14 IPOs in Q1... "Excellent First-Day Returns Compared to IPO Price"

Mixed Outlook for Second Half... "Boom Expected Due to Interest Rate Cuts vs Need to Watch HD Hyundai Marine Solutions"

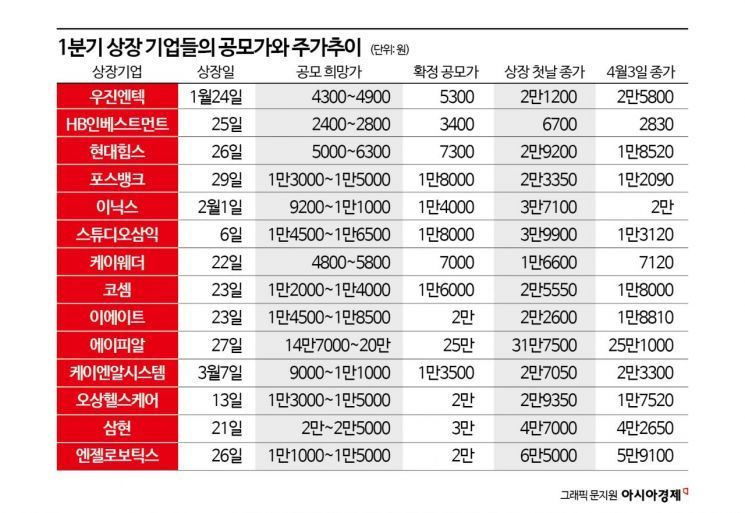

All companies listed on the KOSPI and KOSDAQ in the first quarter exceeded the upper limit of their initial public offering (IPO) price. These companies also recorded excellent returns, with the average opening price increase rate compared to the IPO price exceeding 150%. However, many companies have seen their stock prices continue to decline since listing, with some failing to recover their IPO price.

According to the financial investment industry on the 4th, there were 14 companies that directly listed on the KOSPI and KOSDAQ in the first quarter of this year (excluding KONEX, relisting, transfer/listing, SPAC mergers, etc.). One was on the KOSPI and 13 on the KOSDAQ. All of these companies exceeded the upper limit of their IPO price. Jongseon Park, a researcher at Eugene Investment & Securities, noted, "This is the third time in history that 100% of the stocks in a quarter have exceeded the upper limit of the IPO price, following the first quarters of 2015 and 2021."

Daehyung Cho, a researcher at DS Investment & Securities, also said, "The first quarter continued the hot interest from last year," adding, "All stocks that underwent demand forecasting in the first quarter of this year had their final IPO prices set above the upper limit of the expected IPO price band."

The returns on the day of listing were also excellent. The average opening price return compared to the IPO price for companies listed in the first quarter of this year was 168.0%. Among them, the stocks with the highest returns were Woojin Entech and Hyundai Hims, recording returns of 300% and 296.6%, respectively, successfully achieving double-double (a fourfold increase compared to the IPO price).

Following them were Inix (232.5%), HB Investment (197.1%), Studio Samik (188.9%), and K-Weather (184.6%) in order of high returns. On the other hand, three companies had returns below 100%: APR (78.2%), Osang Healthcare (66.3%), and E8 (30.8%).

However, the returns have been continuously declining. Some companies are trading below their IPO price. As of the 3rd, five companies were trading below their IPO price: E8, Osang Healthcare, HB Investment, and Fosbank.

The securities industry expects the IPO market to maintain its momentum in the second quarter as well. HD Hyundai Marine Solutions, considered a major player, is scheduled to list in May. Additionally, Plantech, which filed for IPO review in November last year, is expected to enter the stock market in the second quarter if approved.

Researcher Park said, "With APR's successful listing in the first quarter, several companies are pushing for additional listings, and major listings are expected to proceed from May," adding, "In the second half of the year, depending on expectations of interest rate cuts and whether the economy recovers, additional major company listings are likely to be pursued."

However, there are also opinions that HD Hyundai Marine Solutions' listing should be closely watched. Researcher Cho advised, "There have been many cases where the market sentiment reversed around the IPO of companies with market capitalizations in the trillion-won range," recommending, "It is necessary to carefully observe the IPO process."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.