KCCI Conducts RBSI Survey on 500 Retailers

Outlook at 85 Indicates 'Negative'

69.4% Say "Chinese Online Platforms Are Threatening"

Expectations for the retail industry’s performance in the second quarter of this year are gradually reviving. However, there is also significant industry concern over the aggressive advance of Chinese e-commerce.

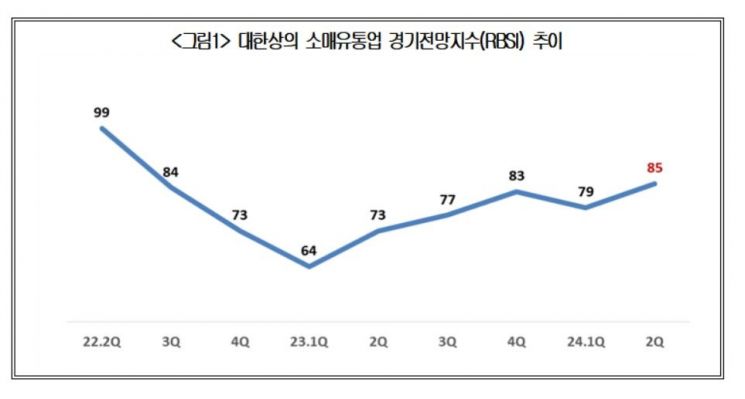

Trend of the Korea Chamber of Commerce and Industry Retail Distribution Business Outlook Index. Graph provided by the Korea Chamber of Commerce and Industry.

Trend of the Korea Chamber of Commerce and Industry Retail Distribution Business Outlook Index. Graph provided by the Korea Chamber of Commerce and Industry.

The Korea Chamber of Commerce and Industry announced on the 8th that it surveyed 500 retail companies on the Retail Business Sentiment Index (RBSI) for the second quarter, which was recorded at 85. The first quarter figure was 79.

The RBSI quantifies the business sentiment and outlook of retail companies, reflecting their perceived economic conditions. A value above 100 indicates that more companies view the upcoming quarter’s retail market more positively than the previous quarter, while a value below 100 indicates the opposite.

Department stores (97) and large discount stores (96) approached the benchmark of 100. In particular, department stores showed the highest level of optimism, maintaining a score of 97 from the previous quarter. Despite an overall contraction in consumer sentiment, department stores are less affected by economic fluctuations and have strengthened luxury goods, food, and leisure offerings, establishing themselves as complex spaces where customers can enjoy shopping, dining, and entertainment together. The weaker Korean won, which boosted foreign customer sales, also contributed to the rise in optimism.

Large discount stores (85→96) also showed strong expectations. This reflected the customer attraction effect from expanding fresh food and experiential spaces, as well as hopes for regulatory easing such as converting mandatory closure days to weekdays.

For online retail (78→84), the rapid entry of Chinese online platforms into the domestic market, leveraging ultra-low prices, somewhat limited the rise in optimism. Convenience stores (65→79) showed the largest increase, benefiting from the peak season with mild weather increasing foot traffic and boosting sales of food, beverages, and alcohol. On the other hand, supermarkets (77→77) saw no increase in optimism, as fierce competition with convenience stores, which are strengthening their food offerings, restrained growth.

As Chinese online platforms accelerate their entry into the domestic market, the sense of crisis among Korean retail companies is also intensifying. Seven out of ten respondents (69.4%) said that the expansion of Chinese online platforms into Korea poses a threat to the domestic retail market or retailers. Additionally, 74.4% of respondents expected this expansion to further intensify competition in the domestic retail market.

Regarding direct impact, 6 out of 10 online shopping companies (59.1%) reported being affected. Large discount stores (56.7%) and supermarkets (48.9%) also reported high levels of impact. This is analyzed as a result of Chinese online platforms recently handling Korean products, increasing the sense of threat.

Regarding the expansion of Chinese online platforms in Korea, many respondents said they either cannot find appropriate countermeasures (27.2%) or are monitoring the situation to decide on future responses (29.2%).

Kim Min-seok, head of the Distribution and Logistics Policy Team at the Korea Chamber of Commerce and Industry, stated, “As the business sentiment of manufacturing and retail companies recovers, it is necessary to proactively respond to the recovering consumption by preparing channel, product, and logistics strategies suitable for the recovery phase.” He added, “Considering the current reality where appropriate countermeasures against the aggressive advance of Chinese online platforms have not been found, government policy support is urgently needed.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.