Both People Power Party and Democratic Party

Emphasize Livelihood and Small Business Owners

Issues Arise When Market Principles Are Abandoned or

Bank Burdens Increase Excessively

Ahead of the April 10 general election, the ruling and opposition parties have unveiled various financial pledges centered on the keyword ‘livelihood.’ These mainly focus on alleviating debt burdens and tailored pledges for small business owners and self-employed individuals. However, there is an analysis that many policies deviate from market economy principles, such as those imposing heavy burdens on the banking sector.

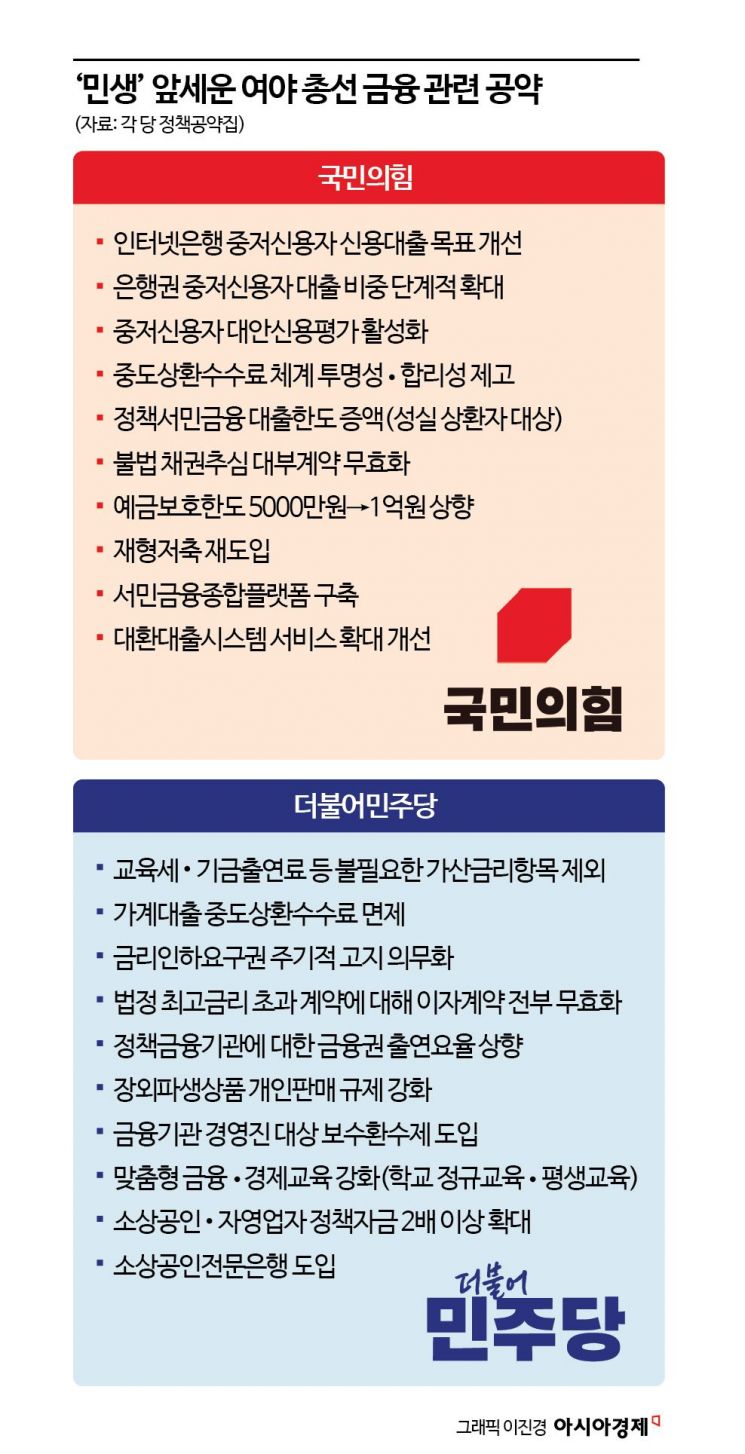

Looking at the People Power Party’s general election pledge book, most financial pledges are mainly placed in the third and fourth of ten themes. The third and fourth themes are ‘Revitalizing Livelihood, New Hope’ and ‘Support for Small Business Owners and Small and Medium Ventures,’ respectively. This is interpreted as an intention to invigorate livelihoods through financial pledges and support small business owners and small and medium ventures.

The pledges under the third theme mostly involve loan-related policies. Specifically, these include improving credit loan targets for medium- and low-credit borrowers at internet banks, gradually expanding the proportion of loans to medium- and low-credit borrowers in the banking sector, expanding and improving the debt refinancing system service, enhancing transparency and rationality of early repayment fee systems, increasing loan limits for policy-based financial products for low-income earners (limited to those with faithful repayment), and raising the deposit protection limit (from 50 million won to 100 million won). Asset formation-related pledges such as reintroducing savings-type tax-exempt savings accounts and establishing a comprehensive financial platform for low-income earners also stand out.

In the area of support for small business owners and small and medium ventures, debt adjustment-related pledges are included. Representative examples are doubling the repayment period for principal and interest on working capital and refinancing guarantees, expanding the support target of the New Start Fund from small business owners affected by COVID-19 to those who operated businesses during the relevant period, and shortening the registration period of debt adjustment public information for New Start Fund debtors. They also pledged to simplify the multi-level structure of payment gateway (PG) companies through an on-site investigation.

Distinctive pledges from the Democratic Party of Korea focus on creating a healthy market environment. Examples include revising standard terms and conditions to improve fee systems such as refunds, payments, and usage of mobile gifticons, and expanding refund policies for balances of exchange-type mobile gift certificates.

The Democratic Party of Korea placed many financial pledges under the first keyword of its four major visions for the general election, ‘Livelihood Recovery.’ In particular, alleviating the burden of loan principal and interest repayment appears as the very first pledge in the pledge book. Under this keyword, they set a goal to closely manage livelihoods and relieve the pain of small business owners and the self-employed.

They proposed excluding unnecessary additional interest rate items such as education tax and fund contribution fees, promoting exemption of early repayment fees on household loans, raising the contribution rate of financial institutions to policy financial institutions, and mandating periodic notification of the right to request interest rate reduction. They also introduced policies to establish a debtor-centered protection system.

To reduce the interest burden on loans for small business owners and the self-employed, they plan to expand low-interest refinancing loans and support converting high-interest insurance policy loans to low-interest loans. They will also prepare measures to prevent disadvantages such as interest rate hikes at financial institutions caused by policy fund loans.

Distinctive pledges from the People Power Party include policies related to financial accidents, expansion of financial and economic education, and the introduction of a specialized bank for small business owners. They pledged to eradicate the shirking of responsibility for financial accidents through measures such as strengthening regulations on the personal sale of over-the-counter derivatives that caused incidents like the Hong Kong H Index (Hang Seng China Enterprises Index, HSCEI) equity-linked securities (ELS) case, introducing a clawback system for financial institution executives’ compensation, and strengthening sanctions for financial accidents at credit specialized companies and credit cooperatives.

However, there is a view that if the pledges of both parties are implemented, they could harm market order or cause moral hazard. The Citizens’ Coalition for Economic Justice recently reviewed the financial pledges of the parties in the National Assembly through an ‘Expert Evaluation of General Election Party Pledges.’ They stated that the introduction of savings-type tax-exempt savings accounts in the People Power Party’s pledges and the Democratic Party of Korea’s alleviation of principal and interest repayment burdens are unrealistic anti-market measures.

There is also an analysis that many fee- and loan-related pledges that increase the burden on the banking sector could actually harm financial consumers. Exemption of early repayment fees and expansion of the proportion of loans to medium- and low-credit borrowers are representative examples. A financial sector official said that banks already bear significant costs during loan screening and that “if financial companies bear the fees entirely, loans will likely be concentrated on high-credit borrowers.” Regarding the gradual expansion of the proportion of loans to medium- and low-credit borrowers in commercial banks, the official added, “Loans are already provided at low interest rates through credit evaluation models and loan cost concepts. If loans to medium- and low-credit borrowers are forcibly increased, a ‘balloon effect’ could occur, where other consumers suffer.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.