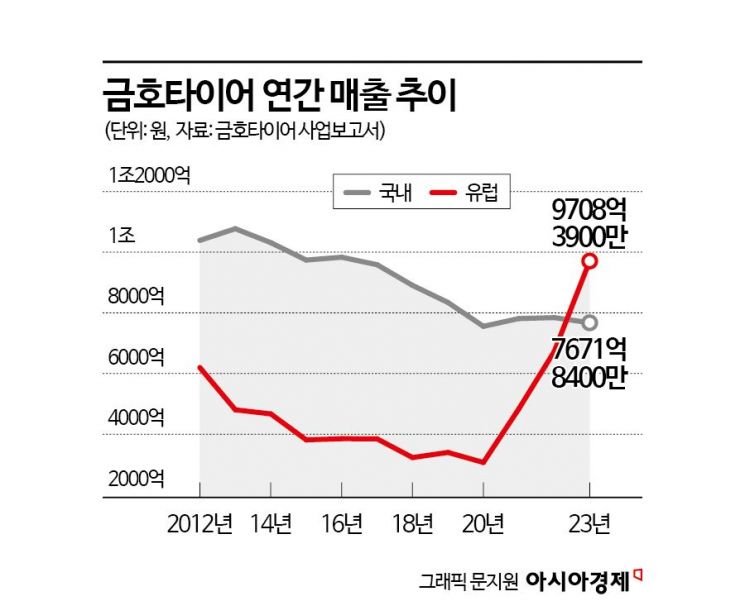

Last Year, European Sales Surpassed Domestic Sales for the First Time

Over 20% Average Annual Growth in European Sales Over the Past 5 Years

European Factory to Be Established Around 2027... Aggressive Investment Planned

Market-Tailored R&D Strategy Hits the Mark

Kumho Tire's sales in the European market have surpassed those in the domestic market. This is the result of steady annual sales growth of over 20% in Europe over the past five years. Confirming significant growth in Europe, Kumho Tire plans to make aggressive investments to establish a local factory.

According to Kumho Tire's 2023 business report on the 3rd, last year Kumho Tire's European sales reached 970.8 billion KRW, surpassing domestic sales (767.1 billion KRW) for the first time. Following North America's sales surpassing domestic sales in 2022 on a single market basis, Europe also generated more sales than the domestic market last year. Until just three years ago, Kumho Tire's export volume to Europe was around 5 million units. This year, the contracted volume secured reaches 15 million units.

Looking at the sales growth rate by market during the same period, domestic sales decreased by 2% compared to the previous year, and North America grew by only 8%. In contrast, the European market showed a significant growth of 44%. Competitors Hankook Tire and Nexen Tire's European sales grew by 27% and 6%, respectively.

The sales growth is evaluated to have been driven by a research and development (R&D) strategy tailored to the characteristics of the European market. Europe is a market where seasonal tire changes are clearly distinguished. To qualify for insurance coverage, winter tires are required in winter, and in summer, tires with maximized wet braking performance are necessary to respond to guerrilla rainstorms.

Kumho Tire, which has relatively weaker brand power in Europe, had no choice but to adopt a strategy of selling tires with the same performance at prices more than 30% lower. Based on the price of premium brand Michelin tires set at 100 for replacement 18-inch all-season tires (245/45/18) sold in Germany, Kumho Tire's price is at the 74 level. Both tires have the same ratings for fuel efficiency, wet braking, and noise.

Currently, most of the European export volume is produced at domestic and Chinese factories and shipped by sea. Minimizing production and logistics costs is a top priority. To this end, Kumho Tire began process improvement work across the entire supply chain last year, including order receipt, production, and delivery. From the time an order is placed, production and delivery status are transparently disclosed to buyers, and efforts were made to reduce the time required for each process. Local logistics warehouses were increased to meet buyers' requested delivery dates as much as possible.

Kumho Tire concluded that local production facilities are necessary to fully root itself in the European market. Securing a stable supply chain is essential to winning OE contracts with European premium automakers. The company is planning to establish a European factory targeting 2027. Currently, four final candidate sites are being weighed, and the initial operating scale will start at 6 million units and increase to 12 million units. Lee Kang-seung, Executive Director and Head of Kumho Tire Europe, said, "We plan sufficient investments for aggressive market share expansion and entry as a premium brand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.