Completion of Integration Work After 23 Months

Synergy Expected... Rebound Anticipated in the Second Half

As Seven Eleven completes the acquisition of Ministop, attention is focused on whether the convenience store Big 3 (CU, GS25, Seven Eleven) will reignite their store opening competition this year.

According to the convenience store industry on the 9th, Seven Eleven has completed the integration with Ministop, which had been underway since May 2022. In March of the same year, Seven Eleven acquired 100% of Ministop’s shares for 313.4 billion KRW and has been replacing the convenience store signs. There are about 10 stores where the transition from Ministop to Seven Eleven has not yet been made. A Seven Eleven official said, "There is still about a month of grace period, so we will do our best to proceed with the transition during that time," adding, "It can be considered that the integration is virtually complete." Franchise stores that have not switched to Seven Eleven signs by the end of this month are expected to be settled through mid-term termination.

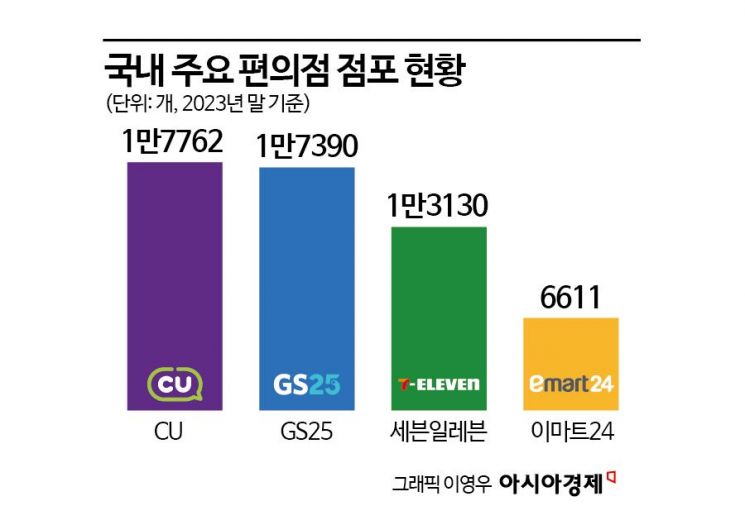

Currently, the number of Seven Eleven stores is about 13,000, which is about 4,000 fewer than BGF Retail’s CU and GS25 stores, which dominate the convenience store industry. However, the industry expects Seven Eleven to focus more on improving profitability rather than increasing the number of stores.

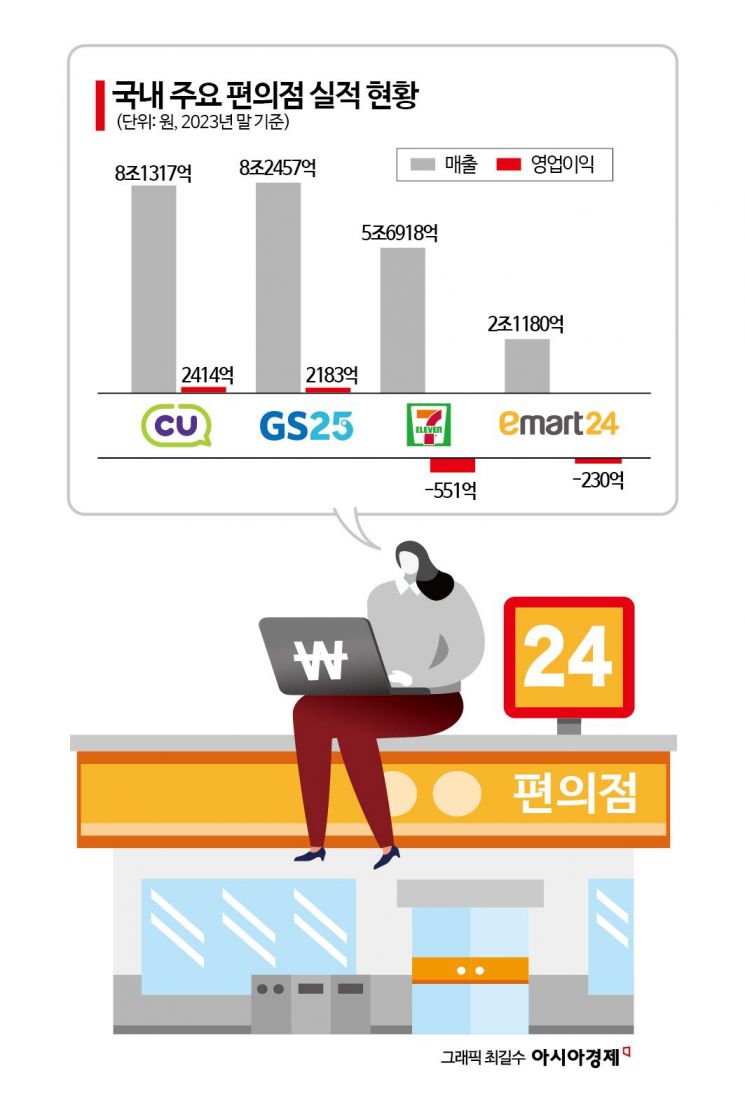

Last year, Seven Eleven’s sales amounted to 5.6918 trillion KRW, a 4.4% increase compared to the previous year. However, the annual operating loss was 55.1 billion KRW, a 1024% increase from 4.9 billion KRW the previous year. The number of stores, which was 14,265 at the end of 2022, decreased to 11,135 by the end of last year. As of the end of last year, competitors’ store counts were 17,762 for CU, 17,390 for GS25, and 6,611 for Emart24.

The deterioration in Seven Eleven’s profitability is due to increased royalties paid to its U.S. headquarters, labor costs, and logistics expenses. Additionally, remodeling costs incurred during the absorption of Ministop also had an impact. Furthermore, the burden increased after losing a Supreme Court appeal filed by the Seoul Metropolitan Government, resulting in a 6.1 billion KRW compensation payment ruling.

Seven Eleven’s financial burden is also cited as a factor hindering store opening competition. According to NICE Credit Rating, Korea Seven, which operates Seven Eleven, had a net debt of 65.6 billion KRW at the end of 2018, 431.6 billion KRW at the end of 2019, and 828.7 billion KRW as of the third quarter of last year. The debt ratio reached 378.6% as of the third quarter of last year. Due to this, Korea Seven’s long-term credit rating was downgraded from A+ (negative) to A (stable).

Seven Eleven’s strategy is to strengthen product competitiveness by expanding its product lineup under its private brand (PB) ‘Seven Select’ to solidify its foundation. In particular, it plans to enhance customer attraction by showcasing popular products from overseas convenience stores using the global Seven Eleven network. In addition, it will advance support for franchise store operations by integrating artificial intelligence (AI) technology, revamp its mobile app to provide O4O (online for offline) services, and enhance daily life convenience services such as parcel delivery and food delivery. A Seven Eleven official said, "The integration with Ministop will be completed in the first quarter," adding, "After a stabilization process in the second quarter, we expect to see significant performance improvement effects in the third and fourth quarters."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.