Disagreement Over 'Bitcoin Spot ETF Approval'

Empty Promises Must End... Focus Needed on Practical Effectiveness

As the ruling and opposition parties vie for the votes of 'coin ants,' the virtual asset industry has focused on taxation policies. With both parties presenting similar pledges, there is an expectation that taxation issues will have a significant impact on voters' choices since they are directly linked to the personal interests of individual investors.

On the 9th, the virtual asset industry identified taxation as a key agenda item among the ruling and opposition parties' general election pledges. This is because individual investors are the main consumers in the Korean virtual asset market, where institutional investors are legally prohibited from participating. A representative from a major domestic virtual asset exchange said, "Taxation is inevitably a sensitive issue for individual investors," adding, "While policies aimed at growing the market and industry are of interest to the sector, from the investor's perspective, taxation issues directly affecting their own profits are crucial." A CEO of a virtual asset-related company conveyed that "retail investors are closely scrutinizing the taxation pledges."

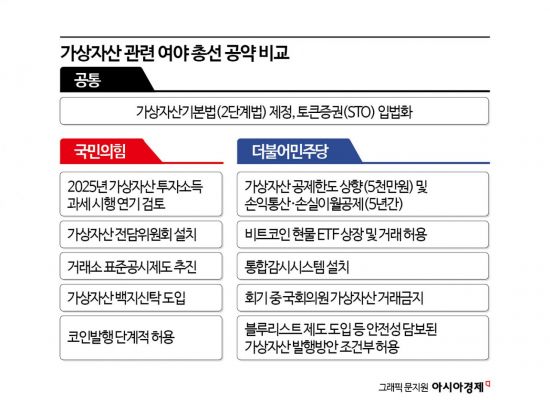

Under the amended Income Tax Act, virtual assets are scheduled to be taxed separately as other income starting from January 1, 2025, on transfers and lending. If income exceeds the basic deduction of 2.5 million KRW, a 22% tax including local taxes was planned to be imposed. The People Power Party took a bold step by proposing to postpone the taxation timing until after the enactment of the Virtual Asset Basic Act (Phase 2 law). They plan to consider delaying implementation until guidelines and regulations related to virtual asset legalization are completed. The Democratic Party of Korea also pledged to significantly raise the virtual asset deduction limit to 50 million KRW and introduce offsetting of gains and losses and a five-year loss carryforward period.

Regarding the Democratic Party of Korea's pledge to allow institutional investors to participate in the virtual asset market and approve Bitcoin spot Exchange-Traded Funds (ETFs), opinions within the industry were divided. One industry insider said, "South Korea is not a Galapagos, and Bitcoin spot ETFs are a global trend, so it will be difficult for only South Korea to reject them," criticizing, "Since this is already underway, the pledge has no real significance." On the other hand, another industry representative said, "There is a completely different weight between what is included in a pledge and what is not," evaluating, "Just as the KRW deposit limit for virtual asset limited accounts was changed to 5 million KRW following lawmaker Kim Hee-gon's National Assembly audit, pledges do carry meaning."

The remaining pledges are similar between the two parties. A representative example is the enactment of the Virtual Asset Basic Act (Phase 2 law), a fundamental law related to the industry that goes beyond the Virtual Asset User Protection Act (Phase 1 law) scheduled for implementation in July. The legalization of token securities issuance (STO) is also a common pledge. The People Power Party's promotion of a standardized disclosure system for exchanges and the Democratic Party's plan to install an integrated monitoring system both aim to strengthen investor protection and enhance market transparency. There is also a shared consensus, stemming from the 'Kim Nam-guk coin incident,' that lawmakers should transparently disclose their virtual asset holdings. The ruling party has proposed introducing a blind trust for virtual assets, while the opposition party has pledged to ban lawmakers from trading virtual assets during sessions. Both parties have similar plans to revise the virtual asset issuance system.

Some have criticized that evaluation should focus more on execution capability rather than the attractiveness of individual pledges. A professor in the virtual asset field said, "Both parties have proposed similar bills, but even if the opposition wins, it may be difficult to properly implement the pledges in coordination with the government," emphasizing, "Policy pledges should not remain mere words but must be supported by substantial administrative capacity in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.