SPC Samlip Subsidiary... Business Closed Last November

Low Profitability Due to Domestic Slump Amid COVID-19 Pandemic

"Operating Loss Despite Growth... Decision for Structural Improvement"

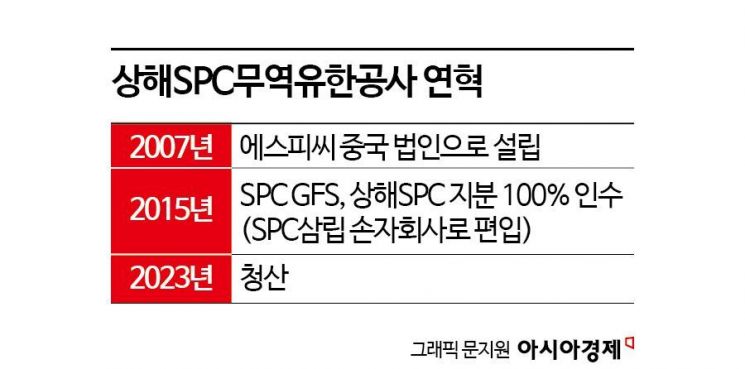

Shanghai SPC Trading Co., Ltd. (Shanghai SPC), which distributed ingredients to Paris Baguette in China, was confirmed to have been liquidated last year. This marks 16 years since its establishment in 2007. The business was closed due to deteriorating profitability caused by the COVID-19 pandemic followed by a slump in the Chinese domestic market.

According to the distribution industry on the 2nd, SPC GFS, a subsidiary of SPC Samlip, liquidated Shanghai SPC on November 2nd last year. Shanghai SPC distributed ingredients to over 330 Paris Baguette stores in China and also exported SPC Samlip’s bakery and snack products as well as food products from domestic small and medium-sized enterprises to the local market.

Shanghai SPC Winds Up Business After 16 Years Since Establishment

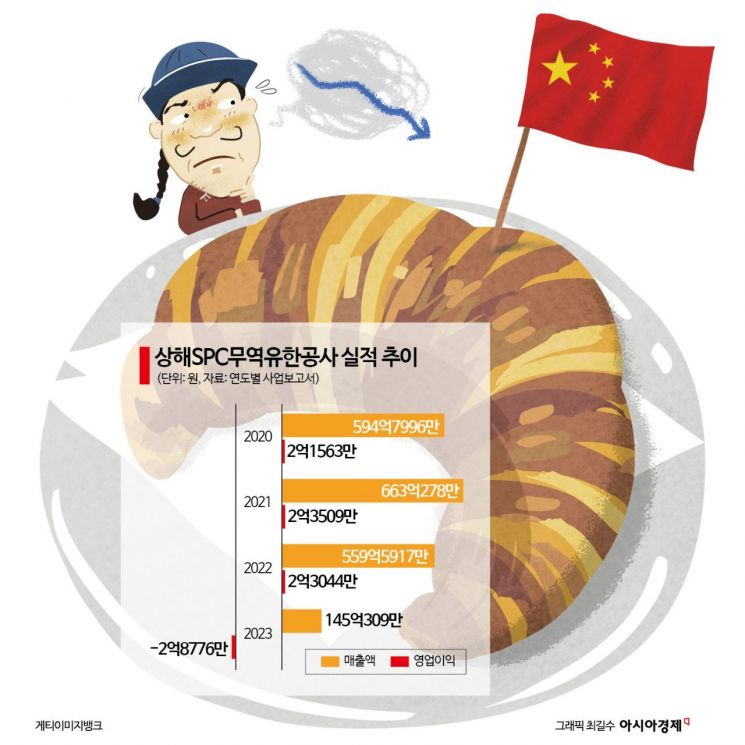

However, after experiencing ups and downs due to the COVID-19 pandemic and a prolonged slump in the Chinese domestic market, the company ultimately decided to wind up its business. Shanghai SPC’s sales last year were 14.53093 billion KRW, a decrease of more than 74% compared to the previous year (55.95917 billion KRW), and it recorded an operating loss of 287.76 million KRW, turning to a deficit. An SPC Group official explained, "Similar to South Korea, the Chinese consumer market has significantly contracted," adding, "We decided to liquidate Shanghai SPC to improve cost efficiency."

Shanghai SPC was initially established in 2007 as the Chinese corporation of SPC, a personal company of SPC Group Chairman Hur Young-in’s two sons, President Hur Jin-soo and Vice President Hur Hee-soo. At that time, sales were only between 100 million and 400 million KRW, but the situation reversed after SPC GFS acquired 100% of Shanghai SPC’s shares in 2015. As Shanghai SPC took charge of distributing Paris Baguette ingredients, which had been scattered across various regions in China, sales increased by several tens of times. By 2021, sales had expanded to around 60 billion KRW.

The problem was profitability. Although the scale expanded, operating performance was poor. Shanghai SPC posted annual sales of 50 to 60 billion KRW from 2020 to 2022, but operating profit remained around 200 million KRW before turning to a loss last year.

However, SPC Group maintains that the operation of Paris Baguette stores in China remains solid. According to the group, the number of Paris Baguette stores in China decreased from 309 in 2021 to 300 in 2022 but has now increased to over 330. An SPC Group official said, "The decision to liquidate Shanghai SPC was due to low profitability related to the export of domestic food ingredients rather than the distribution of Paris Baguette ingredients," adding, "Since China’s market is highly volatile due to liquidity and policy factors, we plan to actively respond by re-establishing the corporation if the market expands again."

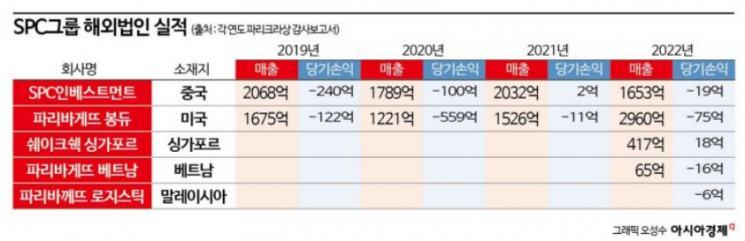

Paris Baguette Overseas Corporations Including China, Consecutive Deficits

Overseas corporations of SPC Group, including Paris Baguette China, have continued to show poor performance. According to the audit report of Paris Croissant, the holding company of SPC Group, sales of the China corporation, which exceeded 200 billion KRW in 2019, shrank to 178.9 billion KRW in 2020 when the COVID-19 pandemic began. Sales recovered to the 200 billion KRW level the following year but shrank again to 162.3 billion KRW in 2022. Profitability also worsened. The China corporation recorded a net loss of 24 billion KRW and 10 billion KRW in 2019. It achieved a net profit of 200 million KRW in 2021 but recorded a net loss of 1.9 billion KRW the following year.

The U.S. corporation showed a similar trend. Due to the impact of COVID-19, U.S. Paris Baguette’s sales in 2020 were 122.1 billion KRW, and net losses expanded to 55.9 billion KRW. Sales recovered to 150 billion KRW in 2021, and net losses decreased to 1.1 billion KRW. However, in 2022, sales surged to 296 billion KRW, achieving external growth, but net losses increased to 7.5 billion KRW. As of 2022, among Paris Croissant’s overseas corporations, the only one to record net profit was the Singapore branch of the hamburger brand 'Shake Shack,' which was introduced from the U.S. Paris Croissant had not submitted last year’s audit report as of this day.

In the case of SPC Samlip, in addition to SPC Shanghai, which was liquidated last year, its overseas corporation Samlip Singapore recorded a net loss of 1.2 billion KRW. This was an increase in losses from 700 million KRW in 2022. The company’s sales last year were 4.1 billion KRW, down from 5 billion KRW the previous year. Operating loss (1.4 billion KRW) and net loss (-1.2 billion KRW) nearly doubled compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.