SPC Samlip, 2023 Business Report Analysis

Traditional Cream Bread Factory Price Soars 30% Over 2 Years

Raw Material Acquisition Cost More Than Halved Last Year

SPC Samlip's raw material inventory assets decreased by more than half last year. This was thanks to a reduction in purchase costs as prices of major raw materials, including flour, fell. However, the factory shipment price of the company's flagship product, Jeongtong Cream Bread, was rather raised, leading to criticism that SPC Group's bread price reduction last year was merely for show.

As the government, which has recently launched an all-out campaign to curb soaring inflation, begins comprehensive pressure to lower bread prices, attention is focused on whether SPC Samlip, which holds an overwhelming market share in the mass-produced bread market, will implement additional price cuts.

When raising prices, 'significant'... when lowering, 'minimal'

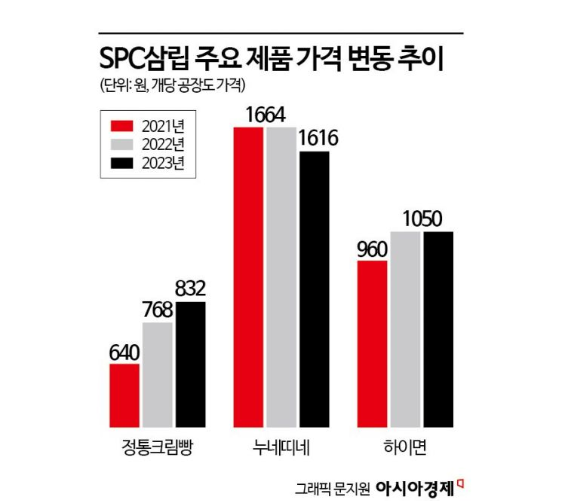

According to the 2023 business report released by SPC Samlip on the 3rd, the factory shipment price of Jeongtong Cream Bread was increased by 8.33% last year to 832 won compared to the previous year. Although this is slightly lower than the first half of last year (896 won), it was only half of the 16.67% increase in the first half. As a result, the factory shipment price of Jeongtong Cream Bread surged by 30% over two years since 2021.

On the other hand, the factory shipment price of Nunettine was lowered from 1,664 won to 1,616 won, and Haimeun was raised by 9.38% to 1,050 won in 2022 and then frozen for two consecutive years.

Jeongtong Cream Bread, first introduced in 1964, is the best-selling single brand cream bread (retail sector, cumulative) over the past decade (2013?2022).

SPC Samlip released a limited edition 'Cream Daebbang' this year to commemorate the 60th anniversary of this bread's launch, which caused a shortage and boosted the popularity of Jeongtong Cream Bread as well.

Earlier, SPC Group raised bread prices for Paris Baguette and SPC Samlip in February last year, citing rising raw material costs, and then announced in June of the same year that they would reduce the average price of 30 types of bread by 5% in response to government and consumer group demands for price cuts following a drop in flour prices. At that time, SPC Samlip said it would lower the recommended retail price of Jeongtong Cream Bread from 1,400 won to 1,300 won (7.1%).

Raised by 300 won in convenience stores, lowered by 100 won

However, a survey by Asia Economy of four domestic convenience store chains (CU, GS Retail, 7-Eleven, Emart24) found that Jeongtong Cream Bread was sold at 1,400 won at all stores. Some supermarkets in Yeongdeungpo-gu, Seoul, charged up to 1,500 won. In some retail stores, the popularity of cream bread and the increase in factory shipment prices seem to have been reflected in the price hike.

The recommended retail price is the price manufacturers suggest to retailers, but retailers are not obligated to sell at this price.

According to the convenience store industry, SPC Samlip raised the price of this bread from 1,200 won to 1,500 won in February last year, but due to a backlash against the excessive increase, it sold the bread at 1,400 won after a 100 won reduction starting in July of the same year. The increase rate in convenience stores last year was 25%, but the decrease was only 6.67%. This differs from the 1,300 won price reduction announced by SPC Group last year for Jeongtong Cream Bread.

SPC explained, "The price reduction announced last year was based on the recommended retail price for large supermarkets." Given that convenience stores account for the overwhelming share of factory-made mass-produced bread sales, the industry finds this hard to understand. A food industry official said, "Since bread is mostly sold in convenience stores, the recommended retail price is determined based on convenience store standards."

According to the Korea Agro-Fisheries & Food Trade Corporation (aT) Food Industry Statistical Information, total offline retail sales of mass-produced bread last year amounted to 660.1 billion won, with convenience stores (287.5 billion won, 43%) having the highest sales share. This was followed by independent supermarkets (144.5 billion won, 21.8%), large discount marts (89.4 billion won, 13.5%), and chain supermarkets (77.8 billion won, 11.7%).

Raw material acquisition cost reduced by 52%... bakery sales grew 10%

Moreover, the company's raw material inventory assets were halved last year. Inventory assets are assets stored in warehouses for sale, and SPC Samlip's raw material acquisition cost as of the end of 2022 decreased by 52.1%, from 91.2 billion won to 42.5 billion won last year. This was due to a significant reduction in costs spent on purchasing raw materials as prices of flour and oils fell.

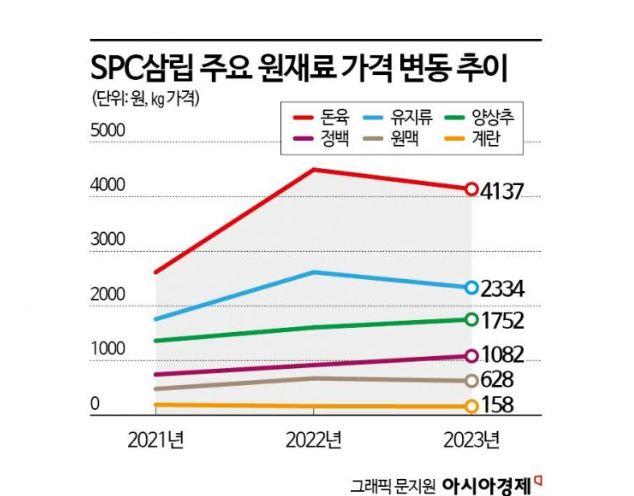

According to the major raw material price trends disclosed by SPC Samlip, prices of major raw materials except sugar fell simultaneously. The price of wheat flour, the main ingredient of bread, dropped by 6.82% last year. Oils used to make cream fell by 10.78%, and egg prices also decreased by 4.24%. However, the average price of two types of refined sugar (15kg and 10kg) rose by 17.99%, from 917 won to 1,082 won.

SPC Samlip recorded consolidated sales of 3.4333 trillion won last year, up 3.6% from the previous year, and operating profit increased by 2.4% to 91.7 billion won, marking its best performance. In particular, the bakery business grew by 10.8%, from 831.3 billion won in 2022 to 921.1 billion won last year.

SPC Samlip's retail market share approaches 80%... government pressures "lower bread prices"

SPC Samlip's retail sales reached 526.5 billion won last year, with a retail market share of 79.76%. The company's Pok?mon bread was so popular that it caused a 'convenience store open run' phenomenon, generating sales worth 110.7 billion won. Samlip Hotteok (53.7 billion won), Boreumdal (41.7 billion won), and Jujobalhyo (39.5 billion won) ranked second to fourth in sales, respectively. Jeongtong Cream Bread sold 31.8 billion won worth last year, ranking sixth in sales.

Therefore, government pressure to lower bread prices is intensifying. With consumer price inflation exceeding 3% for two consecutive months since February, the government demands that reductions in raw material costs be reflected in product prices. On the 13th of last month, Han Hoon, Vice Minister of the Ministry of Agriculture, Food and Rural Affairs, requested at a meeting with major food companies, "The food industry should flexibly reflect changes in international raw material prices in prices to cooperate in stabilizing prices." SPC Samlip also attended this meeting.

The Fair Trade Commission is launching a fact-finding investigation to understand the distribution and price-setting structure of the domestic baking industry.

However, on the 29th of last month, immediately after the regular shareholders' meeting, SPC Samlip CEO Hwang Jong-hyun told an Asia Economy reporter regarding plans to lower product prices, "Prices of other raw materials such as sugar and cocoa have surged, and overall production costs have increased," and refrained from elaborating. However, he stated, "We plan to increase cost-effective (price-performance) products to enhance benefits that consumers can feel."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)