The Business Survey Index (BSI) for manufacturing companies in the Daejeon area has recorded an upward trend for two consecutive quarters, reaching the highest point in the past three years. This is interpreted as reflecting high expectations for economic recovery.

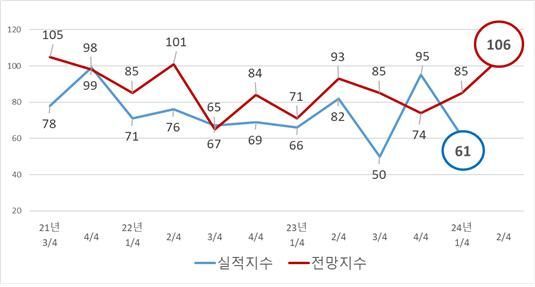

Graph of the 'Business Outlook Index' for manufacturing companies in the Daejeon area from Q3 2021 to Q2 this year. Provided by Daejeon Chamber of Commerce and Industry

Graph of the 'Business Outlook Index' for manufacturing companies in the Daejeon area from Q3 2021 to Q2 this year. Provided by Daejeon Chamber of Commerce and Industry

The Daejeon Chamber of Commerce and Industry announced on the 5th that the '2023 2nd Quarter Business Survey Index' conducted recently among local manufacturing companies was calculated at '106.' This figure exceeds the national average index of '99' and represents a 21-point increase from the previous quarter (85).

The Daejeon Chamber of Commerce and Industry analyzed that this result reflects expectations for economic recovery, as production and exports are expected to increase significantly due to the global IT market recovery, and the popularity of K-Beauty is anticipated to expand demand for cosmetics, beauty medical devices, and semiconductor-related products.

However, the BSI performance index for the 1st quarter of this year recorded '61,' a 34-point drop from the previous quarter (95), indicating that local manufacturers have a negative perception of the current business environment.

By sector, all areas including 'Sales (60),' 'Operating Profit (61),' 'Facility Investment (82),' and 'Financial Conditions (61)' fell below the baseline (100), showing that the performance of local companies is also negative.

Regarding domestic and international risk factors expected to have the greatest impact on business performance this year (multiple responses allowed), 30.9% of all responding companies cited 'domestic consumption contraction.'

Following that, the main risks identified were 'export slowdown due to worsening external economy (22.1%),' 'instability in raw material and oil prices (20.8%),' 'deterioration of financing conditions (13.4%),' 'risks such as exchange rate increases (6.7%),' 'policy uncertainties including corporate regulations (2.0%),' and 'labor-management issues (1.3%).'

Regarding the current direction of investment compared to investment plans for the first half of the year, 56.0% of all responding companies answered 'proceeding as planned without change,' 39.2% responded 'reduced or delayed compared to the original plan,' and 4.8% responded 'expanded compared to the original plan.'

The most important factors considered by local manufacturing companies in the process of establishing and executing investment plans were prioritized as 'profitability relative to investment cost (51.2%),' 'available funds such as cash flow (21.4%),' 'need for technology development and innovation (14.3%),' and 'market conditions among competitors (13.1%).'

In terms of the investment areas prioritized this year (multiple responses allowed), responses were concentrated on 'replacement and expansion of production facilities (25.9%),' followed by 'development of new products and new technologies (23.0%)' and 'market expansion and marketing enhancement (23.0%).'

A representative from the Daejeon Chamber of Commerce and Industry said, "The fact that the economic outlook for the second quarter of this year recorded the highest figure in the past three years can be interpreted as reflecting companies' strong expectations for economic recovery. However, since many companies are still hesitant to make new investments due to sluggish domestic demand in China, contraction in the construction industry, and cost increases caused by rising oil prices, bold regulatory reforms and tax support, as well as practical government-level measures, are necessary."

The Business Survey Index quantifies the on-site business sentiment of companies on a scale from '0 to 200.' The baseline is 100; a figure above 100 means that more companies view the current quarter's economy positively compared to the previous quarter. Conversely, a figure below 100 indicates that more companies perceive the economy negatively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.