Constant Monitoring of Preferential Interest Rate Information... Strengthening Independence of Credit Rating Agencies

Preventing Collusion Between Bank Branches and Rating Agencies... Switching to Headquarters Recommendations

Incentives and Penalties Based on Evaluation Quality

Amending Credit Information Act to Revoke Licenses for Serious Violations

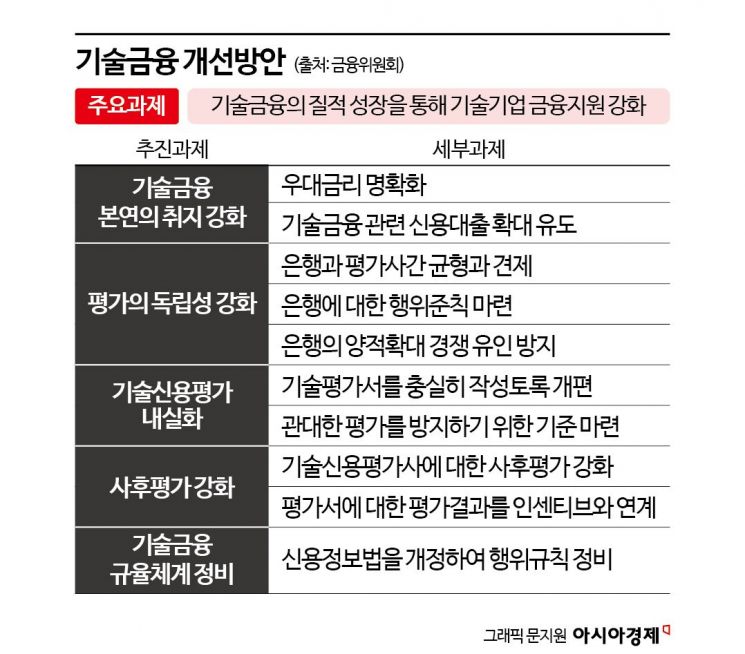

The Financial Services Commission will clarify preferential interest rates for technology companies in line with the purpose of technology finance and create an environment where more unsecured loans can be granted based on technological capabilities. Additionally, it will establish guidelines such as mandating on-site inspections to enable strict evaluations while strengthening the independence of technology credit rating agencies. The Credit Information Act will also be amended to enhance the post-management system, allowing for the cancellation of credit rating agencies' licenses in cases of serious rule violations.

On the 3rd, Vice Chairman Kim So-young held a meeting on technology finance improvement measures at Front1 in Mapo, Seoul, and announced the 'Technology Finance Improvement Plan.' In her opening remarks, Vice Chairman Kim emphasized, "The potential growth rate of our economy continues to decline, and the traditional economic growth model has reached its limits," adding, "It is more important than anything else to increase corporate productivity through technological innovation."

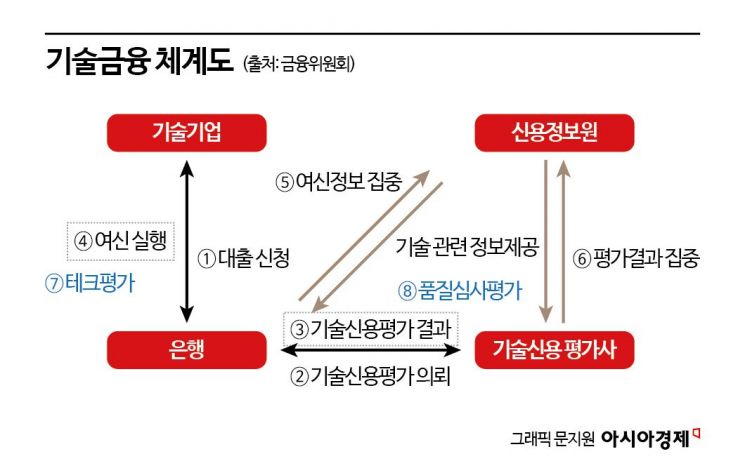

The technology finance system was introduced in 2014 and has grown significantly in quantity over the past 10 years, but the need for qualitative growth has been continuously raised. It has been unclear to what extent technology companies benefit from technology finance, and there have been strong calls for improvement due to serious data inconsistencies in technology credit rating agencies other than banks.

Accordingly, the FSC will reform banks' 'tech evaluation indicators' to provide preferential treatment regarding loan limits and interest rates by evaluating technological capabilities even when collateral and sales are insufficient. By adding indicators related to preferential interest rates for technology finance to the tech evaluation, interest rate information will be centralized at the Credit Information Agency to monitor how much preferential interest banks provide by technology grade. Furthermore, the weight of unsecured loan supply indicators in tech evaluations will be expanded to over 20 points to strengthen financial accessibility for technology companies.

While the proportion of unsecured loans in technology finance loans decreased from 24.2% in 2021 to 22.4% in 2023, the proportion of unsecured loans in general SME loans increased from 11.3% to 11.8% during the same period. Although the score for unsecured loans was raised from 15 to 20 points in 2019 to expand unsecured loans, no rebound has been observed. Vice Chairman Kim explained, "Banks that provide preferential interest rates will be favored in tech evaluations," adding, "We will increase the score for unsecured loans in tech evaluations to reduce the collateral-centric practice."

Strengthening Independence of Technology Credit Rating Agencies... Banks' Headquarters to Recommend Rating Agencies Going Forward

The independence of technology credit rating will also be strengthened. Banks will allocate evaluation volumes based on the quality of evaluation reports rather than evaluation fees, creating an environment where rating agencies can focus on evaluation quality. The results of quality review evaluations by the Credit Information Agency will be used when allocating volumes to enhance objectivity and strengthen capabilities. Additionally, to prevent collusion between bank branches and rating agencies, the method will be changed so that the bank headquarters recommends rating agencies to branches. The headquarters will randomly recommend 2 to 3 agencies to ensure independence from branch influence.

Furthermore, rules of conduct for banks will be established in the Credit Information Act to prohibit banks from inquiring about evaluation grades in advance or requesting specific grades from rating agencies. The scope of technology finance will be clarified to institutionally prevent banks from requesting evaluations for non-technology companies. If cases of issuing evaluation reports for non-technology companies are confirmed during tech evaluations of banks, points will be deducted accordingly.

Vice Chairman Kim stated, "We will allocate evaluation volumes to rating agencies based on the quality of evaluation reports so that agencies can focus on quality improvement," adding, "To prevent collusion between bank branches and rating agencies, the method will be changed so that the headquarters recommends rating agencies."

Enhancing Substance of Technology Credit Evaluation, Mandating On-Site Inspections

The substance of technology credit evaluations will also be enhanced. On-site inspections will be mandated, and detailed evaluation opinions that verify the basis of evaluation grades will be required. Until now, in many cases, new evaluations were conducted remotely without on-site inspections due to manpower shortages at rating agencies. Re-evaluations were sometimes conducted without accurate additional investigations.

Accordingly, the FSC plans to reduce exceptions that allow omission of on-site inspections for new evaluations, effectively mandating on-site inspections. For re-evaluations, a corporate survey form will be introduced to reflect changes, allowing omission of on-site inspections if the survey form is used. Furthermore, detailed evaluation opinions will be mandated to ensure that evaluation results are supported by evidence.

Additionally, to prevent lenient evaluations such as arbitrarily adjusting qualitative scores to upgrade technology grades, guidelines for technology grade calculation will be established using artificial intelligence (AI) technology. This measure addresses the decline in data reliability caused by cases where qualitative scores were raised despite low quantitative scores, artificially upgrading technology grades.

The FSC plans to prepare grade calculation guidelines to prevent excessively high qualitative scores and set quantitative score minimums for specific grades to supplement technology grade judgment criteria. AI will suggest specific technology grades based on learned data, and evaluators will use this to ensure evaluation reliability.

Vice Chairman Kim explained, "We will mandate key compliance items during technology credit evaluations," adding, "On-site inspections will be mandatory to ensure accurate evaluations, and guidelines will be established to prevent arbitrary upgrading of technology grades."

Strengthening Post-Evaluation... 'License Cancellation' for Violations

Post-evaluations of technology finance conducted by the Credit Information Agency will also be strengthened. Evaluations of technology rating agencies will shift from qualitative to quantitative assessments, integrating existing qualitative evaluations into a scoring system. Sampling for quality evaluation reports will be significantly increased from 10 to 30 cases.

The Credit Information Agency will provide incentives by expanding opportunities to participate in policy projects for rating agencies with excellent quality evaluation results. Penalties will be imposed by excluding loan balances evaluated by underperforming rating agencies from the Bank of Korea's financial intermediary fund support loan performance. This is expected to encourage banks to request more evaluations from rating agencies with high-quality grades.

Moreover, the FSC will revise laws related to technology finance to strengthen regulations. Through amendments to the Credit Information Act, which stipulates rules of conduct for technology credit rating agencies, unfair acts such as using others' certificates for evaluations will be prohibited. If rating agencies commit serious violations that undermine the foundation of technology credit evaluations, such as providing evaluation grades in advance or implying lenient evaluation results, the Act will provide grounds for license cancellation or business suspension.

Vice Chairman Kim said, "I hope this improvement plan will help technology finance grow to actively resolve funding difficulties for SMEs with excellent technological capabilities," adding, "We will actively monitor and improve necessary systems to become a system that benefits SMEs with technological capabilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)