Legacy Semiconductor Regulations, Domestic Impact Inevitable

China Sanctions' Reflex Benefit Goes to Taiwan

Possibility of Tariffs on Chinese Legacy Semiconductors

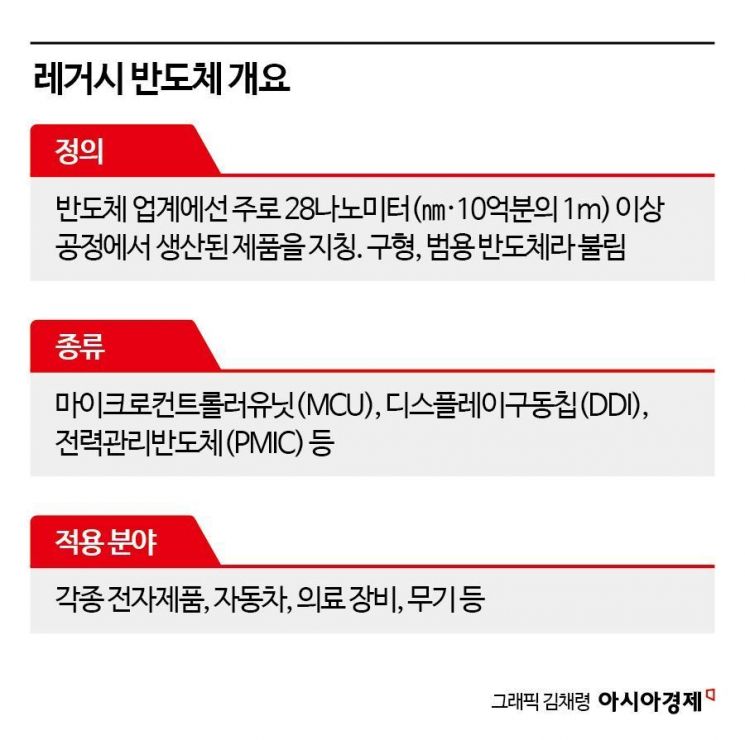

The United States is increasingly moving to tighten restrictions on China not only in advanced semiconductors but also in the legacy (older) semiconductor sector. Although the regulatory measures have not yet been concretely defined, our authorities are closely monitoring the situation. There are also prospects that the U.S. may impose additional tariffs on Chinese-made chips.

On January 10 (local time), Ahn Deok-geun, Minister of Trade, Industry and Energy, who visited the U.S. for the first time since taking office this January, met with domestic reporters at Dulles International Airport near Washington DC. He stated that they are observing the cooperation between the U.S. and Japan regarding regulations on China's legacy semiconductors. Regarding the potential impact on Korea, Minister Ahn said, "The legacy semiconductor issue is still under discussion," adding, "We need to see what specific progress has been made between the U.S. and Japan, and we are still monitoring the situation."

On the same day, U.S. President Joe Biden and Japanese Prime Minister Fumio Kishida held a summit at the White House. Inside and outside the semiconductor industry, there is speculation that the two countries explored ways to reduce dependence on China in the legacy sector of 28 nanometers (nm, one billionth of a meter) and above during this meeting. Previously, the U.S. had consulted with the European Union (EU) about addressing distortions in the legacy supply chain. This is essentially a move targeting China.

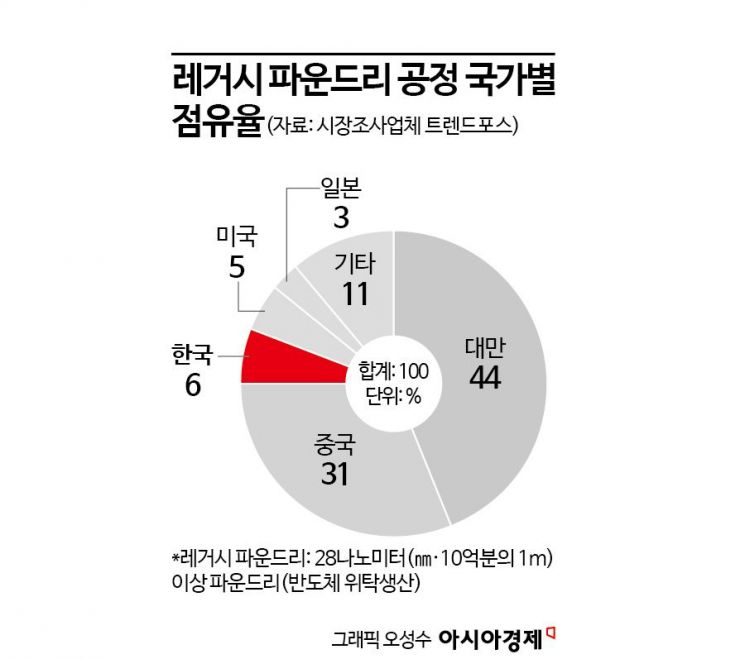

Since the impact varies depending on the scope and intensity of the regulations, interpretations of the effects on our industry differ. However, there is no disagreement that if regulations on legacy semiconductors materialize following those on advanced semiconductors, damage will be inevitable. Given Taiwan's significant share in the legacy ecosystem, there is also an expectation that the benefits may shift toward that region.

A semiconductor equipment industry official said, "There has been no guideline or concrete news on how legacy semiconductors will be regulated," but added, "If they try to control equipment or technology exports as they did with advanced semiconductor regulations, domestic companies could suffer damage." Another industry insider predicted, "Since the Chinese government is focusing on 28nm-class processes within legacy semiconductors, the U.S. may target this area for regulation."

There is also speculation that the U.S. could impose tariffs on legacy semiconductors produced in China as a form of sanction. In this case, the calculations for Samsung Electronics and SK Hynix, which have semiconductor factories in China, could become complicated.

Yeon Won-ho, head of the Economic Security Team at the Korea Institute for International Economic Policy, explained, "The U.S. could impose additional tariffs citing unfair trade or national security reasons," adding, "There is a possibility that the legacy supply chain will become segmented, with Korean companies handling production in China and other countries, while domestic production is exported to the U.S."

Indirect damage has already surfaced. Samsung Electronics and SK Hynix have not been selling outdated equipment amid the U.S. efforts to curb China's legacy semiconductor business. Since there is a risk that this equipment could flow into China and be utilized, they have been storing the equipment in warehouses for over a year. The industry expects the damage incurred by the two companies to amount to several hundred billion won.

An industry official said, "Domestic companies have been paying hundreds of billions of won in warehouse fees for over a year, unable to sell or discard outdated equipment," adding, "After the U.S. imposed advanced equipment export controls in 2022, Samsung Electronics and SK Hynix were granted 'Verified End Users (VEU)' status to avoid regulations, but since this is a one-year temporary exemption, which must be renewed annually, domestic companies are cautious even though there are currently no regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.