Hanwha Corporation's Offshore Wind Power and Plant Business to Hanwha Ocean

Solar Equipment Business Under Momentum to Hanwha Solutions

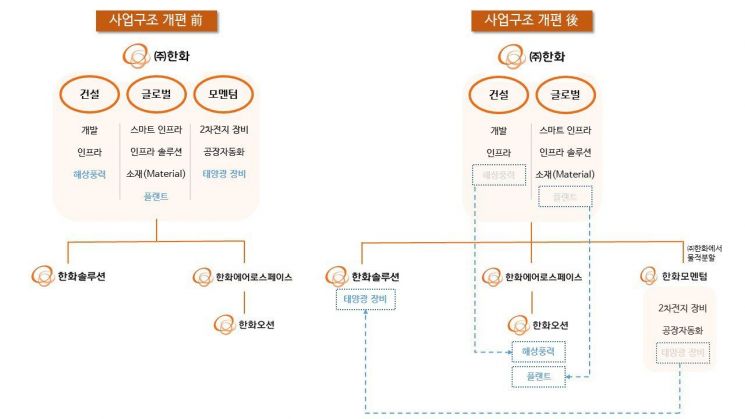

Hanwha Corporation has undertaken a major business restructuring, including the physical division of its secondary battery equipment business to establish 'Hanwha Momentum.' The core of this business restructuring is to promote specialization by business group through selection and concentration.

The business restructuring plan announced by Hanwha Corporation on the 3rd is broadly divided into three parts.

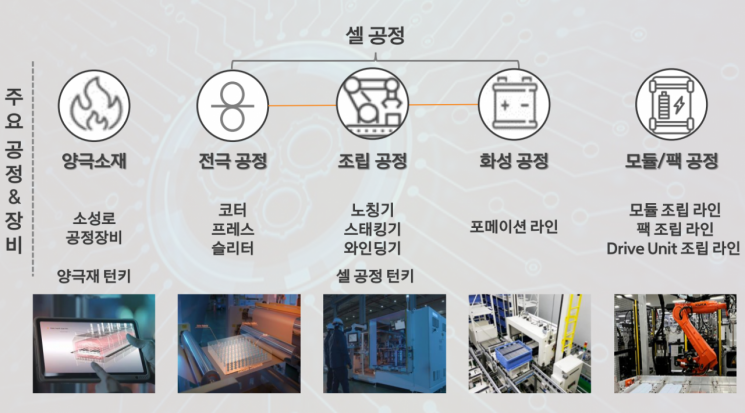

First, the Momentum division within Hanwha Corporation will be physically separated to establish 'Hanwha Momentum,' a wholly owned subsidiary of Hanwha Corporation. Among Momentum's existing businesses, the secondary battery equipment and other businesses (such as factory automation) will be handled exclusively by the newly established company, Hanwha Momentum. Through this, Hanwha Momentum will be able to focus solely on the secondary battery equipment business and operate independently.

Hanwha Corporation stated, "The sales of the secondary battery equipment business and other businesses remaining in Momentum currently account for about 7% of the total on a standalone basis," and added, "Hanwha Momentum plans not to go public for at least five years to protect shareholder value."

Newly Established Spin-off Company 'Hanwha Momentum' Business Operations [Image Source=Hanwha Corporation]

Newly Established Spin-off Company 'Hanwha Momentum' Business Operations [Image Source=Hanwha Corporation]

The solar equipment business previously operated by Momentum will be acquired by the Q CELLS division, which handles the solar business at Hanwha Solutions, for 37 billion KRW. With this acquisition, Hanwha Solutions will be able to actively respond to the development of next-generation solar technology-related equipment. Additionally, vertical integration of the solar equipment business is expected to enhance customer trust and help secure new customers.

Hanwha Corporation explained, "This is about consolidating the solar business, which was mixed within the group, into Hanwha Solutions, a total energy solutions company," and added, "It is significant in that it achieves economies of scale and maximizes the value of the solar business."

Completion of Hanwha Solutions' Solar Value Chain through the Transfer of Hanwha Corporation's Solar Equipment Business

Completion of Hanwha Solutions' Solar Value Chain through the Transfer of Hanwha Corporation's Solar Equipment Business [Image Source: Hanwha Corporation]

Next, Hanwha Ocean will acquire the offshore wind power business from Hanwha Corporation's construction division and the plant business from the global division.

By securing EPC (Engineering, Procurement, and Construction) personnel with extensive experience and track record in the relevant businesses of Hanwha Corporation's construction division, Hanwha Ocean will be able to improve its basic design capabilities and management competencies. This also brings the company one step closer to completing the offshore wind power value chain, from business development to power generation and electricity sales.

During the business restructuring briefing conference call, when asked whether Hanwha Corporation would transition into a pure holding company, Hanwha responded, "We are not at that stage," and said, "The focus is on specialization and affiliation by business group through a 'divide and unite' approach." They added, "There are listed companies within the group, and through this business restructuring, investors will have a clearer understanding of which companies they are investing in."

They continued, "At last month's regular shareholders' meeting, an amendment to the articles of incorporation was passed to assign the role of effectively controlling subsidiaries," and said, "We will proceed with a two-track approach to separately maximize subsidiary value and maximize brand royalty income and dividend income." Hanwha Corporation expects that, based on a stable financial structure, it will intensively invest in its own high value-added materials business in the global division and enhance specialization and affiliation by business group, thereby increasing the corporate value of subsidiaries and expanding dividend income through subsidiary growth.

The business transfer and physical division agenda resolved at the board meeting on this day is expected to be completed in early July after an extraordinary shareholders' meeting in May.

Prior to this business restructuring, Hanwha Group has been promoting business restructuring through the transfer of businesses and assets between affiliates to improve business efficiency. The defense business, which had been dispersed across three companies, was integrated into Hanwha Aerospace, and Hanwha Impact acquired Hanwha Power Systems, a subsidiary of Hanwha Aerospace, to expand the hydrogen business value chain, including hydrogen co-firing power generation. The collaborative robot, automated guided vehicle (AGV), and autonomous mobile robot (AMR) businesses of Hanwha Corporation's Momentum division were separated to launch Hanwha Robotics.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.