Financial Supervisory Service Announces Improvement Measures for Substitute Driver Insurance

The Financial Supervisory Service announced on the 7th that it has improved substitute driver insurance products, including the establishment of a 'rental cost guarantee special clause.'

Substitute drivers subscribe to substitute driver insurance to prepare for accidents that may occur while driving on behalf of others. However, there has been an issue where the coverage scope and limits were low, resulting in insufficient actual protection against accident risks. The Financial Supervisory Service, together with the insurance industry, announced the 'Substitute Driver Insurance Product Improvement Plan,' which includes expanding the coverage scope and limits of substitute driver insurance so that substitute drivers can be effectively protected against accident risks through substitute driver insurance.

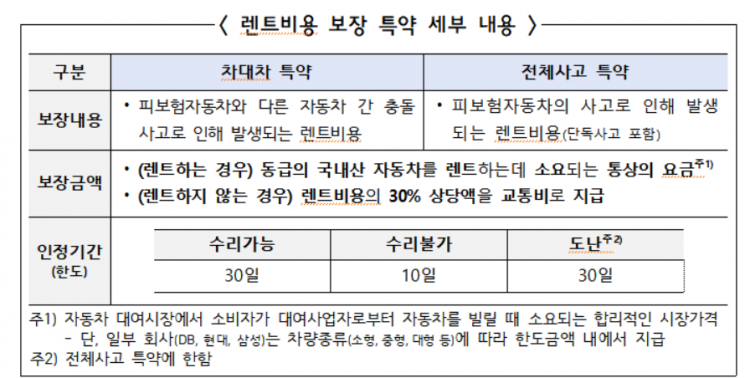

Going forward, a rental cost guarantee special clause will be established to compensate for related costs when the vehicle owner rents a car due to an accident caused by the substitute driver's fault. Since additional insurance premiums will be incurred when supporting rental costs, it will be operated in the form of a 'special clause' so that substitute drivers can choose whether to subscribe. It will be released in two types: a special clause that covers only car-to-car accidents (car-to-car special clause) and a special clause that covers all accidents including single-vehicle accidents (all-accident special clause). Substitute drivers can choose and subscribe to one of the two special clauses considering their driving habits and insurance premium levels.

The compensation limits for property damage liability and own vehicle damage coverage will also be expanded. Currently, substitute driver insurance allows subscription with limits of 200 million KRW for property damage liability and 100 million KRW for own vehicle damage. Personal automobile insurance typically provides 1 billion KRW for property damage liability, and damages exceeding the compensation limit in accidents with high-value vehicles must be borne by the substitute driver. Going forward, the compensation limits available for substitute drivers will be subdivided into 300 million, 500 million, 700 million, and 1 billion KRW for property damage liability, and 200 million and 300 million KRW for own vehicle damage. Substitute drivers can select and subscribe to compensation limits considering the accident risks they want to be covered for and the insurance premium levels.

Four insurance companies?DB Insurance, Hyundai Marine & Fire Insurance, Samsung Fire & Marine Insurance, and Lotte Insurance?plan to sell substitute driver insurance products with expanded coverage and limits starting in April. Meritz Fire & Marine Insurance and KB Insurance also plan to launch additional products within May.

A Financial Supervisory Service official said, "With the expansion of coverage and limits of substitute driver insurance, both substitute drivers and users are now sufficiently protected against accident risks," adding, "The blind spots in coverage for substitute drivers will be resolved, and users will be able to use substitute driving services with greater peace of mind."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.