscribers, but these worries proved unfounded. A CJ ENM official explained, "After the news of securing professional baseball broadcasting rights, there were signs of expansion in viewing time and subscriber numbers," adding, "In particular, in the February viewing time metrics, Tving surpassed Netflix, with Tving's viewing time at 520 minutes, nearly 80 minutes higher than Netflix's 422 minutes."

Last month, Tving became the first domestic OTT operator to launch a 5,500 KRW ad-supported subscription plan (AVOD), which allows simultaneous access on up to two devices, enabling users to enjoy all professional baseball games throughout the month for about 2,700 to 2,800 KRW per person.

At this rate, it is expected that the subscriber target of 5 million for this year will be easily surpassed. As of the end of the first quarter this year, Tving's paid subscribers numbered approximately 4.3 million. The company said, "If the league's ranking battle intensifies and Tving's content continues to succeed, achieving 5 million subscribers will be smooth."

In the securities industry, CJ ENM's first-quarter sales are estimated to reach 1.0139 trillion KRW, a 6.8% increase compared to the same period last year. Operating profit is expected to turn positive at 19.7 billion KRW.

The shift in media consumption patterns toward OTT is also positive. The Korea Communications Commission revealed in the ‘2023 Media Usage Survey’ that 77% of Koreans use OTT. Especially, the usage rates among people in their 20s (97.8%) and teens (97.6%) are nearly 100%, establishing OTT as a universal viewing platform nationwide.

The Korea Information Society Development Institute (KISDI) reported in its 2022 ‘OTT Report’ that only 39.3% of OTT users watch just one service, while 60.7% subscribe to two or more OTT platforms.

An industry insider analyzed, "With rising OTT subscription fees increasing economic burdens, a dual-stronghold structure is solidifying: 'Global series on Netflix' and 'domestic broadcasting and professional baseball on Tving.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)