With the US presidential election approaching this November, companies are rushing to issue corporate bonds. They are proactively securing funds in anticipation of increased market volatility.

According to the London Stock Exchange Group (LSEG) on the 31st of last month (local time), the amount of corporate bonds issued by companies so far this year is estimated at about $606 billion (approximately 816.3 trillion KRW). This represents an increase of about 40% compared to the same period last year and is the largest scale since 1990.

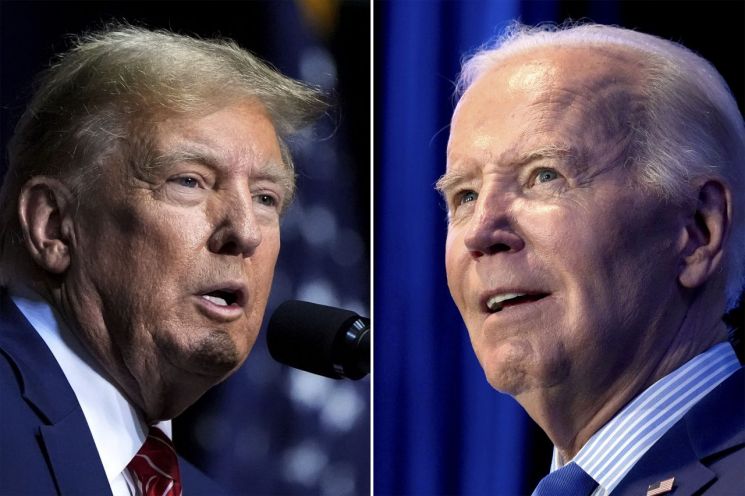

Teddy Hodgson, co-head of Morgan Stanley’s Global Investment Grade Syndicate Loan, said, "We are about two months ahead of the usual schedule," adding, "Certainly, the driving force behind all this supply is the (US) presidential election." He explained that with the close contest between President Joe Biden and former President Donald Trump in November, companies are advancing their plans for bond issuance in the second half of the year. Major blue-chip companies that have issued corporate bonds so far include Ford, Toyota, Caterpillar, Morgan Stanley, and JP Morgan.

Hodgson said, "Most companies, especially those that frequently issue corporate bonds, are thinking, ‘Let’s complete most of the fundraising in the first half of 2024,’" adding, "After the election, if the market reaction is positive for any reason, they will use the end of the year to start 2025." In particular, certain sectors such as healthcare, energy, and China-related companies are considered relatively more sensitive to the election results.

Additionally, the recent narrowing of the spread between government bond yields and corporate bond yields has also worked in favor of companies. According to ICE Bank of America (BofA), the current investment-grade bond spread averages 0.93 percentage points, the tightest level since November 2021. The average high-yield bond spread is also at a minimum since December 2021, at 3.12 percentage points.

John McCauley, head of Citi’s North American Bond Syndicate Loan, said, "Overall, increased trading volume and narrowing spreads are improving corporate accessibility." Hines, another official, also evaluated, "Considering the possibility of an economic slowdown in the second half and historically tight credit spreads, it seems wise to issue bonds now rather than wait until the second half."

Some expect that with growing uncertainty ahead of the election, initial public offering (IPO) activity will also accelerate in the coming months. The recent successful IPOs of Trump Media & Technology Group, the parent company of Truth Social, and Reddit are positive signals. Convertible bond (CB) issuance has also surged in parallel. The issuance scale this year is estimated at about $17 billion, an increase of more than 50% compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.