PF Support Plan Briefing at Seoul REITs Association on the 8th

Demand Survey from 8th to 30th Followed by REITs Approval Process

The Ministry of Land, Infrastructure and Transport announced that it will hold a briefing session on the 8th for the industry regarding support measures for real estate project financing (PF) utilizing public-supported private rental REITs and corporate restructuring (CR) REITs.

The briefing session is a follow-up measure to the "Construction Market Recovery Support Plan" announced on the 28th of last month, with participation from the Korea Real Estate Board, Housing and Urban Guarantee Corporation (HUG), Korea Financial Investment Association, Korea Construction Association, Korea Real Estate Development Association, and Korea Housing Association.

The Ministry of Land, Infrastructure and Transport will conduct a demand survey from the 8th to the 30th and proceed with subsequent procedures such as REITs approval. It will also shorten administrative procedures by concurrently conducting fund investment committee reviews and REITs approval processes, and consider reasonable regulatory improvements such as easing participation requirements for REITs.

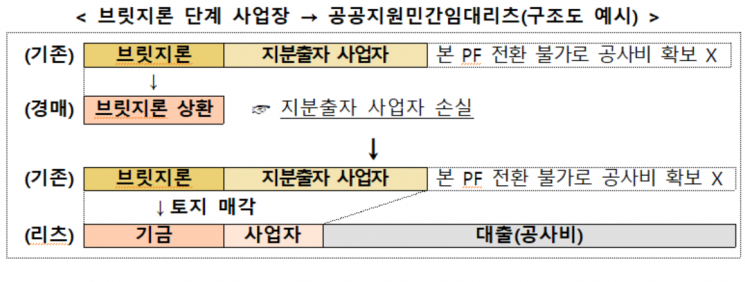

Structure of Publicly Supported Private Rental REITs. [Image provided by Ministry of Land, Infrastructure and Transport]

Structure of Publicly Supported Private Rental REITs. [Image provided by Ministry of Land, Infrastructure and Transport]

Public-supported private rental REITs target projects at risk of auction due to failure to convert to main PF. Such projects receive support from the Housing and Urban Fund and are converted into public-supported private rental REITs. At this time, credit is reinforced through HUG’s guarantee to promote PF loans and construction commencement.

When converted to public-supported private rental REITs, equity investors can also recover their investment costs. If the bridge loan fails to convert to the main PF and the land is auctioned, the investor suffers losses. However, by investing in public-supported private rental REITs, they become shareholders of the REIT, receive rental income, and can recover their investment by selling the project site when the real estate market improves in the future.

Also, if the construction company that owned the land participates in the REIT, it can repay the bridge loan through land sales and secure sales through contract construction.

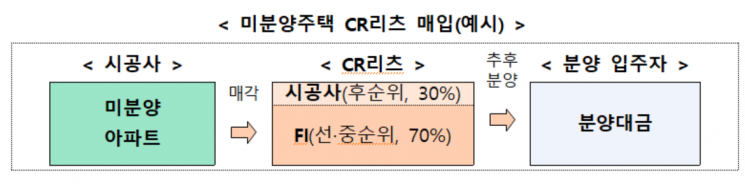

For projects that face difficulties in financing due to unsold units after completion, CR REITs support the purchase of unsold housing units. Construction companies or trust companies holding unsold housing units form CR REITs by receiving senior investments from financial investors (FIs) and operate them as rental housing.

At this time, the main PF loan can be repaid with investment funds and rental deposits. Also, when the real estate market recovers and the rental housing is sold, the remaining project costs can be recovered. In 2009, CR REITs purchased 2,200 unsold housing units, operated them as rentals for 2 to 4 years, and then sold all of them.

To expedite the establishment of CR REITs, they are exempt from registration system application and public offering obligations. They also receive tax benefits such as a reduction of acquisition tax from the existing 12% to 1-3% (1% for under 600 million KRW) and exclusion from comprehensive real estate tax aggregation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)