The global mergers and acquisitions (M&A) market, which had been frozen solid, is now stretching out as spring arrives. The number of blockbuster deals by large corporations in the first quarter of this year has more than doubled compared to a year ago. Optimism is pouring in that M&A transactions will surge this year, supported by improvements in financial markets and pent-up demand.

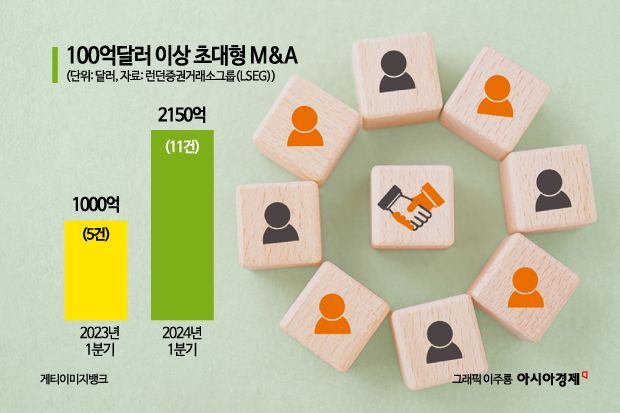

According to the London Stock Exchange Group (LSEG) on the 29th (local time), the number of mega M&A deals with transaction sizes exceeding $10 billion in the first quarter (January to March) surged to 11, up from 5 in the same period last year. The total value of these 11 deals reached $215 billion, more than double the approximately $100 billion recorded in the same period last year.

These blockbuster deals were mainly centered around U.S. energy, technology, and financial companies. Representative examples include Capital One's acquisition of Discover Financial ($35 billion) and Synopsys' acquisition of Ansys ($35 billion), both U.S.-based semiconductor design and equipment manufacturers. Tyler Dickson, head of Citigroup's investment banking division, stated, "Large-scale deals are active," adding, "Companies are leveraging market conditions to accelerate growth." While the total number of M&A deals under $10 billion in the first quarter decreased by 31% year-on-year, the overall transaction value increased by 30% to $690 billion.

The market is flooded with analyses suggesting that M&A activity, which had plummeted to its lowest level in a decade, is returning to a normal trajectory. Andre Kellnerus, head of EMEA (Europe, Middle East, and Africa) at Goldman Sachs, said, "It has now returned to average, normal levels," adding, "It strongly rebounded from an exceptionally low level a year ago." According to global consulting firm PwC, the global M&A volume, which surpassed $5 trillion in early 2021 thanks to ultra-low interest rates immediately after the pandemic, was halved to $2.5 trillion last year, just two years later.

There are also expectations that the M&A market will enter a new phase this year, starting with these blockbuster deals. Brian Levy, a PwC partner, evaluated in an early-year report, "We are hearing the starting bell signaling an increase in M&A activity." He noted that M&A rebounds have already begun in the energy, technology, and pharmaceutical sectors, and potential opportunities are emerging in retail, real estate, and construction as well.

The primary reason behind the optimistic outlook surrounding the M&A market is the improved financial market environment. As inflation slows, major central banks, including the U.S. Federal Reserve (Fed), are expected to cut benchmark interest rates within the year. For companies pursuing M&A, this means a significantly reduced burden in raising funds. Massimiliano Ruggeri, head of EMEA at Morgan Stanley, also said, "From a deal perspective, it is definitely a better environment," adding, "Throughout the quarter, both investors and issuers have shown higher levels of participation."

The substantial pent-up demand for M&A also adds weight to the optimistic market outlook. PwC mentioned the approximately $4 trillion in dry powder (unfunded committed capital), forecasting an increase in so-called exit sales. Dry powder typically refers to cash or liquidity that investors hold while waiting for potential opportunities in the M&A market. Additionally, from the corporate perspective, M&A is becoming increasingly attractive. Partner Levy pointed out, "Many companies face an urgent strategic need to adjust and transform their business models," adding, "M&A is certainly one of the clear paths for companies to scale up, acquire technology and talent, and accelerate growth."

However, concerns about market uncertainties remain. Besides economic uncertainties, geopolitical risks and elections in major countries including the U.S. are factors clouding the outlook for 2024, PwC noted. Stefan Feldgoise, global head of M&A at Goldman Sachs, expressed caution, saying, "Volatility is high," and described the situation as "mixed signals."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)