New App Installations Are 2.5 Times Higher with Temu than Ali

Gap Remains Wide Compared to Coupang Users

The number of users of the Chinese direct purchase app Temu has reportedly caught up with AliExpress. Temu significantly outpaced AliExpress in new app installations.

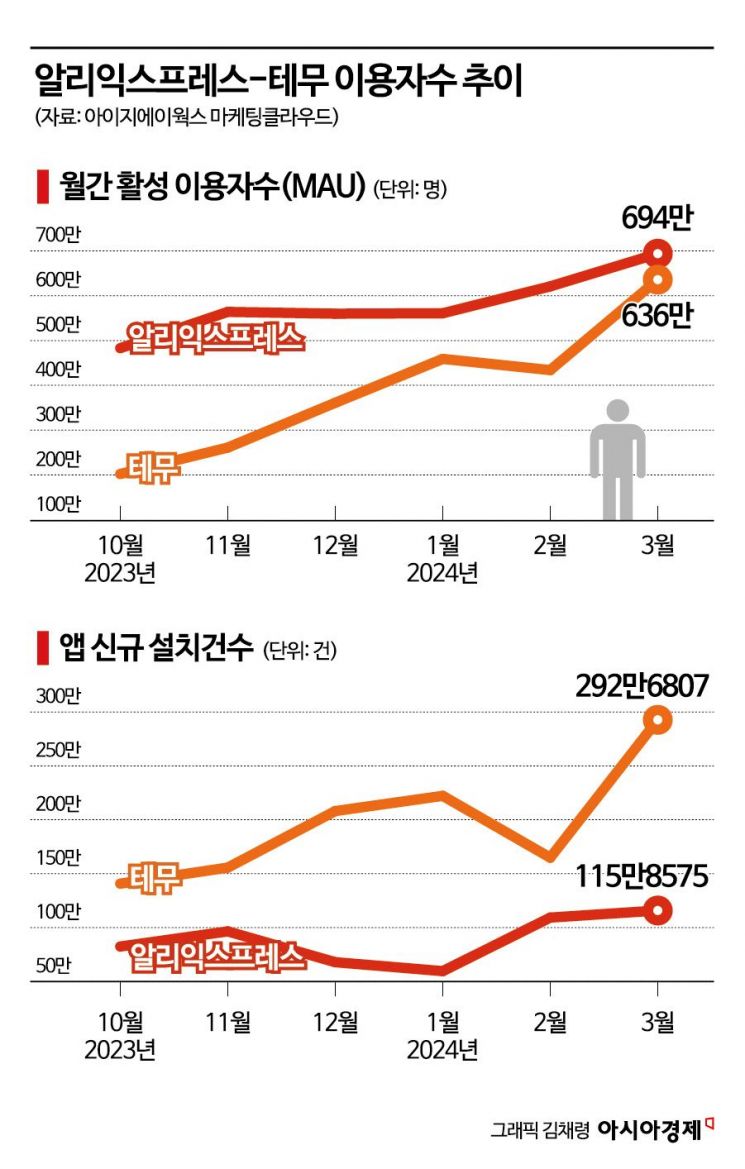

According to marketing cloud data from IGAWorks on the 4th, the monthly active users (MAU) of AliExpress and Temu last month were approximately 6.94 million and 6.36 million, respectively. The MAU gap between the two apps in March was about 580,000, with AliExpress having roughly 10% more users than Temu.

Temu logo. [Image provided by Temu]

Temu logo. [Image provided by Temu]

Temu's user count in March increased by nearly 2 million in just one month, bringing it close to AliExpress's figures. Temu's MAU in February was about 4.34 million, meaning its user base grew by more than 46% in a single month. Considering that Temu launched its domestic service in July last year and has not yet reached one year, this growth rate is seen as steep.

The gap in user numbers between the two apps is rapidly narrowing. In September last year, AliExpress and Temu had MAUs of 4.24 million and 1.46 million, respectively, with AliExpress having about three times more users. Two months later, in November, the gap narrowed to about twice as many users (AliExpress 5.64 million vs. Temu 2.61 million), and by January this year, the difference shrank further to 22% (AliExpress 5.6 million vs. Temu 4.6 million).

In terms of new customer acquisition, measured by new app installations, Temu had about 2.5 times more installs than AliExpress. Temu's new app installations in March (Android + iOS) were approximately 2.93 million, a 77.5% increase from the previous month (about 1.65 million). During the same period, AliExpress recorded 1.16 million new app installations, showing little change from the previous month (1.09 million). The gap in new app installations between Temu and AliExpress is gradually widening.

The distribution industry attributes Temu's significant user growth to consumers' increasing interest in ultra-low-priced overseas direct purchase (direct import) products. Temu is aggressively marketing by distributing cash-equivalent coupons and offering discount coupons through roulette games to increase new memberships.

AliExpress also attracted customers last month by holding an anniversary discount event. AliExpress hosted the '100 Billion Festa' event, offering special discounts on the K-Venue channel, where domestic sellers are present. The 100 Billion Festa commemorates AliExpress's 14th anniversary and signifies providing benefits worth 100 billion KRW to domestic customers. During the event, products from Samsung Electronics (official online partner), CJ CheilJedang, LG Household & Health Care, and others were sold at discounted prices. Some special-priced items sold out immediately after the sale began.

However, neither app seems to have reached the scale of Coupang, considered the largest domestic e-commerce platform. Coupang's MAU in March was about 30.39 million. During this period, AliExpress and Temu's MAUs were only 22.8% and 20.9% of Coupang's, respectively. Even combined, the two apps' user numbers do not reach half of Coupang's.

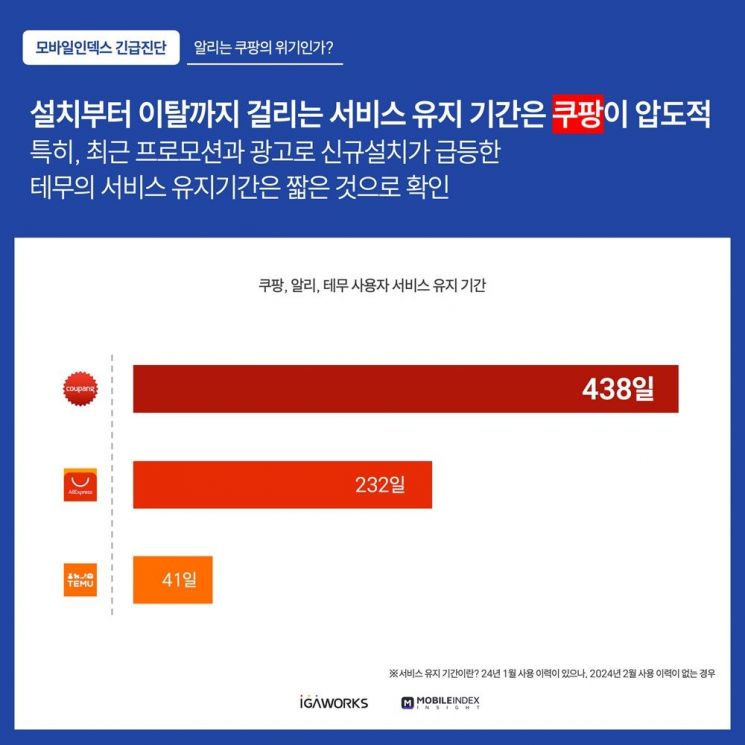

Comparison and Analysis of Service Maintenance Periods: Coupang, AliExpress, and Temu.

Comparison and Analysis of Service Maintenance Periods: Coupang, AliExpress, and Temu. [Image provided by IGAWorks]

The gap between Coupang and C-commerce apps widened further in terms of service retention period, which refers to the time consumers continue using the app after installation before churning. According to Marketing Cloud data, Coupang's service retention period was 438 days, meaning customers use the app for an average of 1 year and 2 months. In contrast, AliExpress and Temu had retention periods of 232 days and 41 days, respectively. Temu showed the shortest retention period, likely due to its recent rapid user growth driven by promotions and advertising targeting a broad audience.

Given that Coupang still holds a dominant lead in monthly app user metrics, it seems difficult for C-commerce apps to catch up with Coupang in the short term. Coupang provides next-day and early morning delivery services called 'Rocket Delivery' across major regions nationwide through its extensive logistics centers. Fast delivery is also cited by consumers as Coupang's key advantage. While AliExpress and Temu are targeting the domestic market with ultra-low prices, relatively slow delivery and inadequate consumer protection policies are pointed out as limitations. To address these shortcomings, AliExpress has announced plans to invest $200 million (approximately 263.2 billion KRW) to establish a domestic logistics center within this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.