NAND Flash Expected to Return to Profitability

Rising HBM Demand Drives Joint Increase

Market Targeted with CXL and Others

Taiwan Earthquake Likely to Affect Prices

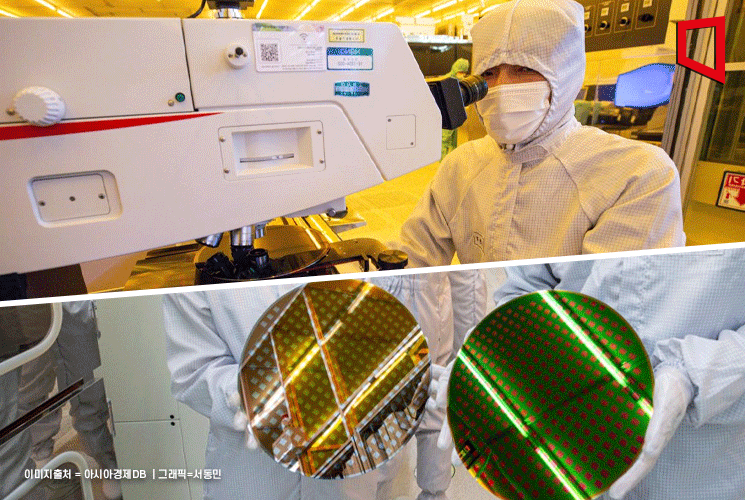

As the supply and demand of memory semiconductors improve, attention is focused on whether this year's semiconductor recovery will become a 'super cycle.'

According to the industry on the 5th, Taiwan-based market research firm TrendForce revealed on the 3rd that the spot prices of memory semiconductors (DRAM, NAND flash) have been continuously rising. On the 3rd alone, DRAM products ‘DDR5 16G (2Gx8) 4800/5600’ and ‘DDR4 16Gb (1Gx16) 3200’ rose by 0.17% and 0.42%, respectively, while the price of ‘DDR4 8Gb (1Gx8) 3200’ increased by 0.23%.

The price increase for NAND flash was even greater. ‘SLC 2Gb 256MBx8’ rose by 1.57%, and the price of SLC 1Gb 128MBx8 increased by 1.82%. The fixed transaction prices of NAND flash also rose, with 128Gb and 64Gb increasing by an average of 3.82% and 3.26%, respectively. The rising prices indicate that demand has also increased. Samsung Electronics is reportedly still recording losses in NAND flash, but if the price increase continues, NAND flash is expected to turn profitable following DRAM.

Semiconductor prices are analyzed to have entered an upward phase recently, driven by the development boom in AI semiconductors. The industry sees that as demand for high-bandwidth memory (HBM), identified as a core element for AI operation, increases, sales of DRAM and NAND flash have also risen accordingly. The dominant forecast is that semiconductor prices will rise significantly in the second quarter as well. In particular, Samsung Electronics plans to target the AI market with a diverse portfolio, including not only HBM but also high-performance, high-capacity DDR5, and Compute Express Link (CXL), which connects memory semiconductors to increase data processing speed and capacity.

Earlier, Samsung Electronics announced an ambitious goal to change the AI semiconductor market landscape centered on HBM with the ‘Maha1’ chip for large language models (LLM), aiming to resolve AI system performance degradation caused by memory bottlenecks.

The earthquake that occurred in Taiwan is also identified as a variable affecting semiconductor prices. On the 3rd, a magnitude 7.2 earthquake struck Taiwan, causing partial shutdowns of TSMC’s local factories. The Hsinchu Science Park, where the earthquake occurred, is densely packed with advanced process production bases that account for half of TSMC’s sales. As a result, TSMC is expected to face difficulties in semiconductor production for the time being, which could significantly impact market prices. TSMC is responsible for more than 50% of system (non-memory) semiconductor production and greatly influences industries worldwide, from advanced industries to home appliances and automobiles.

British investment bank Barclays stated in a report related to the Taiwan earthquake, "The suspension of semiconductor fabs (production facilities) will disrupt processes, increasing upward pressure on semiconductor prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.