Olive Young's Sales Reach 3.68 Trillion KRW Last Year

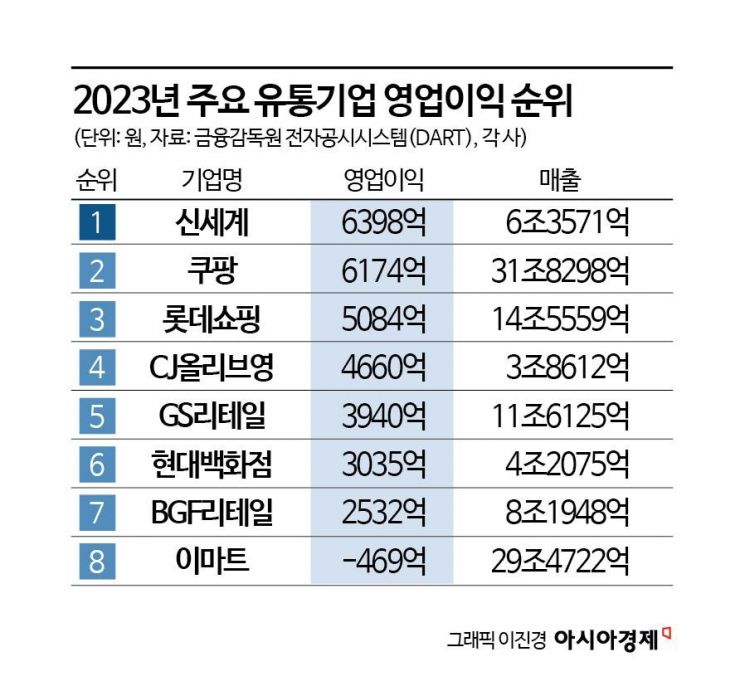

Operating Profit 466 Billion KRW... Ranked 3rd Among Domestic Retailers

Growth Centered on Online Mall... Same-Day Delivery Differentiation

CJ Olive Young, which has dominated the domestic health and beauty (H&B) store market, achieved operating results last year that surpassed those of large corporate distribution affiliates. As 'K-content' gained worldwide popularity, Olive Young stores became a must-visit tourist spot for foreigners visiting Korea. Additionally, when offline stores were hit during the COVID-19 pandemic, the same-day delivery service 'Oneul Dream' offered through its online mall drove its performance, according to analysis.

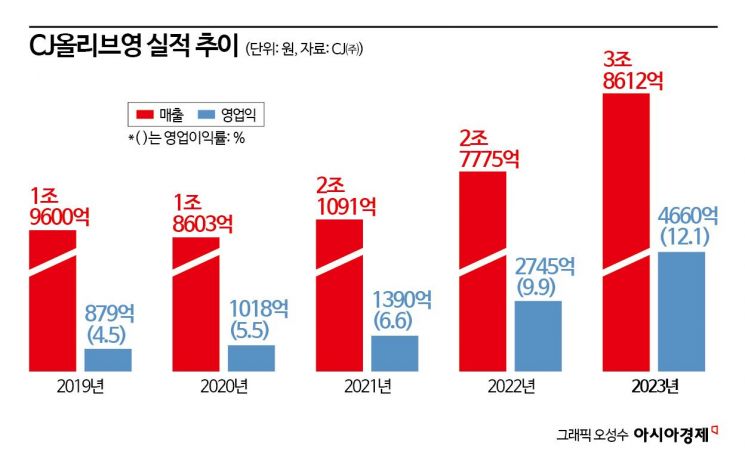

According to the distribution industry on the 5th, Olive Young's sales last year recorded 3.8612 trillion KRW, a 39% increase compared to the previous year. Olive Young achieved sales in the 2 trillion KRW range for the first time since its founding in 2022, and within a year, sales surged by more than 1 trillion KRW to nearly 4 trillion KRW, setting a new record for maximum sales.

Last year's operating profit growth was even steeper. It recorded 466 billion KRW, an increase of about 70% in one year. In terms of operating profit alone, it ranks among the top five domestic distribution companies. Olive Young's operating profit surpassed Hyundai Department Store's annual operating profit (303.5 billion KRW) and is approaching the level of the large distribution company Lotte Shopping's operating profit of 508.4 billion KRW. Among distribution companies last year, Shinsegae (639.8 billion KRW) and Coupang (617.4 billion KRW) had the highest operating profits.

COVID-19 Emergency Measure 'Only In Mall' Savior... Utilizing Over 1,300 Olive Young Stores Nationwide as 'Logistics Centers'

The secret to Olive Young's strong performance is attributed to the growth of its online mall. Olive Young, which had grown centered on offline stores, has shown continuous growth by strengthening its online services.

In particular, Olive Young's online mall differentiated itself from e-commerce competitors through the quick commerce-based Oneul Dream. The Oneul Dream service, launched in December 2018, is an instant delivery service where products ordered by customers are delivered from nearby Olive Young stores. With over 1,300 Olive Young stores nationwide, these stores effectively serve as logistics centers.

Recently, by establishing urban logistics hubs, the Oneul Dream delivery network has been optimized. Oneul Dream guarantees delivery within 3 hours after ordering, and if customers select the fast delivery option, delivery is completed in an average of 45 minutes. Oneul Dream deliveries are carried out through partners such as quick service or delivery agencies, and free delivery is provided for purchases over 30,000 KRW.

The Oneul Dream service experienced rapid growth triggered by the COVID-19 pandemic. Although demand for major beauty products decreased due to gathering bans and mandatory mask-wearing, sales growth was achieved during the pandemic period through delivery services optimized for non-face-to-face transactions. According to Olive Young, the sales of the Oneul Dream service showed an average annual growth rate exceeding fivefold over four years from 2019 to 2022.

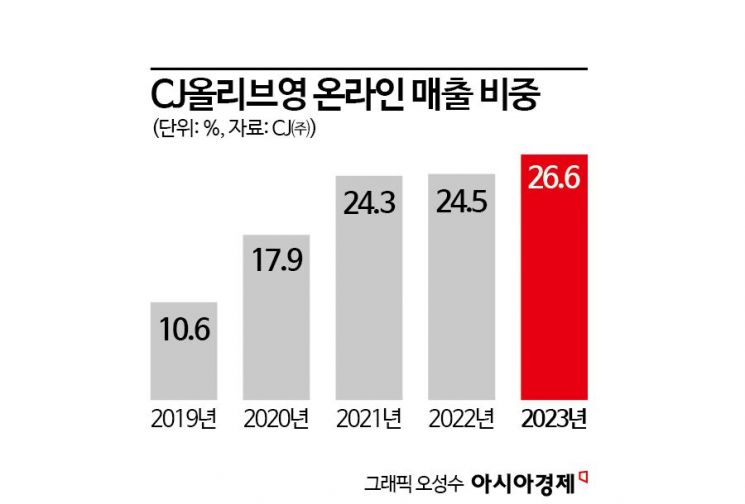

Thanks to the growth of the Oneul Dream service, Olive Young's online sales ratio has also steadily increased every year. Last year, Olive Young's online sales ratio recorded 26.6%, up 2.1 percentage points from 24.5% the previous year. Compared to four years ago in 2019, the online sales ratio increased by 16 percentage points. Especially in the fourth quarter of last year, the online sales ratio rose to 27.5%. During this period, about one-third of total sales came from the online mall.

Olive Young Dominates Domestic H&B Market... Online and Offline Growth Model

Olive Young was the only company to survive in the domestic H&B market, which suffered performance deterioration during the COVID-19 pandemic. GS Retail's H&B store Lalavla closed all its stores in 2022, and Lotte's LOBS also decided to withdraw in the same year. Last month, Louis Vuitton Mo?t Hennessy (LVMH)'s beauty select shop Sephora announced its withdrawal from the domestic market.

In the distribution industry, Olive Young's survival secret is attributed to utilizing existing stores as logistics hubs without large-scale logistics investments for the delivery network. While domestic e-commerce companies have continued operating losses due to trillion-won investments in building logistics centers, Olive Young was able to reduce operating costs by using existing stores. In fact, Olive Young's operating profit margin last year was recorded at 12.1%, the highest among major distribution companies. Compared to 9.9% in 2022, it increased by 2.2 percentage points. A distribution industry official said, "It is rare to find a case where online and offline complement each other and both grow evenly across the distribution and platform industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)